Market Events

Monday, October 27th 2025

Market Pricing Heavier Volatility for Jobless Claims & Core PCE than the FOMC Decision

Markets expect post-Fed economic data to drive the real move, with event premium peaking late in the week.

Summary

Traders expect post-Fed economic data to drive market volatility more than the FOMC decision itself, with significant implied volatility for Initial Jobless Claims and Core PCE Price Index. The FOMC meeting is anticipated to have little binary uncertainty, focusing instead on Powell's tone and subsequent data. Strategies like calendar spreads and diagonal spreads can capitalize on the expected volatility shifts, particularly as the market adjusts after the Fed announcement.

As the Federal Reserve prepares to announce its latest policy decision on October 29, options markets are already revealing how traders expect the week to unfold. ORATS’ event-adjusted volatility model shows something subtle but important: the heaviest implied volatility isn’t tied to the FOMC itself, but to the data that follows.

Event-Adjusted Volatility Explained

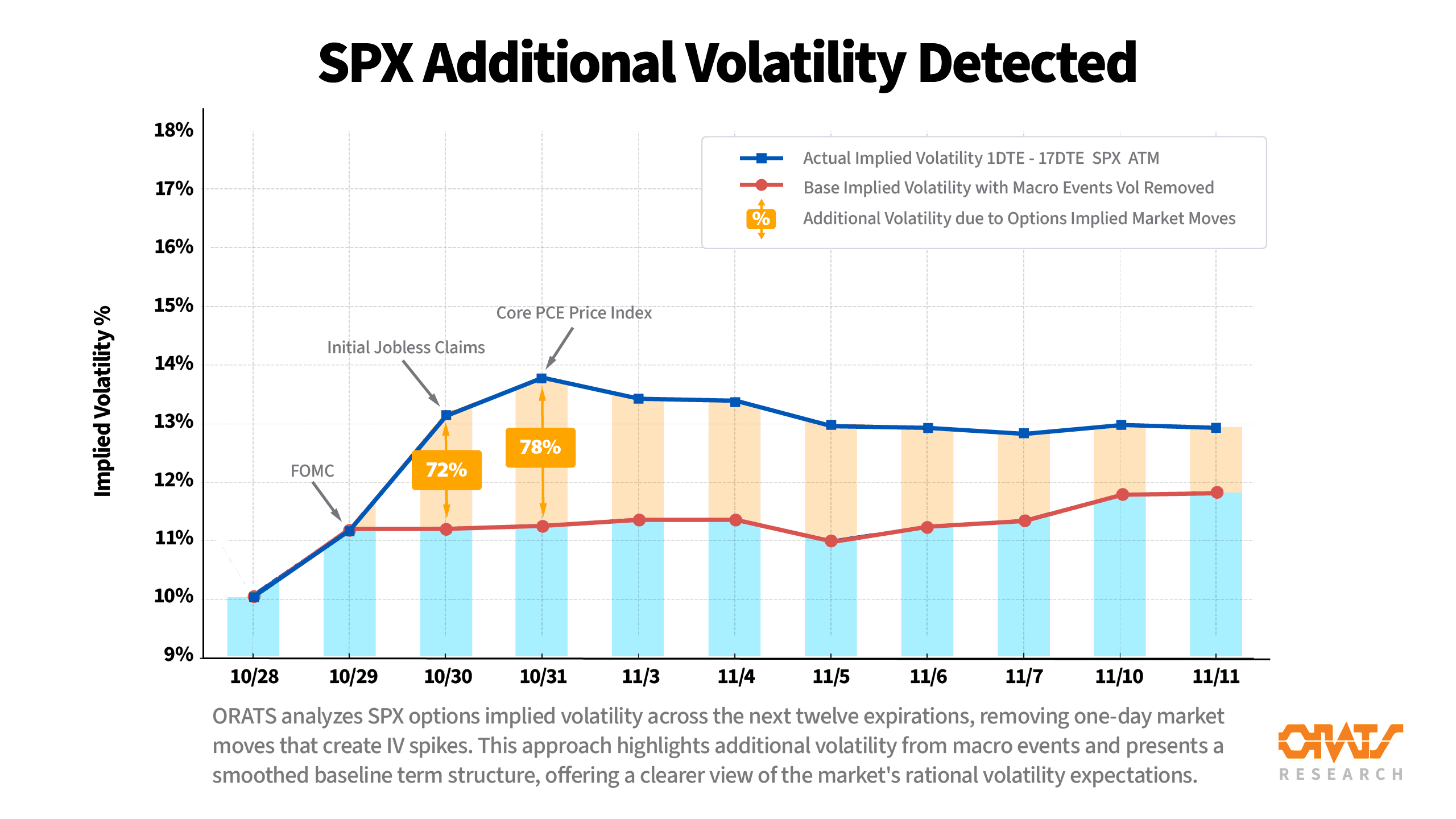

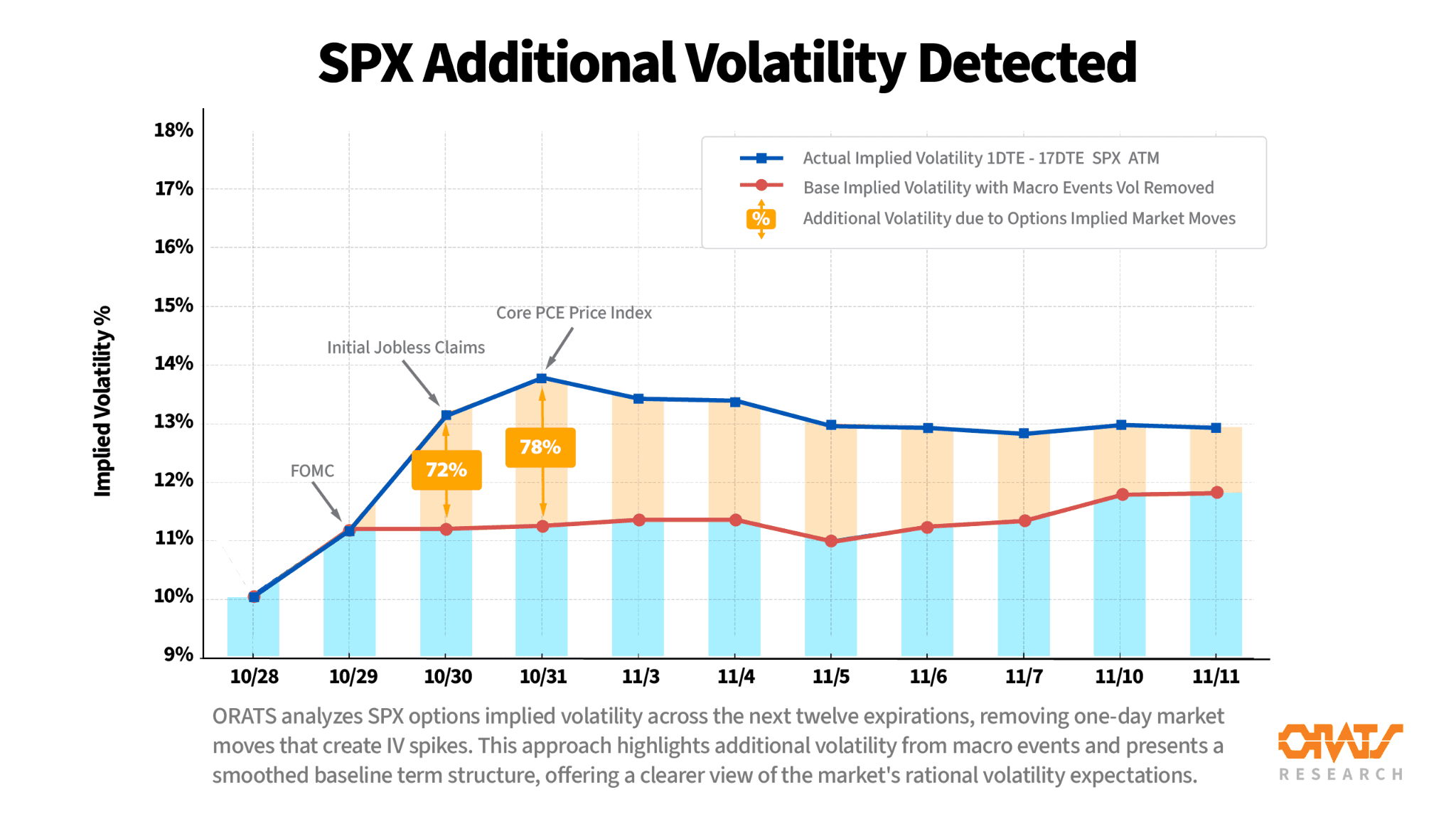

The chart below compares actual near-term SPX implied volatility (blue) against a baseline term structure that removes macro event related spikes (red). The shaded area between them highlights the additional volatility traders are pricing in for major catalysts.

What the Market’s Pricing

Here’s how implied volatility is lining up for this week’s macro cluster, based on ORATS’ analysis:

- FOMC (Oct 29) → Vol uptick, but not extreme. The market expects a measured outcome.

- Initial Jobless Claims (Oct 30) → About 72% additional event volatility versus baseline.

- Core PCE Price Index (Oct 31) → Peaks near 78% additional event volatility, the highest reading of the week.

- After Friday, implied vol gradually tapers back toward baseline levels.

This setup suggests traders are bracing for post-Fed data validation rather than the rate decision itself. In other words, the market sees reaction risk more than announcement risk.

Understanding FOMC Term Structure Distortion

FOMC weeks follow a well-studied pattern in options term structure. Here’s what typically happens around the event, according to ORATS’ volatility analytics:

Pre-FOMC (Now through Wednesday morning)

- Short-term IV (0–7 DTE) inflates sharply.

- Medium-term IV (30–60 DTE) rises modestly.

- Long-term IV (90+ DTE) barely moves.

During the FOMC (Wednesday)

Morning (9:30 AM to 1:00 PM):

Front-week IV reaches its peak as traders hedge into the rate decision. The curve shows maximum backwardation, often with 1 DTE IV near 25% while 30 DTE sits closer to 18%.

1:00 PM – Rate Decision Release:

Volatility collapses immediately as uncertainty is removed. Short-term options lose 30–50% of their implied vol within minutes.

Longer-dated maturities barely react at first.

1:30 PM – Powell’s Press Conference:

Secondary moves can occur if the tone or forward guidance surprises the market, but the majority of the IV crush has already taken place. The term structure begins to normalize.

Post-FOMC (Thursday onward)

After the event:

- The curve flips back to normal contango.

- Short-term IV drops below medium-term IV.

- Within one to two days, the curve is typically 70–90% normalized.

By the following week, the entire structure usually returns to its baseline slope unless Powell signals a major shift.

What to Monitor Using ORATS Data

Traders can track the term structure changes in real time using ORATS fields and summaries:

- Contango:

- Forward Volatility Ratios:

- Ex-Earnings IV Comparison:

These tools help quantify how much of the IV curve is being distorted by event risk and when that premium begins to unwind.

- Calendar Spreads:

- Diagonal Spreads:

- Iron Condors and Short Premium Plays:

- The Double Crush:

This meeting carries little binary uncertainty. The market is pricing a 95%+ probability of no rate change at 4.25%, so the rate decision itself is not the focus. Instead, traders are watching for signals in Powell’s tone and the incoming data that could influence the next meeting’s expectations.

The ORATS event-volatility chart confirms that the heaviest implied risk sits in the Thursday–Friday data window, not during the Fed announcement. If economic data surprises, volatility could stay elevated longer; otherwise, the crush may be faster and more complete than usual.

FOMC weeks offer a repeatable framework for understanding short-term volatility cycles. By combining the event-adjusted volatility model with term structure analytics, traders can identify where the market is truly pricing uncertainty and structure trades accordingly.

This week’s pattern is clear: the real uncertainty lies beyond Wednesday.

Chart Source: ORATS Research — SPX Additional Volatility Detected, 10/28/25

Author: ORATS Research Team

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts