Market Events

Friday, February 22nd 2019

CELG buyout by BMY: What did the options market know?

The Celgene's buyout by BMY was unexpected. So much so that even the implied volatility forecasts missed it. Here's what story the data told us.

Summary

The buyout of Celgene by Bristol-Myers Squibb at a 54% premium was unexpected and there was little foreknowledge of the deal in the options market, according to ORATS implied volatility data. If there was leakage, we would likely see a drop in longer-term IVs, but this did not occur. The deal appears to have a high degree of certainty as short-term IVs fell along with long-term options.

Celgene (CELG) is to be bought by Bristol-Myers Squibb (BMY) at a 54% premium to the closing price yesterday. Under the proposed deal, CELG holders would receive one Bristol-Myers share and $50 in cash for each Celgene holding, as well as a special rights issue that will pay off if the merged group meets certain business targets according to TheStreet.com.

What did the options market know prior to the announcement? Not much. According to ORATS implied volatility data which can show if there was movement before the deal, "there was little foreknowledge of the deal", according to Matt Amberson, Principal at ORATS talking to reporters.

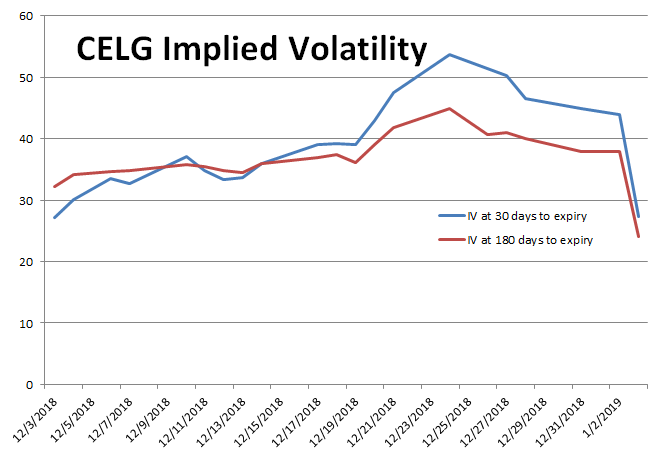

I do not see any obvious leakage in the options market for CELG. If there was a major leak, the IV at 180 days would have moved lower faster.

As the 180 day IV stood yesterday at 38%, it was down from the highs from 12/24 of 45% but above the trending volatility from the rest of December that averaged about 35%. Currently, the constant volatility or interpolated 180 day IV is 24%.

If there was leakage, we would likely see a drop in longer-term IVs, because the maximum duration of all options become the finalization of the buyout. This appears as a large fall in implied volatility especially in the longer dated options.

Near-term options IV are dependent on the certainty of the deal. This deal looks to have a high degree of certainty because the short-term IVs fell along with the long-term options as you can see in the graph.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts