Market Events

Thursday, November 16th 2023

Will Shrink Strike Again? DICK’S and Best Buy Highlight Week 2 of Retail Earnings

We profile two retailers that have struggled this year for signs of a turnaround

Summary

The upcoming holiday shopping season is uncertain, with mixed signals in card usage trends and weak consumer sentiment. Traders will be closely watching the heavy stretch of retail earnings, along with October Retail Sales and CPI and PPI data. The SPDR S&P Retail ETF has seen a significant decline in share price. DICK'S Sporting Goods will be under scrutiny after disappointing Q2 results, with concerns about inventory shrink. Best Buy faces challenges from e-commerce and heavy discounting. Overall, retail earnings will provide important insights into spending trends.

Authored by Wall Street Horizon on https://www.wallstreethorizon.com/blog/will-shrink-strike-again.

Watch what I do, not what I say. That's likely to be the mantra heading into the holiday shopping season. The National Retail Federation predicts a modest rise in overall spending, but there are mixed signals when assessing card usage trends from the latest batch of weekly and monthly updates. What's more, the University of Michigan's Consumer Sentiment Survey revealed the weakest reading since May, despite the rapid fall-off in gas prices.

The picture will be clearer after traders digest this week's heavy stretch of retail earnings. Along with October Retail Sales from the Census Bureau and the monthly CPI and PPI looks, all eyes will be on the winter holiday spending period.

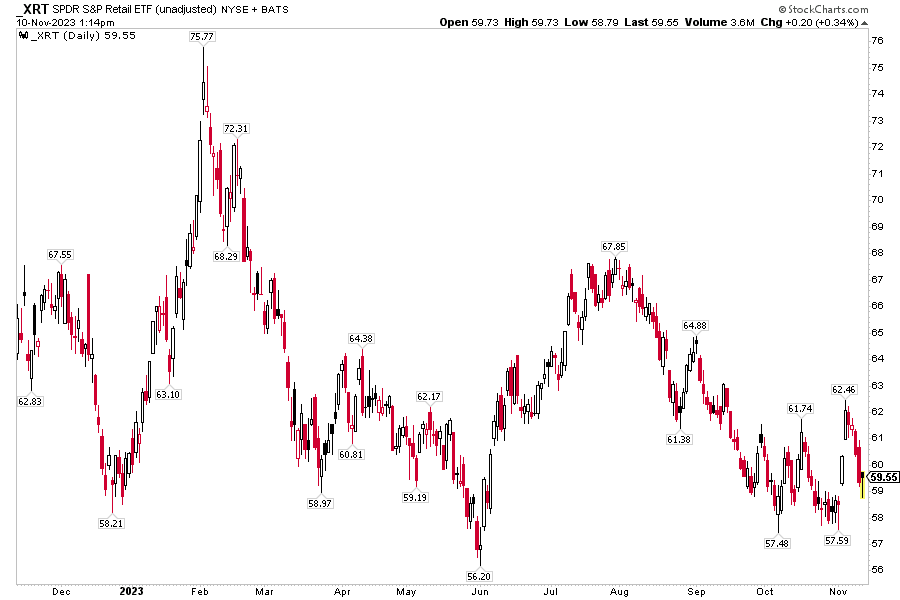

The price-action theme over the last few months has been anything but cheery. The SPDR S&P® Retail ETF (XRT) has seen its share price fall down the chimney, plunging from just shy of $68 in the summer to sporting a 5-handle at the close of last week. The fund and many of its holdings are in play this week amid key earnings reports and macro data.

The good news for both traditional retailers and e-commerce companies is that there's an extra week between Thanksgiving and Christmas this year. Five full weekends, retail executives hope, will allow for a few extra splurges to boost bottom lines after what has been a remarkably strong year in terms of total spending.

S&P Retail ETF: Strong Sales, Weak Share-Price Trends

With some of the Consumer Staples and Consumer Discretionary heavyweights having already reported Q3 results, the focus shifts to more niche spots. After Walmart (WMT) and Ross Stores (ROST) provide earnings numbers this Thursday, Thanksgiving week provides little respite in the two consumer sectors. Let's home in on the slew of third-quarter reports confirmed to be released on Tuesday next week.

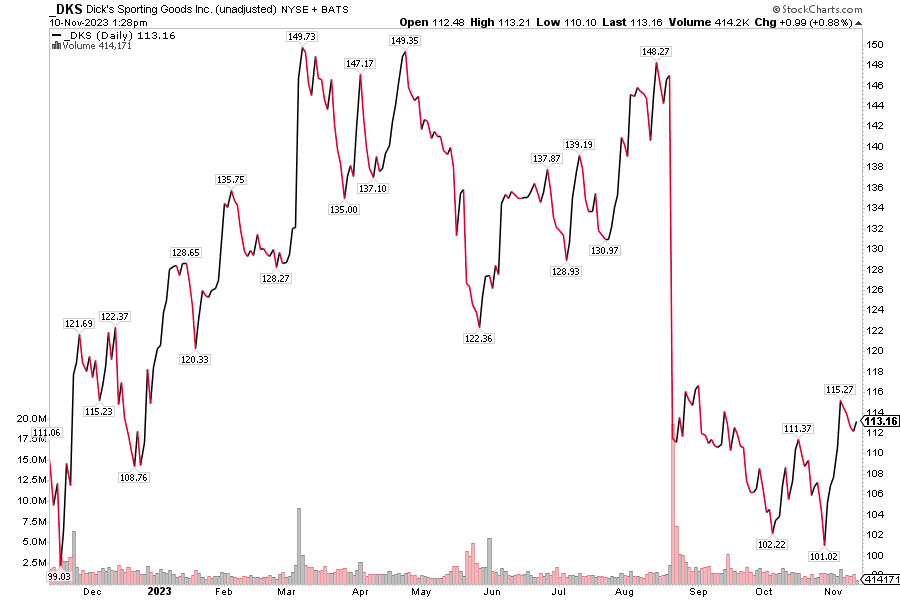

DICK'S Looks to Get Back in the Bullish Game

DICK'S Sporting Goods (DKS) will be under the spotlight. Scrutiny will be high as the $9.5 billion market cap Specialty Retail industry company shocked analysts back in August. Its Q2 operating EPS figure of $2.82 missed the mark by $0.99 while quarterly revenue verified near expectations. Weaker-than-expected guidance helped to send shares lower by 24%, but of particular concern was its management team citing elevated inventory shrink leading to soft Q2 profits.

While not the only retailer hinting at problems with theft (which is just one element of retail shrink), DKS was perhaps the poster child of the trend last earnings season. Critics suggest that shrink has become the new 'weather' in terms of what to blame for a weaker quarter. We'll know more after the Pennsylvania-based sporting goods retailer serves up third-quarter numbers next week.

As it stands, the options market has priced in a high 8.4% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the November 21 reporting date, according to Option Research & Technology Services (ORATS). That is the largest implied move since November last year.

DKS 1-Year Stock Price History: High-Volume Drop Following Weak Q2 Results

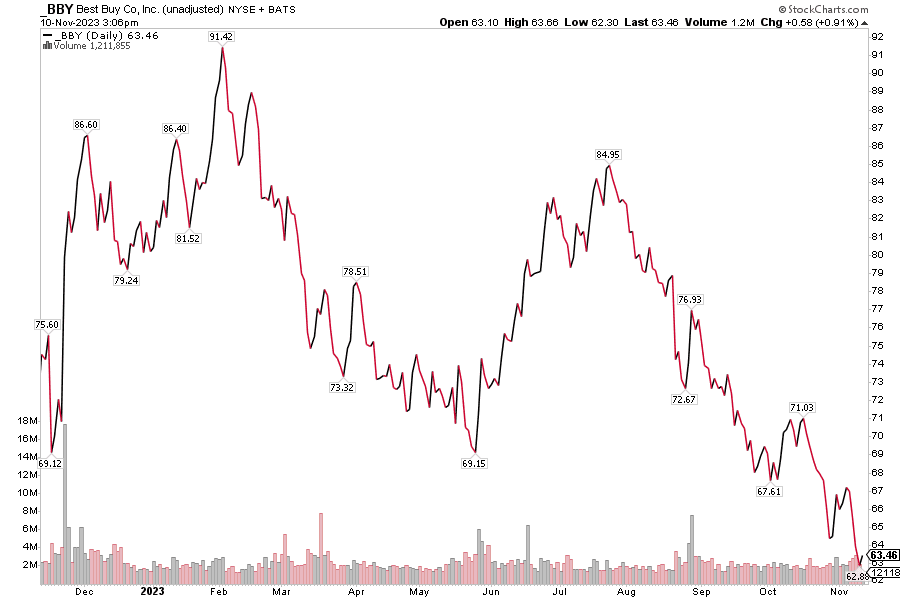

Best Buy Tossed into the Clearance Bin

Maybe the most impacted big-box store by the rise of e-commerce is Best Buy (BBY). It was not long ago when "showrooming" - the consumer practice of checking out electronics at a physical store only to tap buy on a smartphone from an online merchant (typically Amazon) - was the major negative investment thesis with BBY. While that's certainly still a risk, another holiday sales season of heavy discounting and at-risk margins are top of mind with investors. Not surprisingly, the consensus estimate for current-year EPS is just $6.22 - a 12% annual decline.

Analysts at Goldman Sachs see a flicker of opportunity in the stock, however. Last month, Goldman upgraded the retailer from a Neutral rating to a Buy. The firm cited signs of stabilizing demand for some tech products and better comp-store sales trends in the offing. The valuation case can be made considering that BBY trades near 10 times forward operating earnings, a steep 22% discount to its 5-year average.

BBY's Q3 2024 results will be the all-important data point given that no other corporate events are slated for the balance of the year, according to Wall Street Horizon. Implied volatility is also to the high side with Best Buy, but the company has topped EPS estimates in 11 of the previous 12 quarters with the stock trading higher post-earnings in six of the last seven quarters, per ORATS.

BBY 1-Year Stock Price History: Best Buy Shares on the Fritz

The Bottom Line

It'll be planes, trains, automobiles, and retail earnings numbers during Thanksgiving week. Executives from consumer companies big and small hope spending trends hold up amid a less-firm labor market and a downbeat sentiment situation. A handful of bellwether firms have already posted mixed results, and more market-moving quarterly figures are on tap.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts