NEW: Real-time data in Trading Tools

Connect now

About

We believe that alpha is a consequence of quality data. That's why we've built an entire ecosystem around hundreds of proprietary indicators, trading tools, APIs, and historical quotes. Since 2001, our products have served thousands of retail traders, hedge funds, and institutional clients.

Our Story

1993

Matt Amberson starts as a CBOE market maker and hires statistically minded individuals for market making and options research. Techniques to calculate superior volatility calculations and forecasts are developed.

2001

Option Research & Technology Services (ORATS) is formed to offer options products using procedures developed for a successful market making operation. The Smoothed Market Values (SMV) system is designed to produce the best greeks, implied volatilities and theoretical values in the industry.

2005

Core data based on summarizations from the SMV system including implied earnings and dividends is offered as a product.

2010

Data APIs are offered to access information. Backtesting options strategies for clients are introduced.

2017

The first version of Wheel – our online platform for backtesting – is released to the public.

2019

SMV summarizations are enhanced with forward volatilities, skew granularities, and component calculations.

2020

Optimization services are offered to clients as a way to quickly test thousands of parameters and indicators to find the best-performing investment strategies.

2022

The ORATS Dashboard is launched, adding stock scanning, trade building, earnings analysis, and more to our suite of web tools.

2023

The Dashboard is augmented with new broker integrations and better trading capabilities. The new backtest finder is launched, giving users the ability to search, filter, and sort millions of backtests. More tutorials and an upgraded website compliment the new features.

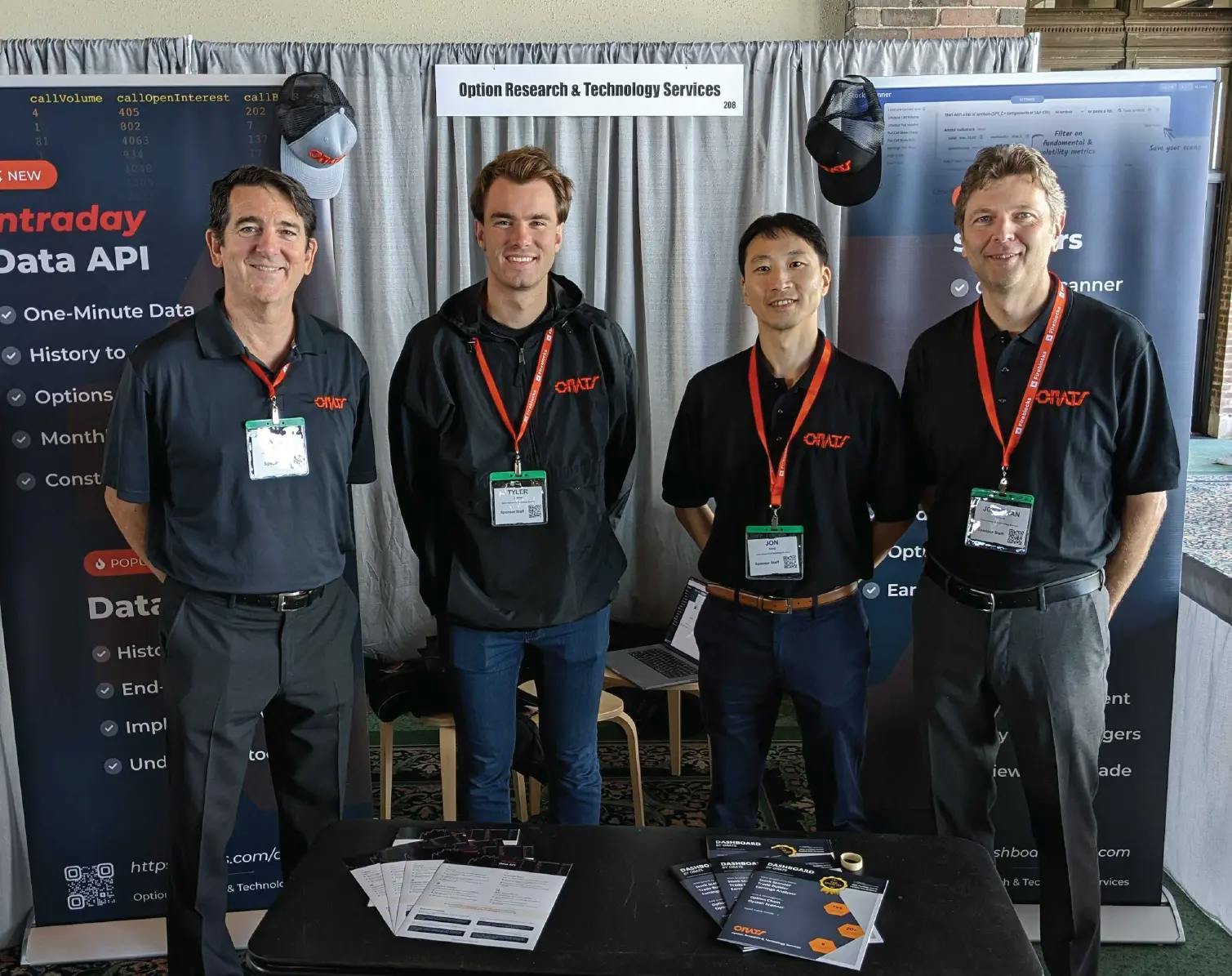

Our Team

Matt Amberson

Founder & Principal

Matt started ORATS in 2001 and has served thousands of clients in his two decades at the helm. Before ORATS, Matt worked as a market maker on the floor of the CBOE.

Jon Kong

Director of Engineering

Jon has been with ORATS since 2007, leading the engineering efforts in building out our products, services, and IT infrastructure.

Tyler Cheves

Product Manager

Before working at ORATS, Tyler created an options trading platform on iOS. His experience as a developer, trader, and designer helps us improve and expand our product offering.

Wendy Rauch

Dividend Analyst

Wendy has been our lead dividends researcher since 2009. Prior to ORATS, Wendy worked as a public relations manager for a large mutual fund management company.

Jonathan Sleeuw

Software Engineer

Jonathan has served a variety of roles at ORATS over the years. With decades of experience working within financial firms, Jonathan provides valuable insight and development tips.

Learn from an ex-market maker

Weekly options education hosted by ORATS founder Matt Amberson.

Contact Us

Questions about the API requirements? Want to become an affiliate? Curious about the backtester? Leave us a message and we'll get back to you shortly.

Your email

Your message

Submit

ORATS

Institutional Quality Tools for All Options Traders

(312) 986 - 1060

support@orats.com

36 Maplewood Ave, Portsmouth, NH 03801

Trading Tools

Historical Data

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors. For more information please see our disclaimer.

Interactive Brokers is not affiliated with Option Research & Technology Services, LLC and does not endorse or recommend any information or advice provided by Option Research & Technology Services, LLC.