Backtesting

Friday, March 19th 2021

Answers To Common Questions: Backtesting

ORATS backtesting uses historical market data quotes and applies rules to make the backtest of options as realistic as possible.

Summary

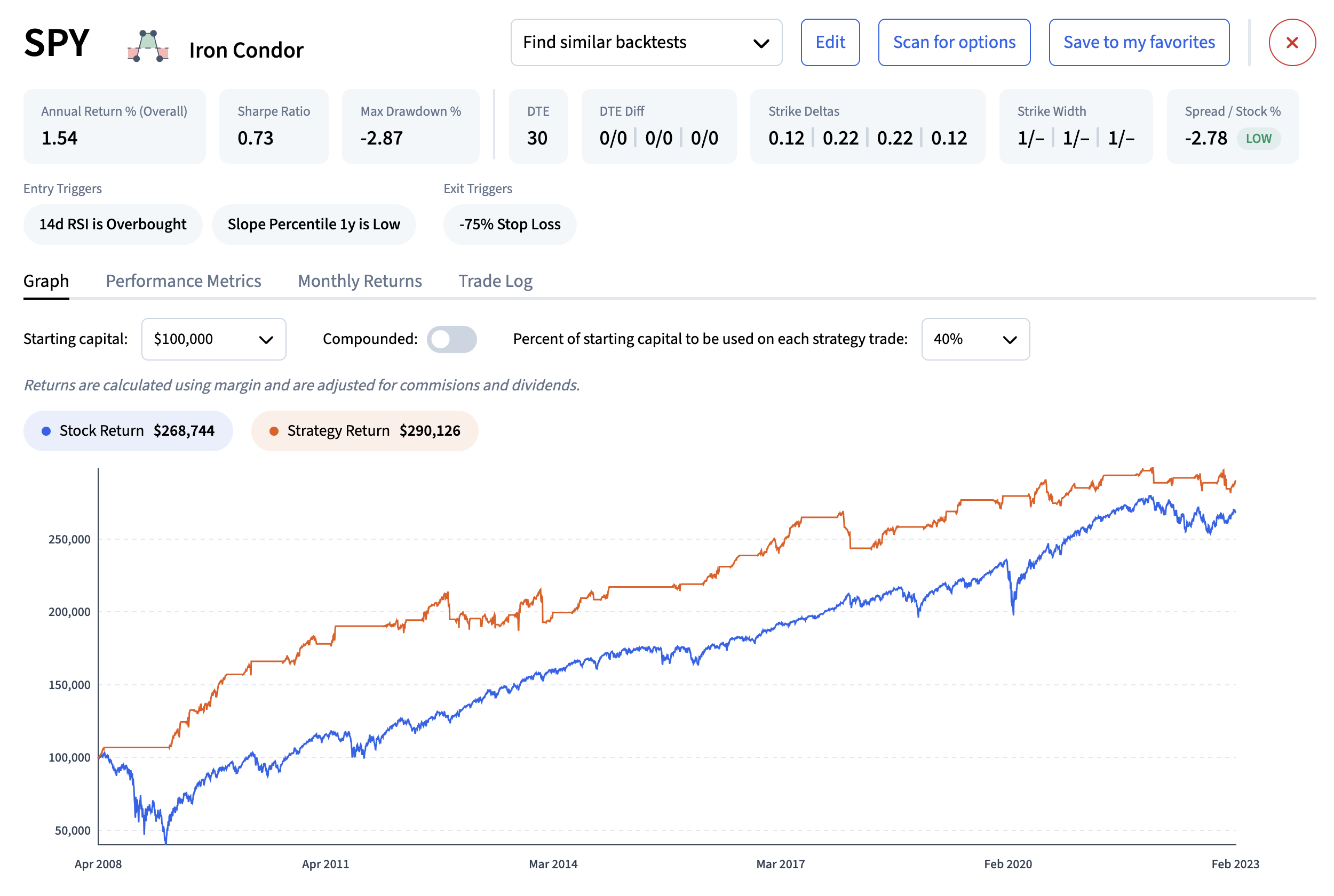

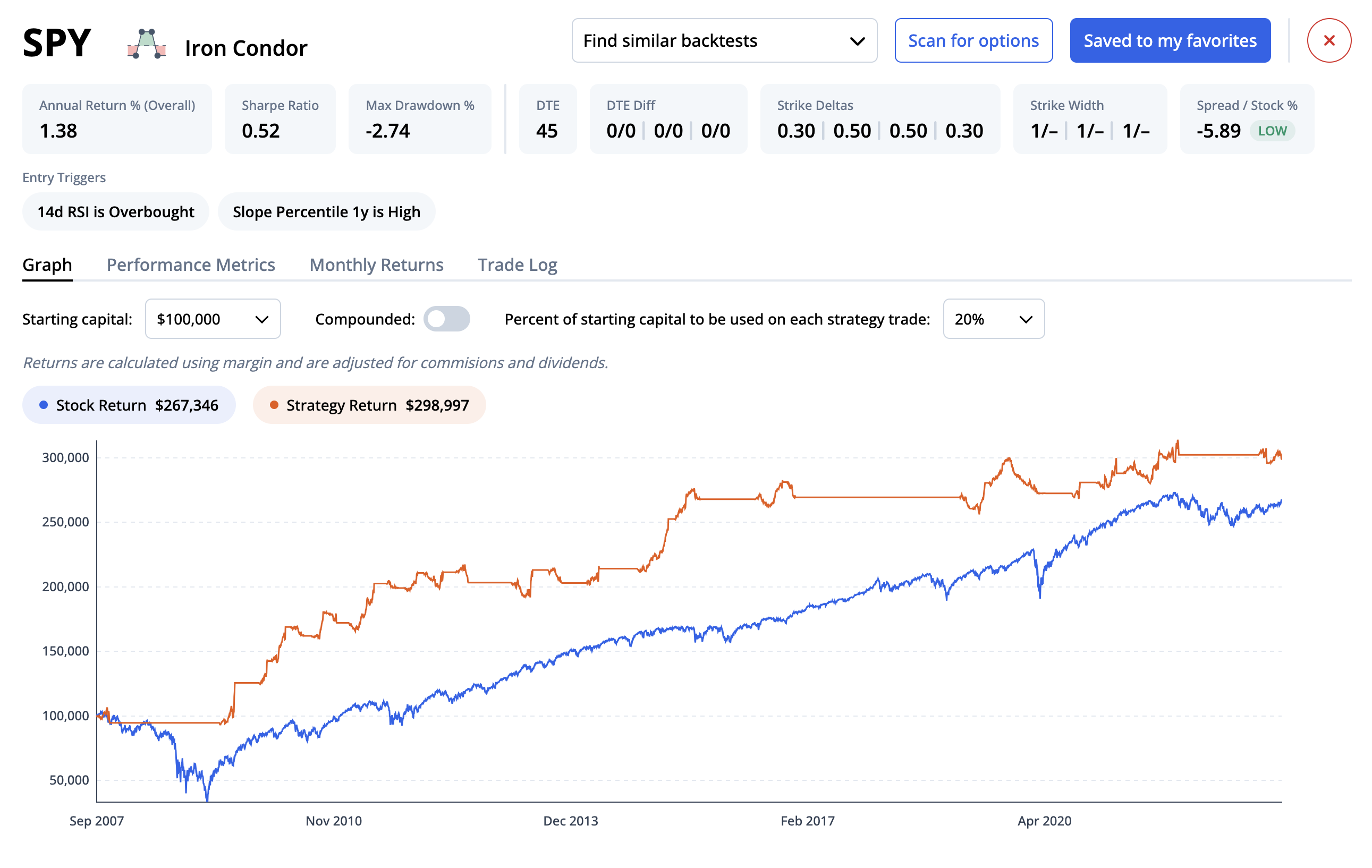

ORATS backtesting uses actual bid-ask prices to simulate trading, not theoretical values. The backtester works by finding the options closest to the target days to expiration and target delta to trade. ORATS uses arithmetic returns to avoid path dependency and to avoid issues if more than 100% of a strategy returns are lost. The backtester has many pre-canned strategies that can be tested with various entry parameters, exit methods, flexible commission and slippage assumptions, and earnings entry and exit days. Backtests can be combined and reports with financial statistics like Sortino, win rates, and best month returns generated. Optimizations can be run with thousands of backtests automatically run, sorted, and a report generated.

Try the backtester today at wheel.orats.com

User feedback is critical to helping us ensure top-quality tools and data. Answers to common questions will be a series of blog posts with our answers.

"Is it true that no real option mid-price data is used in backtesting after the skews are fit (i.e., everything is off the theoretical values?"

No, we use options market bid-ask quotes to simulate trading in our backtester, not theoretical values.

Every trading day back to 2007, we take snapshots of market bid-ask quotes and stock mid-point prices at the same time each day, 14-minutes before the close. Backtesting on closing markets does not have representative quotes as market makers will often widen out as the close approaches.

We create greeks with our intensive smoothed market values process (SMV).

Our backtester works by finding the options closest to the target days to expiration and target delta to trade.

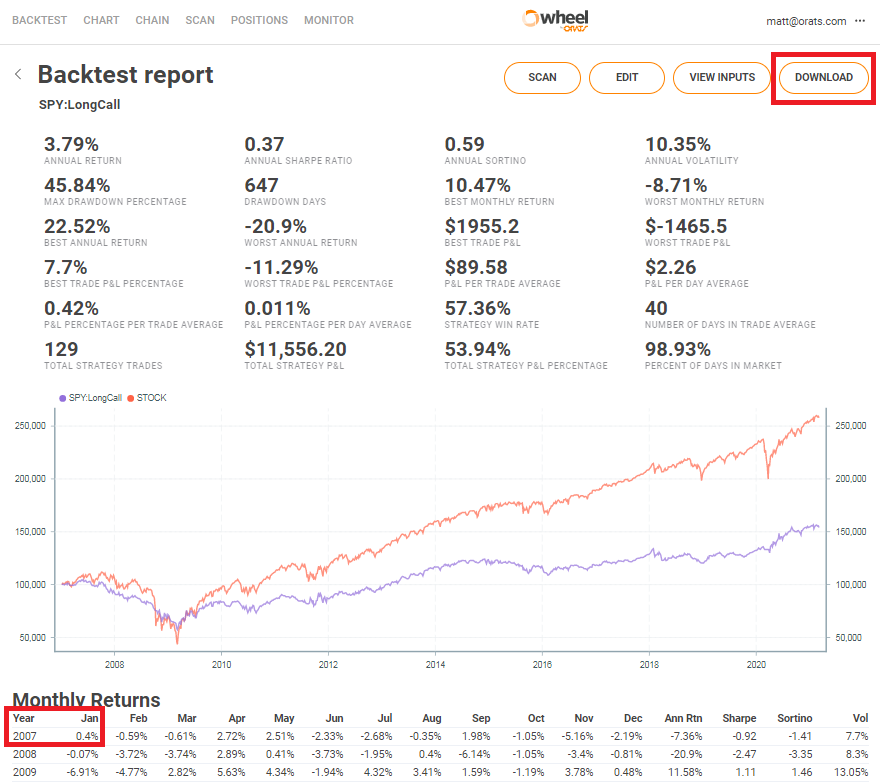

For example, for a SPY Long Call strategy with a specified target of 40 days to expiration and an acceptable range from 30 to 50 days, and a target of .65 delta --acceptable range .55 to .75, the backtest will pick the closest target value for the trade. It will choose the closest DTE of 40 days and .65 delta.

Once an option is found, we use actual bid-ask prices to simulate entry and exit prices and apply the slippage calculations below. To mark our options positions to compute daily returns, we use mid-point prices. The table below shows how we use bid-ask prices to simulate the backtest buys and sells at the mid-point plus or minus slippage at our one-leg default of 75%.

The slippage formula to buy is Bid + (Ask - Bid) * slippage%

The slippage formula to sell is Ask - (Ask - Bid) * slippage%

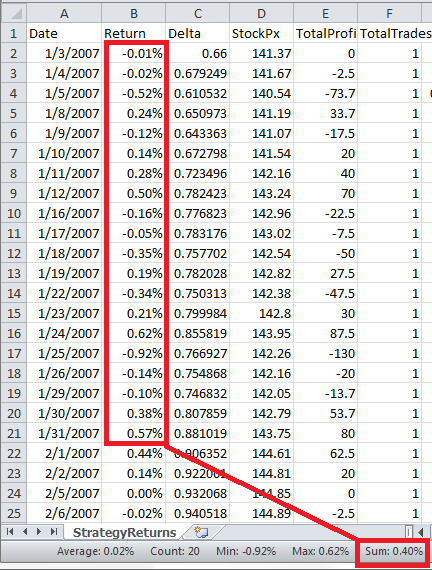

In the SPY Long Call example above, here are the first two trades starting in 2007.

The simulated first trade was buying the February 16th, 140 strike call with a market bid-ask of $3.60 x $3.80 making the simulated trade price $3.75. If the next day’s bid-ask were $3.90 x $4.00, then the profit would be $0.20, and the daily return calculation would divide that by the stock price at open of the trade, $141.37 or 0.1415%.

The formula for daily return = option profit / opening stock price.

If there are any stock components (Hedging, covered calls, married puts, etc.) we use the formula: (option profit + stock profit) / opening stock price.

Daily returns can be found in the downloads accessible from the backtest report. We use simple arithmetic interest and the daily returns will add up to the monthly returns found in the Backtest Report.

We calculate using geometric returns if you select compound returns in the backtester. We use average arithmetic returns as default, using a constant amount invested per day to calculate a balance. For example, the graph in the backtester uses a constant $100,000.

For example, the January 2007 daily returns add to 0.40% matching the backtest report.

We use arithmetic returns to avoid path dependency and to avoid issues if more than 100% of a strategy returns are lost.

Here are some other noteworthy characteristics of the ORATS Backtester:

- Many pre-canned strategies can be tested with various entry parameters like varying DTE, delta, or stock OTM% for strikes, different other parameters like setting the spread price percent of the strikes' width or setting the price of the option divided by the stock price.

- Exit methods are used like when a delta is reached, profit level hit, or a percent of the max spread profit attained, and the trade is closed.

- We have flexible commission and slippage assumptions that change for the number of legs. For example, a setting of 75% travel to trade the bid-ask spread for a one-leg option translates to 56% for a four-leg spread.

- Earnings entry days and exit days in relation to the announcement dates can be tested.

- Backtests can be combined and reports with financial statics like Sortino, win rates, best month returns generated.

- Optimizations can be run with thousands of backtests automatically run, sorted, and a report generated.

We think our backtester is the best out there. What do you think? Email us at contactus AT orats.com. You can see our features with other backtesters at https://quantpedia.com/links-tools/

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts