Backtesting

Thursday, May 28th 2020

Covered Call Backtest: Finding The Best Maturity, Strike, IV, And Earnings Methods

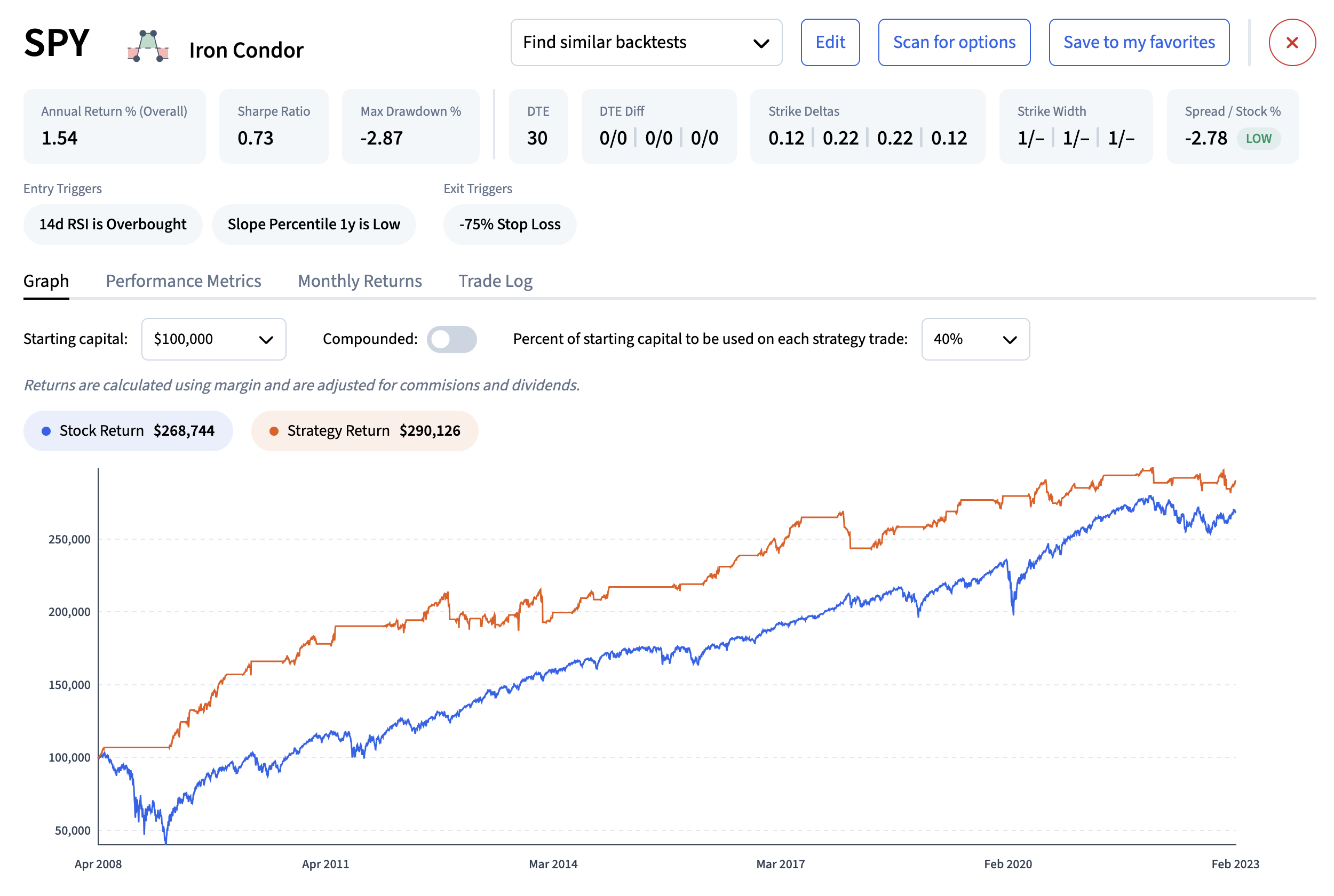

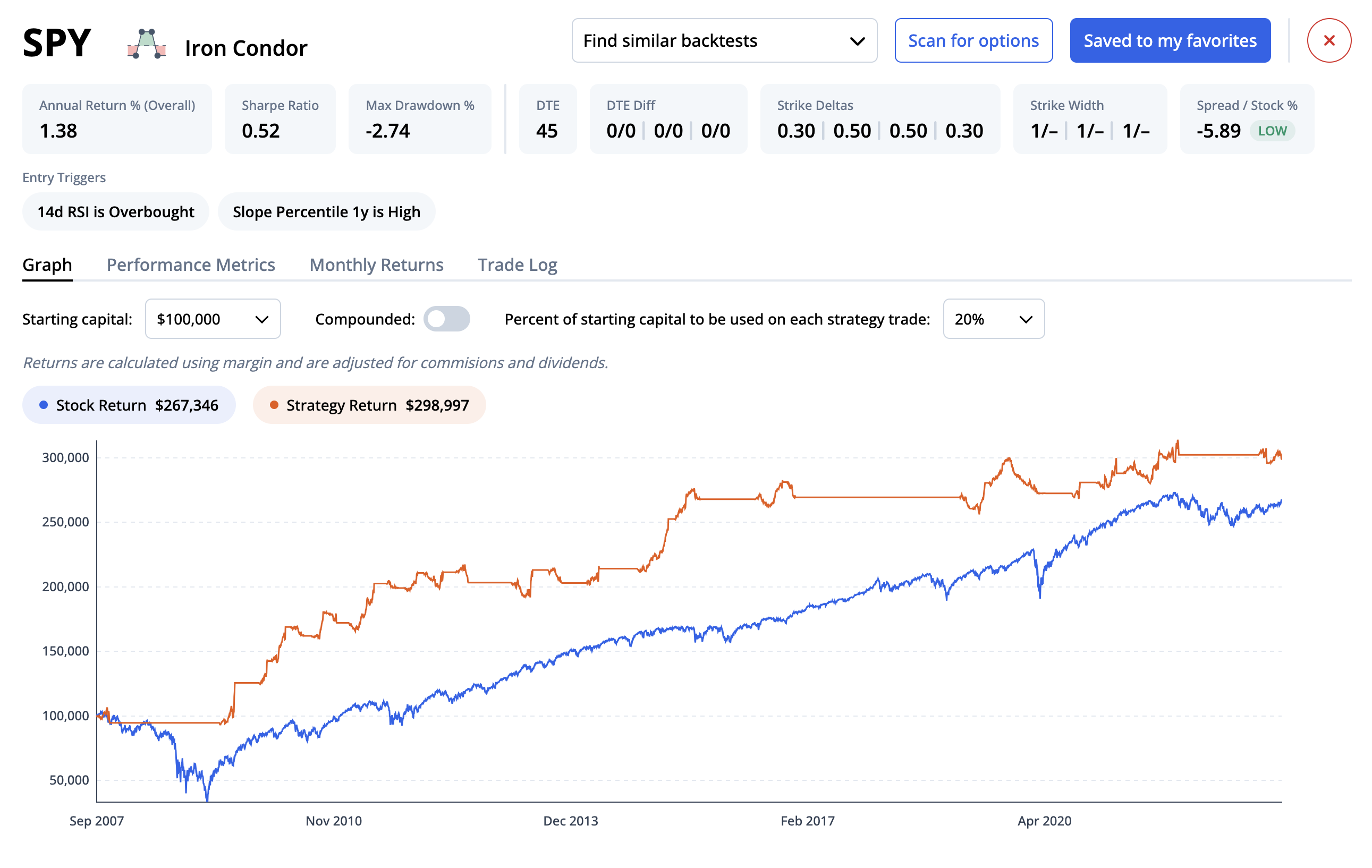

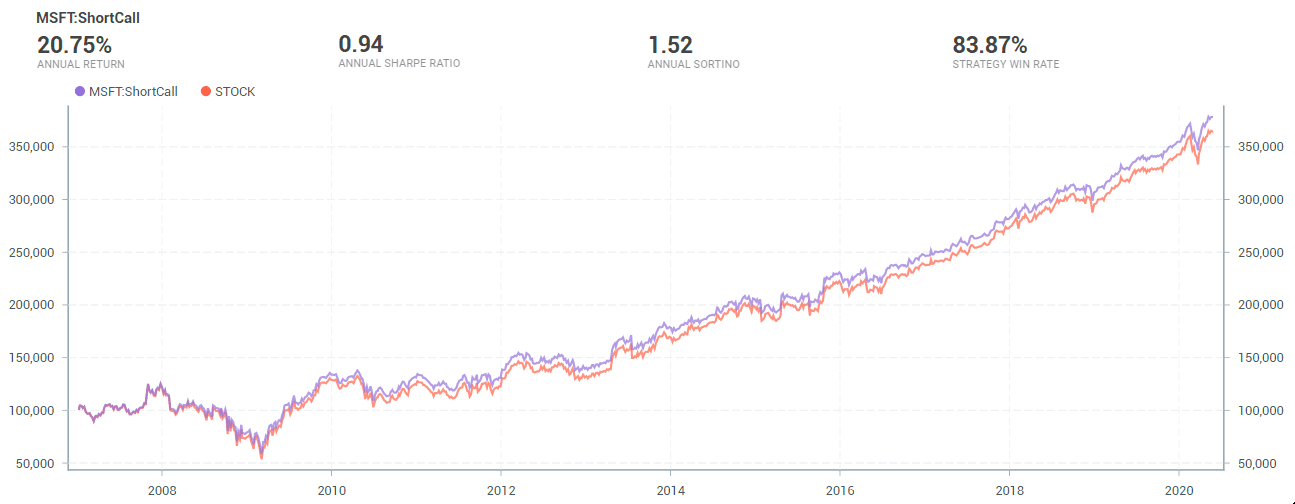

Covered call backtest on the S&P500 names like MSFT, MA, INTC showed that options with 30 days to maturity and 10 delta performed better than other strategies.

Summary

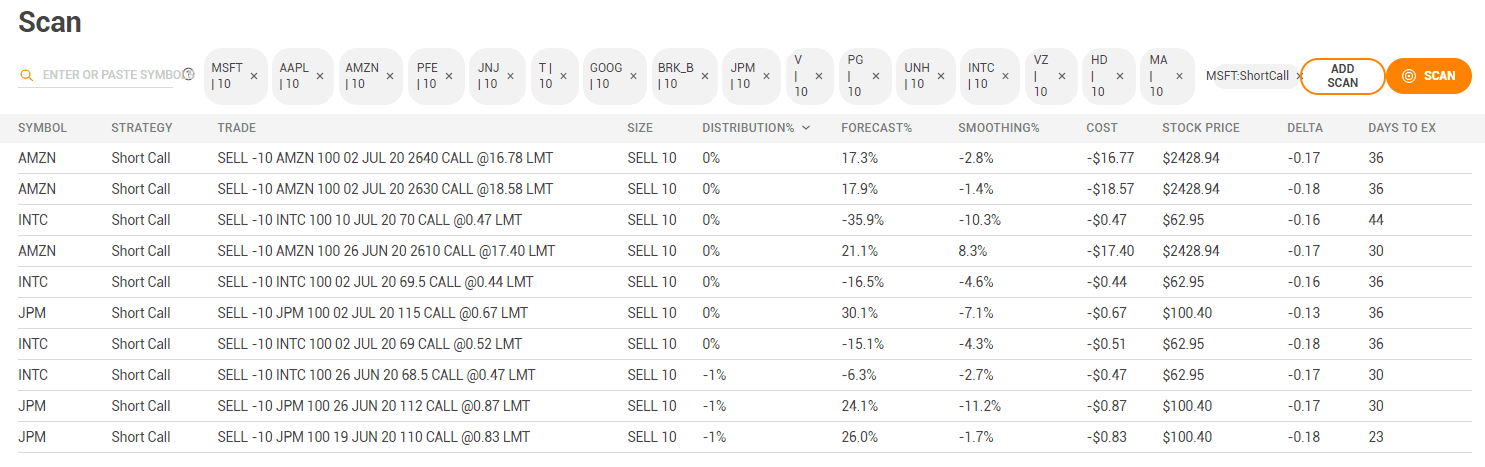

A backtest on S&P 500 components showed that selling calls with 30 days to expiration and 10 delta, avoiding earnings, and holding to expiration were the most profitable strategies. A call value of 2.0% of stock price was optimal, and selling calls when IV percentile was above 66% was best. ORATS web tools can be used to scan for these parameters and implement trading of these calls.

We ran a large backtest to identify the best maturity, delta, call value as a percent of stock price, earnings strategy, and implied volatility profile for call selling on S&P 500 components.

Symbols used in the test were MSFT, AAPL, AMZN, PFE, JNJ, T, GOOG, BRK_B, JPM, V, PG, UNH, INTC, VZ, HD, MA making up 30% of the S&P 500 weighting.

Days to expiration (DTE) used were 10, 15, 20, 30, 45, 60, 90, 120, 180, 240 days to expiration.

Deltas tested were 5 to 50 by 5 deltas.

IV Percentile and Skew/slope Percentile tested were under 33%, between 33% and 66%, under 66%, over 33% and over 66%.

Call market price as a percent of stock price tested were 0.5%, 1%, 1.5%, 2.0% and 2.5% and no filter. We call this Spread Yield%.

Exiting after 75% profit is made and no early exit were tested.

Avoiding earnings by trading out before the announcement was tested along with trading through earnings.

In all, there were 3.5 million combinations of the above parameters run back through 2007 and here are the results.

The best maturity was 30 days to expiration and best delta was 0.10.

Avoiding earnings was better than trading through earnings.

Holding to expiration was better than exiting after profit.

A call value of a percent of stock price that was best was 2.0%.

The best use of IV percentile and slope was selling a call when the IV percentile was above 66%. Slope percentile was not important for identifying the best calls to sell.

Scanning for the above parameters is easy using the ORATS web tool.

Trading through our brokerage APIs such as Tradier or Thinkorswim is made possible.

Monitoring fills can be done to see if the market goes against the trade to cancel is available.

Paper trading is available through Tradier brokerage.

Position tracking and exit alerts along with delta and profit can be found in our Risk web tool.

ORATS has backtested many parameters for identifying covered calls. The best are described here. Using web tools, ORATS makes it easy to implement the trading of these calls.

Please contact us at 312.986.1060 or support@orats.com to start.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts