Market Events

Thursday, July 14th 2022

What Options Market Tells Us About Twitter

Amid a legal battle between Elon Musk and Twitter, traders can assess trends in options market for clues on where stock might go

Summary

Traders can use trends in the options market to assess where Twitter's stock might go amid the legal battle between Elon Musk and the social media platform. ORATS found interesting stock and volume trends ahead of key news events earlier this year, and traders expect significant volatility ahead of an important earnings report on Friday morning. The options market initially believed the deal would go through, but now suggests a low probability of a takeover.

- Mike Zaccardi author

- Amid a legal battle between Elon Musk and Twitter, traders can assess trends in options market for clues on where stock might go

- ORATS found interesting stock and volume trends ahead of key news events earlier this year

- An important earnings report Friday morning, and traders expect significant volatility

The Elon Musk vs Twitter saga continues. It’s been more than three months since the world’s richest man disclosed a 9% stake in the popular, though struggling, social media platform. Twitter (NYSE:TWTR) shares rose sharply on April 4—gapping up from near $39 to almost $50. The stock hit a peak of $54.57 the next day, above the dubious $54.20 offer price that would come on April 14. The Twitter board accepted Musk’s offer on April 25. Since then, however, it has been an ugly feud, all the while a massive sell-off in tech shares persisted. There’s no doubt that the market value of Twitter is far less today than when Musk polled his followers as to whether the platform supports free speech on March 25.

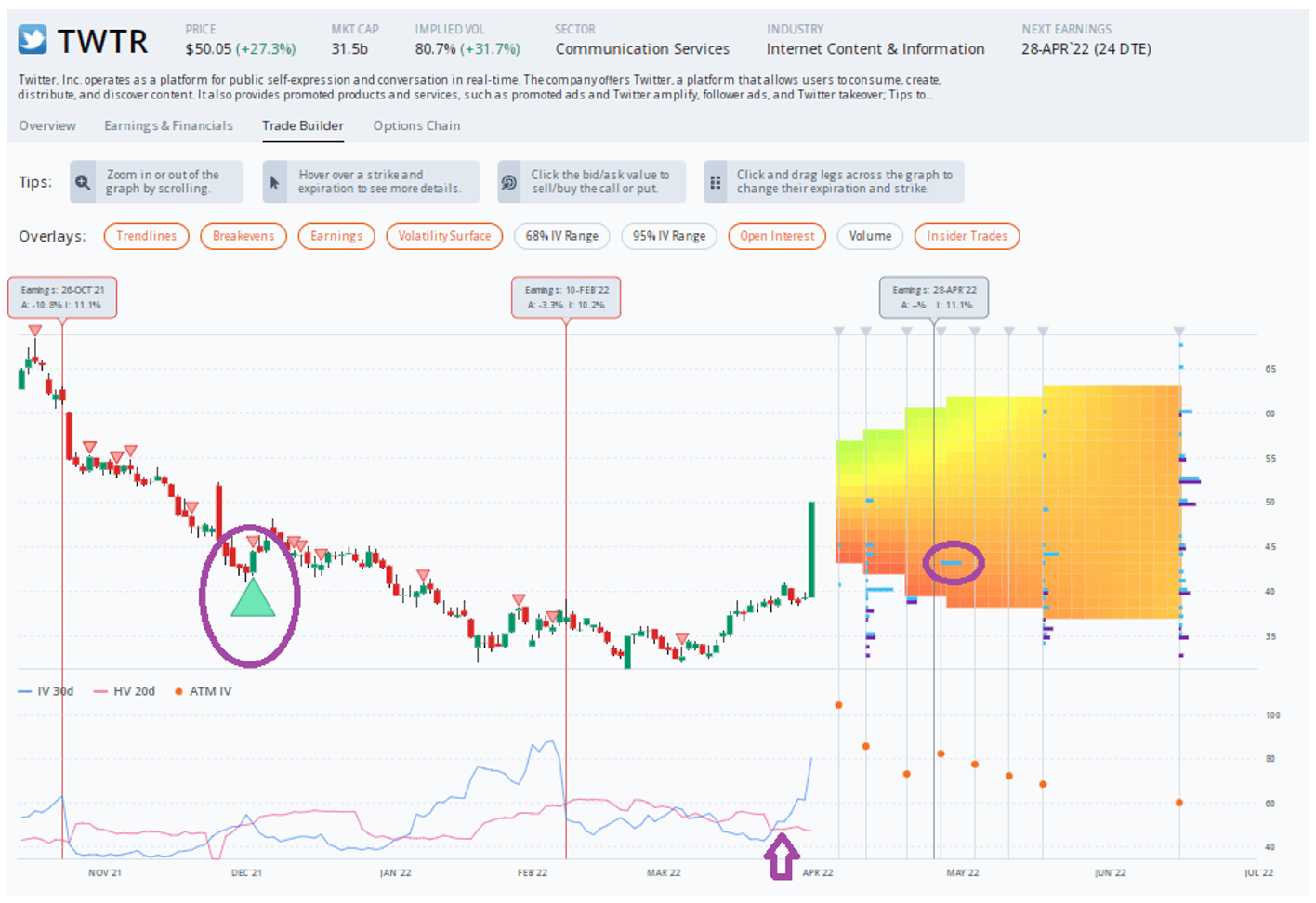

At ORATS, we noticed a large amount of call volume on Twitter shares as some investors were betting the stock would rally. While spotting interesting trading trends in puts and calls is important, so too is simply looking at implied volatility (IV). The higher the IV, the more premium in options. We observe implied volatility 30 days to expiration.

TWTR $44 Strike Call Options Expiring In May Saw Big Activity March 25

Twitter Overview

Source: ORATS

A well-timed options trade took place on March 25, where the $44 strike calls expiring in May were likely purchased at around $1 with the stock trading near $38. A little more than a week later, the stock breached $50, resulting in a more than 600% return.

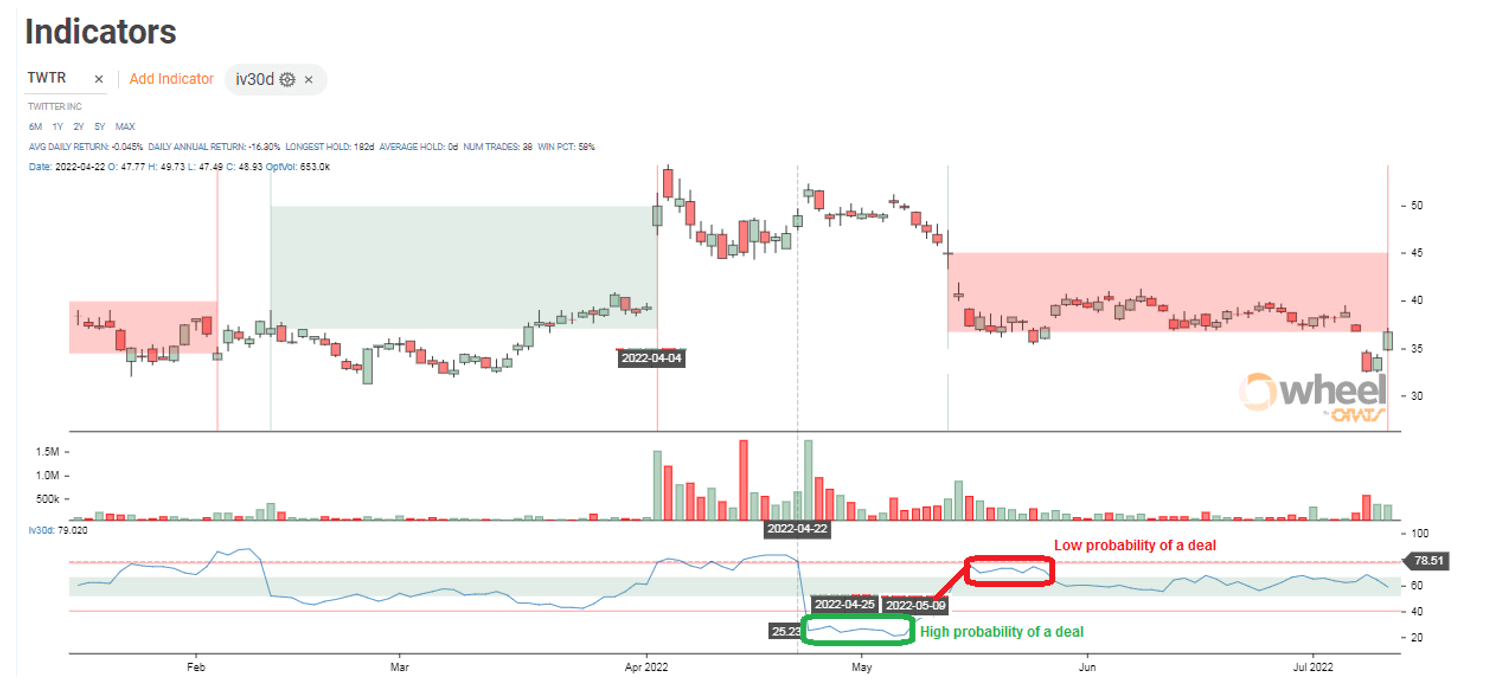

If the options market expects a takeover to go through with no issues, then it is common to see premiums and IV collapse. After all, if an all-cash deal is a virtual lock, then the stock will simply approach the offer price and hover there until the corporate transaction occurs. Mechanically, once the deal is finalized, call options with strikes above the takeover price and put options with strikes below the takeover price become worthless. It’s important to know that premium is the portion of an option's price that is above intrinsic value. Intrinsic value for a call is simply the price of the stock minus the strike.

Getting back to TWTR – the options market generally believed the deal would go through back in late April. We noticed that IV levels on TWTR shares fell big from 78.5% to 25.2% on April 25. In May, though, the tide began to change. From May 9-13, the options traders thought less and less of the notion that a deal would happen at $54.20. It was then when implied volatility rose from 25% to near 80%. For perspective, the 200-day moving average of IV was just 50%.

TWTR’s IV Priced-In A High Probability Of Deal Initially

Twitter Indicators

Source: ORATS

Jump ahead to today, and TWTR’s IV is 59%, suggesting there is a low probability of a takeover. Bear in mind that its Q2 earnings report is confirmed to be released on Friday, July 22 BMO, according to a company press release on the evening of July 13. The at-the-money straddle implies about a 10% move up or down in TWTR shares by expiration on the 22nd.

The Bottom Line

Expect more swings in TWTR over the coming days as more Musk-related rumblings continue. The deal could be squashed, but it appears the courts will have the ultimate say. Traders can avoid the noise and look to the options world to get an idea of where Twitter shares might be headed. It was initially thought that an acquisition would go through, but that is no longer the case today. Looking ahead, a key company earnings report should bring about more volatility.

Disclosure: Mike Zaccardi has no position in any of the securities mentioned in this article.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts