Backtesting

Tuesday, January 13th 2026

Help, My Backtest Isn’t Working!

Where Options Backtests Break Down in the Real Market

Summary

Options traders often face discrepancies between backtested and live results due to flaws in backtesting systems. Key issues include unrealistic execution prices, ignored slippage, overfitting, path dependency bias, and misunderstanding returns. To improve accuracy, traders should validate strategies with similar backtests, filter by time in market, use multiple risk metrics, apply realistic entry triggers, and set proper exit criteria. Forward testing is essential to validate strategies in real-time before live trading, and ORATS is developing automated trading capabilities to streamline this process. Ultimately, rigorous backtesting combined with disciplined forward testing enhances the likelihood of achieving live results that reflect research findings.

Every options trader has experienced it: you discover a strategy with stellar backtest results, deploy it with real capital, and watch the actual performance fall short of expectations. This frustrating gap between backtested and live results isn’t just bad luck—it’s often the result of fundamental flaws in how most backtesting systems work.

The Hidden Pitfalls of Options Backtesting

- Unrealistic Execution Prices

Most backtesting platforms use end-of-day closing prices, but these rarely reflect where you’d actually get filled. Closing prints can be stale, illiquid, or simply not representative of tradeable prices. ORATS addresses this by using data from 14 minutes before the close—the optimal window where quote quality remains high without the deterioration that occurs in the final minutes of trading.

- Ignoring Slippage

A backtest that assumes mid-price fills is fantasy. Real trades require crossing the spread, and multi-leg strategies compound this cost. ORATS applies realistic slippage assumptions based on years of trading experience:

- 1-leg trades: 75% of bid-ask width

- 2-leg trades: 66% of bid-ask width

- 3-leg trades: 56% of bid-ask width

- 4-leg trades: 53% of bid-ask width

These aren’t arbitrary—they reflect the reality that market makers provide better fills on complex spreads than single legs.

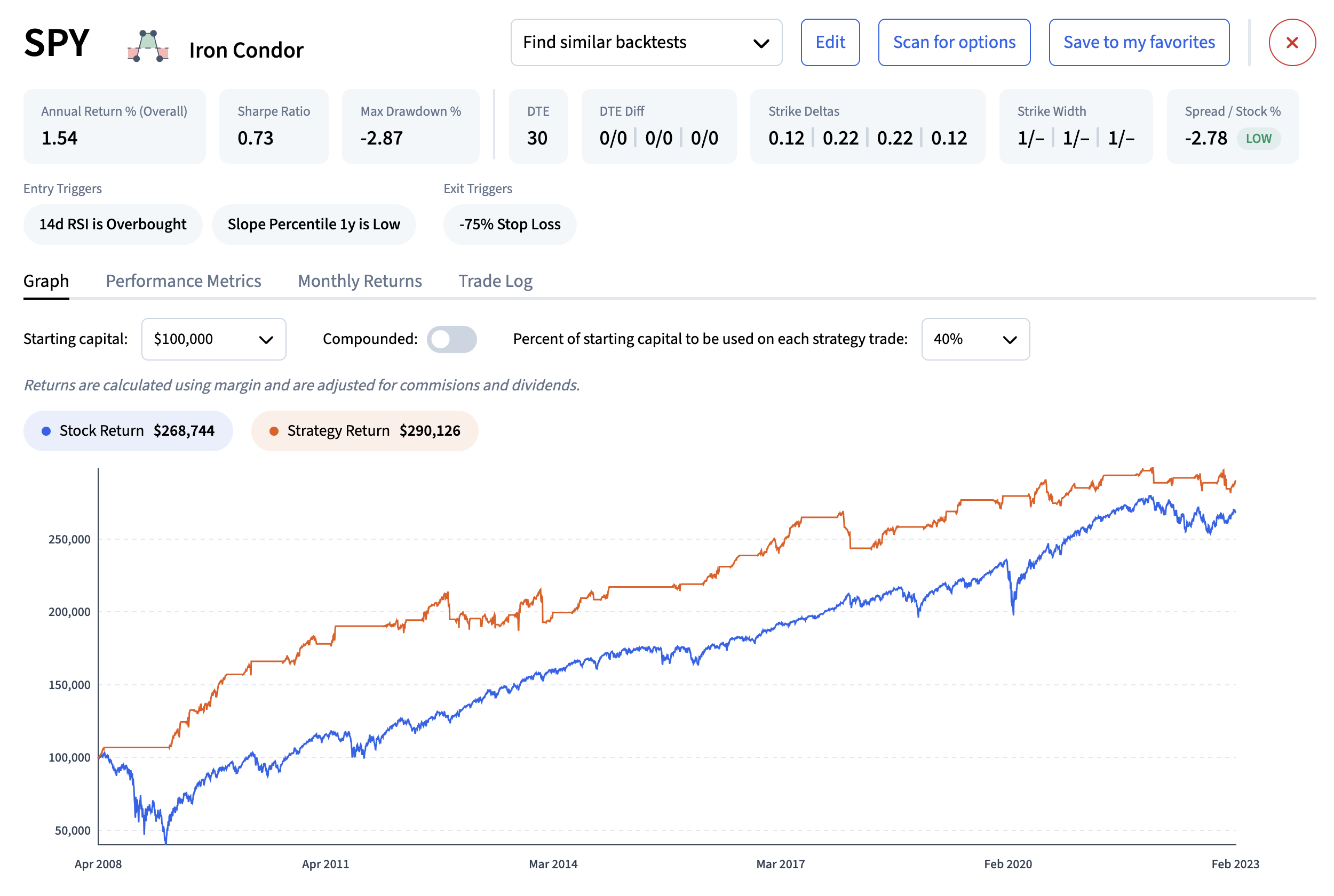

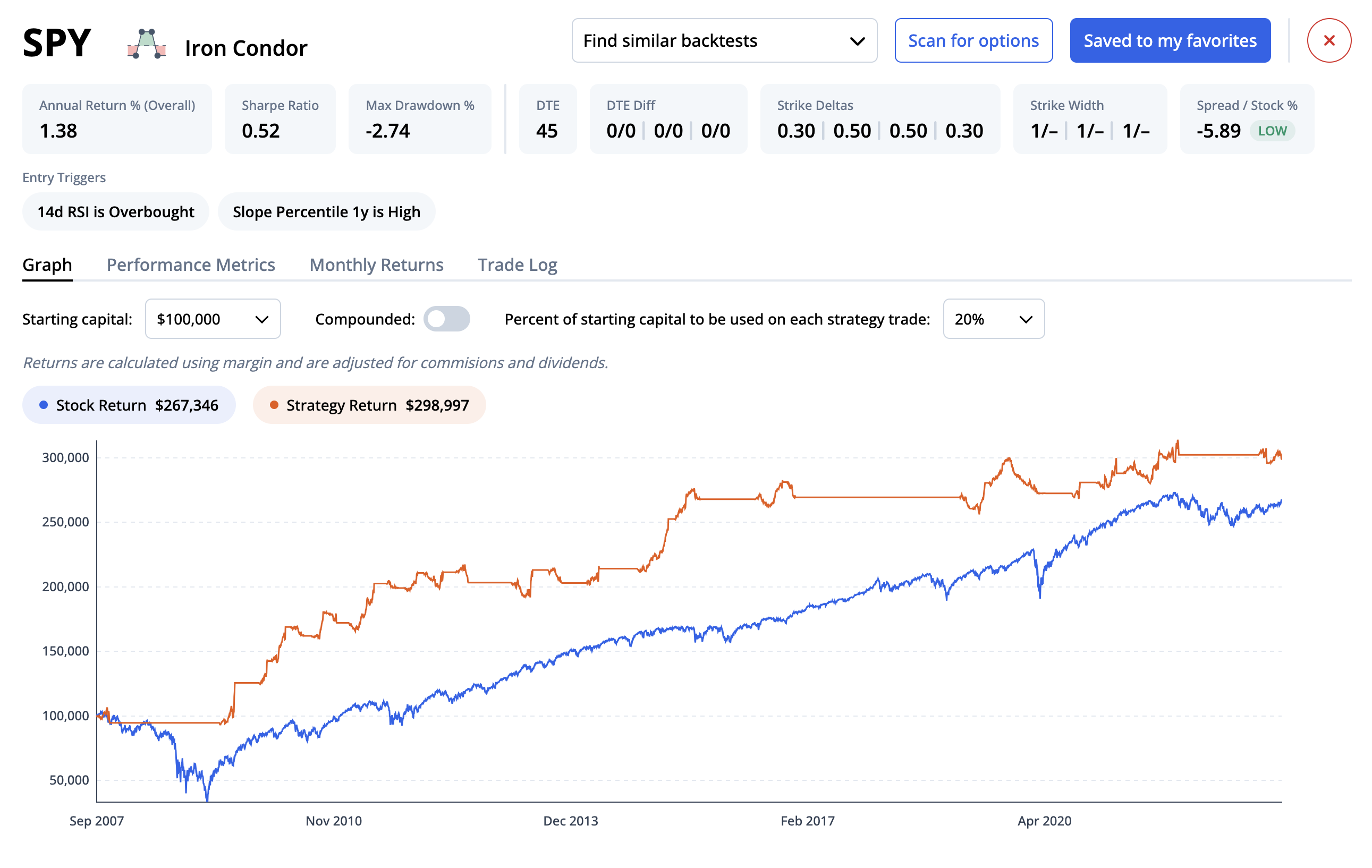

- Overfitting: The Silent Killer

Running dozens of backtests and cherry-picking the best performer is a recipe for disappointment. That “optimal” 45-DTE entry might just be noise. ORATS combats this with a “Find Similar” feature that automatically shows backtests with comparable parameters. If your chosen strategy performed well but similar variations failed, that’s a red flag.

- Path Dependency Bias

Starting a backtest on January 1st versus January 15th can produce wildly different results. ORATS eliminates this bias by entering one trade per day, every day entry criteria are met—allowing multiple overlapping positions. While this isn’t how most traders operate in practice, it provides statistically robust performance metrics free from timing bias.

- Misunderstanding Returns

A strategy showing 200% returns sounds incredible—until you realize that’s margin return on a highly leveraged position. ORATS emphasizes notional returns for comparing strategies because they normalize performance across different structures and symbols. Margin returns are shown separately for understanding capital efficiency, but with appropriate caveats.

What You Can Do

Validate with Similar Backtests

Don’t trust a single result. Use ORATS’ database of 300+ million pre-computed backtests to find strategies with similar parameters. Consistent performance across variations indicates robustness; wide dispersion suggests overfitting.

The Backtest Finder displays millions of pre-computed backtests, sortable by performance metrics.

Filter by Time in Market

A strategy that’s only been in the market for 30 days might show great returns but lacks statistical significance. Set minimum thresholds for time in market and total number of trades to ensure meaningful sample sizes.

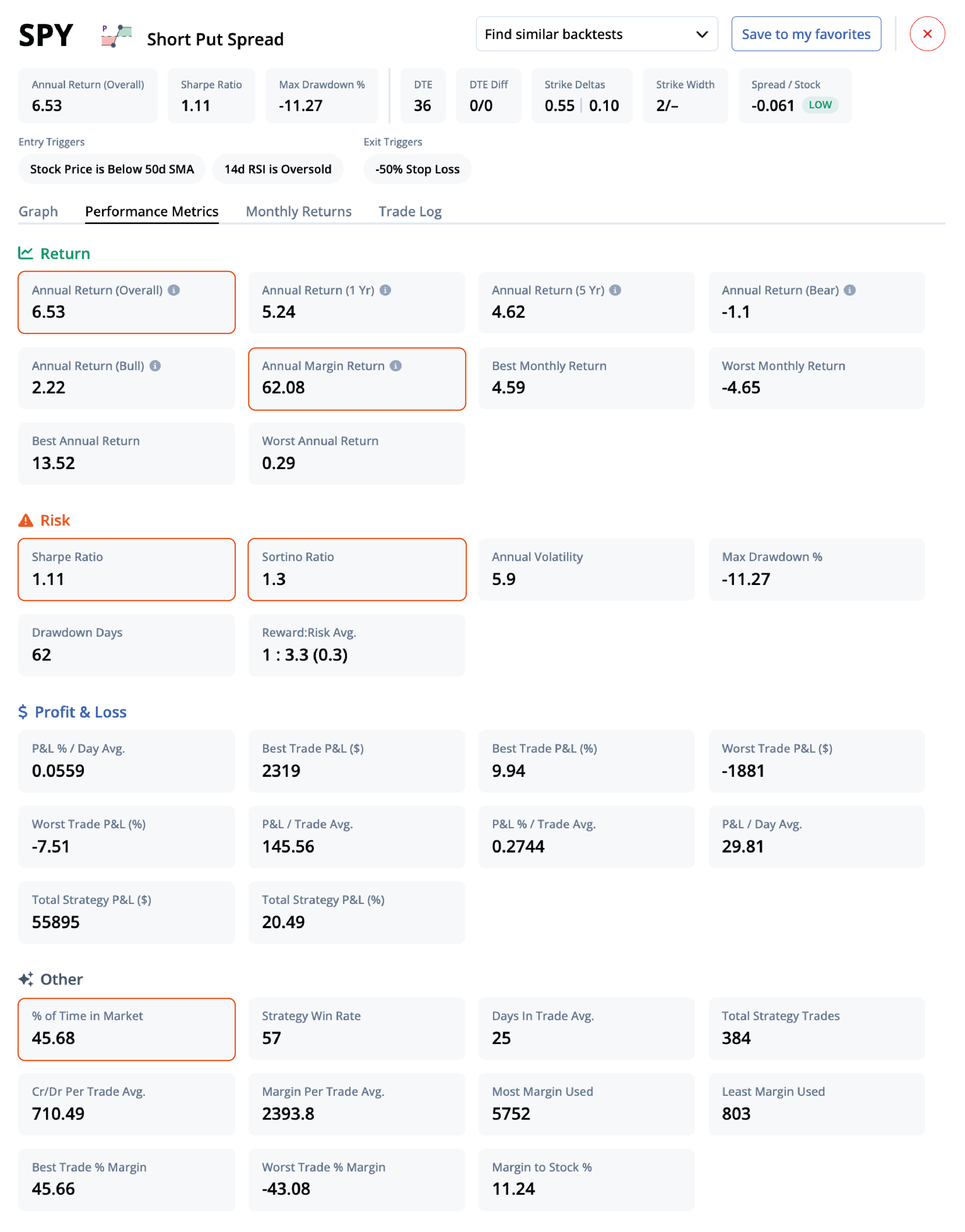

Use Multiple Risk Metrics

Don’t just chase returns. Examine:

- Sharpe Ratio: Risk-adjusted return considering all volatility

- Sortino Ratio: Risk-adjusted return penalizing only downside volatility

- Max Drawdown: The worst peak-to-trough decline

- Win Rate: Consistency of profitable trades

Apply Realistic Entry Triggers

ORATS tests strategies across various market conditions using indicators like VIX levels, RSI, IV percentile, and slope percentile. Filter for backtests that performed well in the current market environment rather than averaged across all conditions.

Set Proper Exit Criteria

The backtest finder tests multiple stop losses (-25%, -50%, -75%) and profit targets (+25% to +300%). Understand how different exit rules affected historical performance before deploying capital.

The Bridge: Forward Testing Before Live Trading

Even with rigorous backtesting methodology, there’s an inherent limitation: you’re always looking backward. Market regimes change, correlations shift, and strategies that worked historically may not persist. This is where forward testing becomes essential.

What Is Forward Testing?

Forward testing (also called paper trading or out-of-sample testing) runs your strategy in real-time against live market data—without risking capital. It’s the critical validation step between backtesting and deployment.

Why Forward Testing Matters

- Validates execution assumptions: See how your entry triggers actually fire in live conditions

- Tests current market regime: Confirms the strategy works now, not just historically

- Builds confidence: Watching a strategy perform in real-time before committing capital reduces emotional decision-making

- Catches curve-fitting: A strategy that looked great in backtests but stumbles in forward testing likely overfit historical data

ORATS Auto-Trading: From Backtest to Forward Test to Live

ORATS is developing automated trading of backtested strategies, creating a seamless workflow:

- Find a strategy in the Backtest Finder with strong historical performance and low p-values

- Optimize it using ORATS proprietary indicators to enhance average daily profit

- Save the strategy to “My Strategies” for continuous monitoring

- Forward test automatically—the system tracks how the strategy would perform in real-time

- Deploy to a connected broker when you’re confident in the results

This automation removes the manual effort of tracking paper trades and ensures consistent execution of your rules, eliminating the human errors and emotional deviations that often cause live results to diverge from expectations.

The P-Value Check

Before forward testing, examine the p-value of your backtested strategy. A low p-value indicates the results are statistically significant and less likely due to chance. Strategies with high p-values may show attractive returns but are more likely to disappoint in forward testing and live trading.

The Bottom Line

The gap between backtest and reality usually stems from unrealistic assumptions baked into most testing platforms. By using accurate near-close pricing, applying realistic slippage, guarding against overfitting, eliminating path dependency, and properly understanding return calculations, you can build confidence that your backtested edge will translate to live trading.

But backtesting alone isn’t enough. Forward testing bridges the gap between historical analysis and live deployment. With ORATS’ upcoming auto-trading capabilities, traders can systematically validate strategies in real-time before risking capital—creating a complete workflow from idea to implementation.

No backtest guarantees future results—markets evolve and past performance is not predictive. But combining rigorous backtesting methodology with disciplined forward testing dramatically improves the odds that your live results will resemble your research.

Learn more about the workflow from backtesting to automation in our recent webinar:

Forward Test Your Options Strategy Automatically | Driven By Data Ep. 113

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts