Trading

Sunday, August 31st 2025

ORATS Launches Enhanced Production Platform with AI Assistant and Advanced Trading Tools

ORATS is pleased to announce the promotion of our beta dashboard to full production status, bringing powerful new capabilities to options traders and institutional clients.

Summary

ORATS has launched an enhanced production platform featuring the Otto AI Assistant for real-time data access, a Strategy Optimizer with statistical validation, and curated trade ideas. The platform improves user experience with streamlined navigation and integrates backtesting with live trading. These features are available to all subscribers, reinforcing ORATS' commitment to providing high-quality options analytics.

New Features Now Available

Otto AI Assistant

Our AI-powered assistant provides instant access to ORATS data and analytics. Otto can help users

- Navigate volatility analysis

- Interpret market indicators

- Understand complex options strategies using natural language queries

- and much more…

The assistant integrates directly with our comprehensive API suite, delivering real-time insights on over 5,000 symbols.

Strategy Optimizer with Statistical Validation

The new Optimizer enhances trading strategies using statistical analysis across our database of 300+ million backtests. Key features include:

- P-value validation to avoid overfitting and ensure statistical significance

- Access to 98 proprietary ORATS indicators including ex-earnings IV, slope, and contango measurements

- Technical indicator integration with SMA, Bollinger Bands, RSI, and CCI

- Real-time performance analysis showing return improvement, Sharpe ratios, and risk metrics

Curated Trade Ideas

Our enhanced Trade Ideas tab now features:

- Backtested trade recommendations ranked by risk-adjusted performance

- Current environment filtering based on VIX levels, RSI, IV percentiles, and slope conditions

- Strategy deployment allowing users to save optimized strategies for ongoing scanning

- Performance tracking with detailed trade logs and attribution analysis

Enhanced User Experience

The production platform maintains all existing ORATS functionality while adding:

- Streamlined navigation and improved data visualization

- Integration between backtesting, optimization, and live trading tools

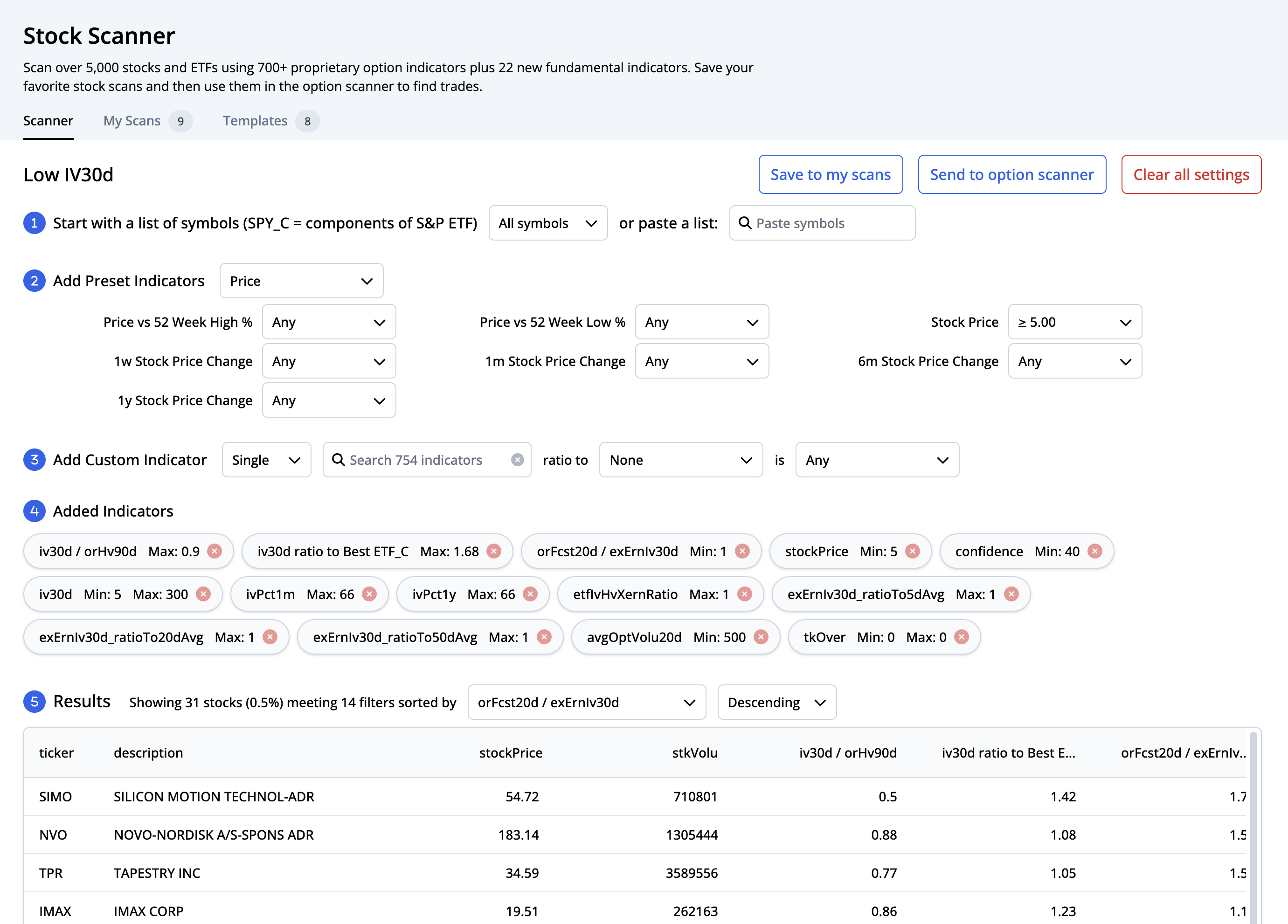

- Comprehensive options scanning with theoretical edge calculations

- Advanced volatility surface analysis and forecasting

Availability

These enhancements are immediately available to all ORATS Trading Tools subscribers at existing pricing levels. The upgrade reinforces ORATS' commitment to providing institutional-quality options analytics with retail accessibility.

Technical Foundation

All new features are built on ORATS' proprietary Smoothed Market Values (SMV) methodology, ensuring consistent data quality across historical analysis, real-time scanning, and strategy optimization. Our comprehensive dataset extends back to 2007 for end-of-day analysis and August 2020 for minute-level historical options data.

For more information about the enhanced platform capabilities, visit dashboard.orats.com or contact our support@orats.com team.

About ORATS: Founded in 2001, Option Research and Technology Services provides comprehensive options data and analytics to traders, institutions, and financial technology firms worldwide.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts