Backtesting

Tuesday, June 11th 2019

Backtesting Calendar Spreads Based on IV Contango

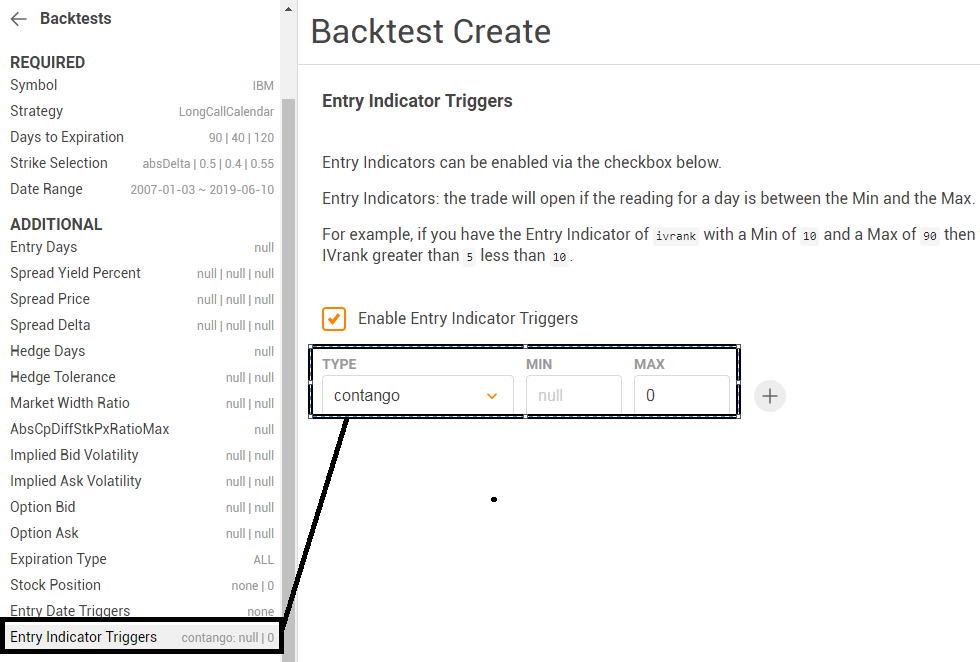

Backtest a calendar when the implied volatility term structure is in your desired shape. Set the Entry Indicator Trigger to Contango.

Summary

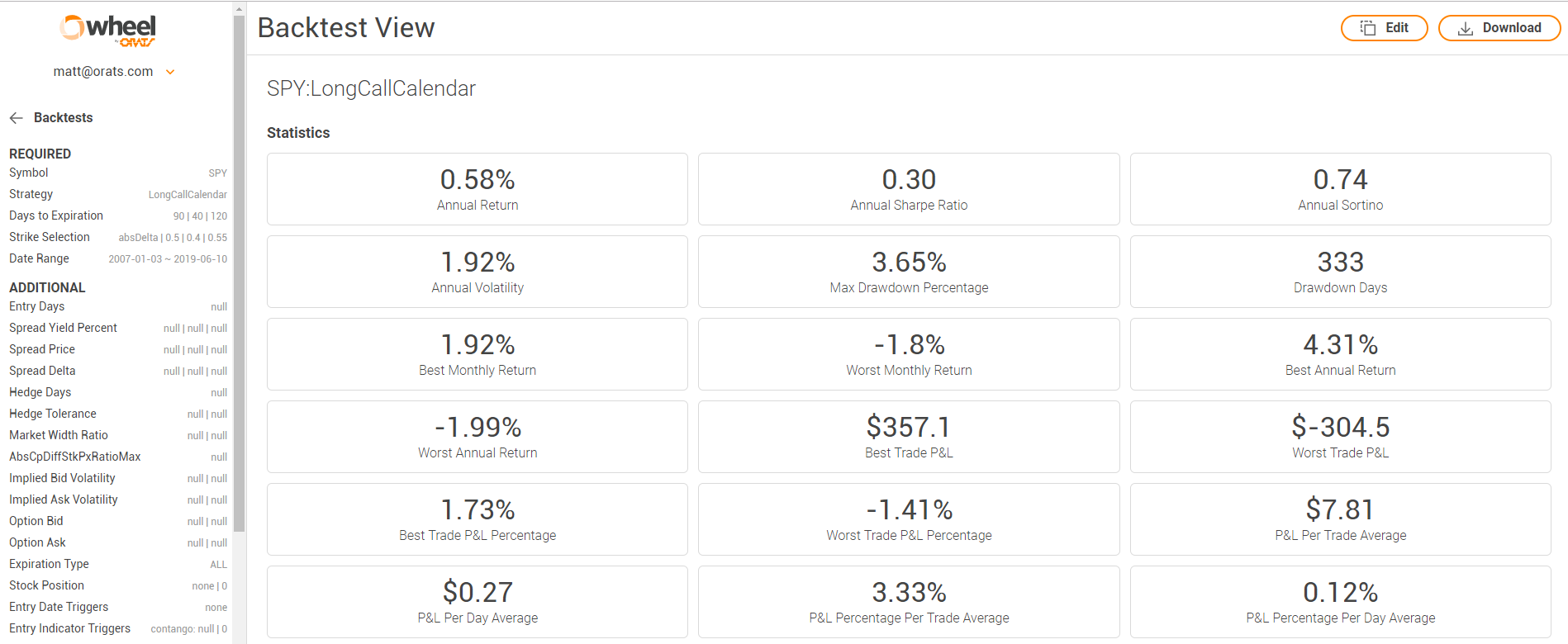

Backtest a calendar spread based on IV contango by setting the entry indicator trigger to contango, which measures the slope of the 45 day implied volatility term structure. When contango is negative, the term structure is in backwardation, which is favorable for buying a calendar spread. By setting the max to 0 and leaving the min blank, you can run the long call calendar and compare it to a test not using contango. The SPY long call calendar had an annual return of 0.58% with contango set to max=0, compared to -0.09% without it.

You can instruct the ORATS backtester to trade a calendar only when the implied volatility term structure is in your desired shape.

The easiest way to do this is to use the Contango measurement. ORATS Contango is the slope of the 45 day implied volatility term structure. When Contango is negative, the term structure is in 'Backwardation'. Since when you buy a calendar you are buying the back month and selling the front month, you want the shape of the skew to be in your favor as much as possible, and this means you want Backwardation.

To trade only when your ticker is in Backwardation, you can set the Entry Indicator Trigger to Contango by clicking on the IV Rank drop down box and typing in contango. Set the Max = 0 and leave the Min blank as in the picture below.

Now you can run the long call calendar and compare to a test not using Contango.

I ran the SPY long call calendar with the default values and got an average annual return of -0.09%. With the Entry Indicator Triggers Contago set to Max=0, I got an annual return of 0.58%, a substantial uptick and was in the market 66% of the time.

Try it yourself. Get a free trial to the backtester HERE.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts