Backtesting

Wednesday, August 28th 2019

Delta Neutral and Other Ways to Delta Hedge in Backtests

The ORATS backtester can delta hedge an options strategy using hedging with the underlying stock using number of days or hedge if the position reaches certain delta levels.

Summary

The ORATS backtester offers several ways to delta hedge an options strategy using hedging with the underlying stock, including delta hedging every certain number of days or hedging if the position reaches certain delta levels. The backtester also allows for under hedging, such as only hedging 50% of the delta. By using these strategies, traders can improve their returns and reduce volatility.

Using the ORATS backtester, there are many ways to delta hedge a strategy using hedging with the underlying stock. You can delta hedge every certain number of days or hedge if the position reaches certain delta levels. There are also ways to under hedge, for example, only hedge 50% of the delta.

First a primer, delta hedging usually means buying or selling the underlying to offset a position in options that has a negative or positive delta. For example, if an at-the-money straddle is purchased and the price of the underlying goes up, there will be a positive delta in the straddle. The positive delta straddle will make more if the stock continues to go up than it would make if the stock were to go down. The trader may want to sell the underlying to offset the asymmetric profit picture.

If the trader wishes to get flat at the end of every day, there is a feature of the backtester called Hedge Days, here set to 1 hedging every day at the close:

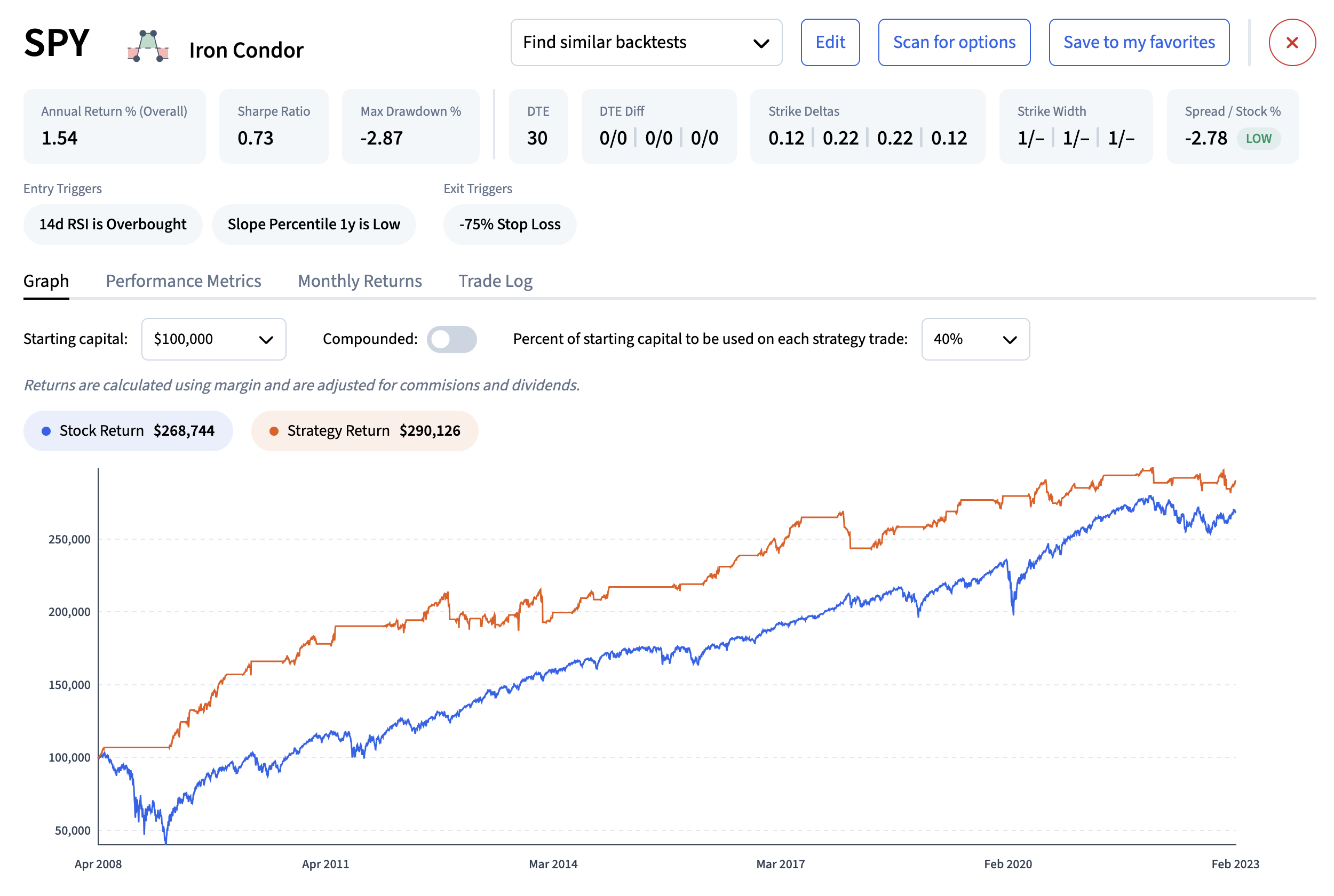

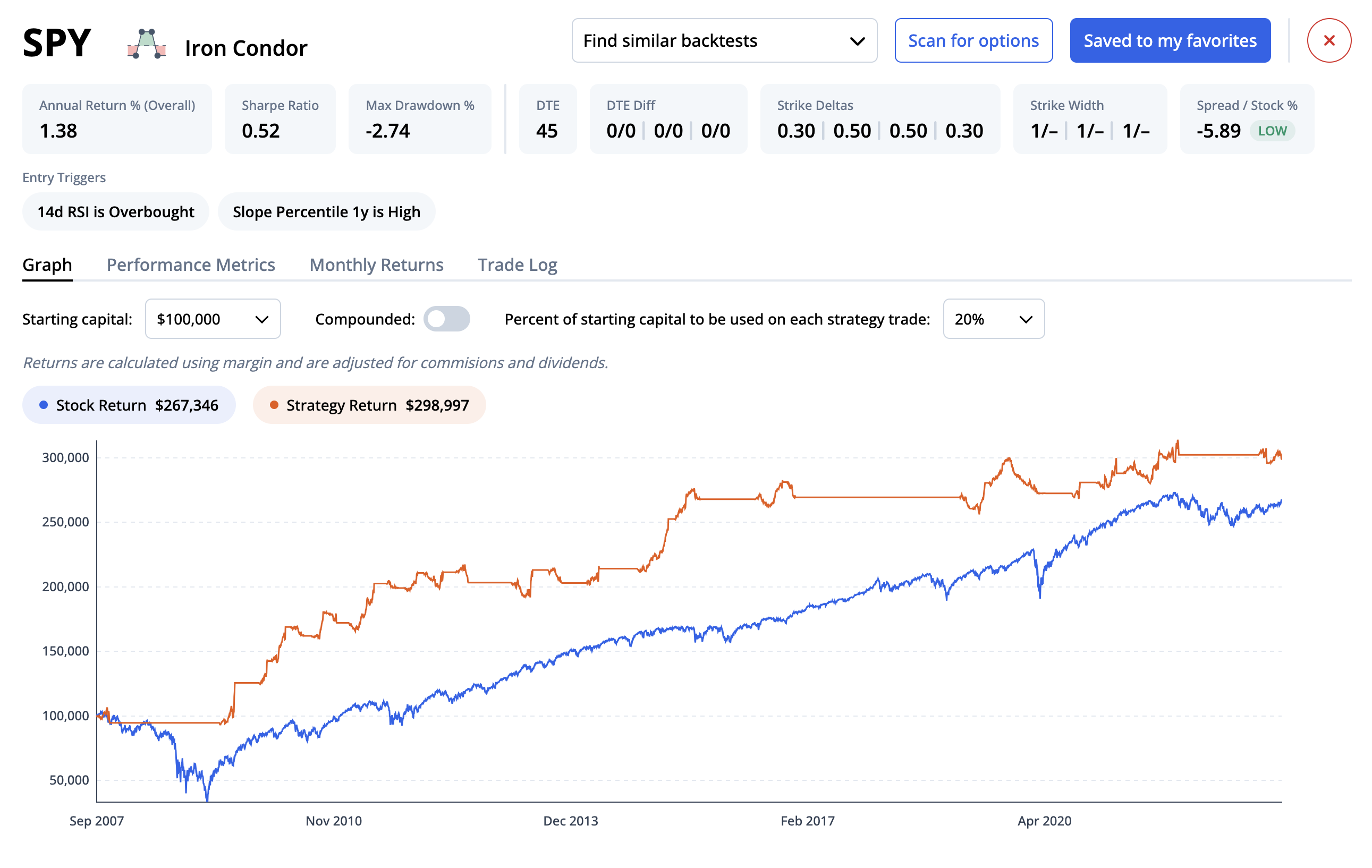

For the long straddle in SPY, there returns are not very good for a delta neutral strategy returning -4.77% annually. However, the delta neutral strategy did perform better than not hedging that had an annual return of -6.67%. The delta neutral strategy also had a better (lower) annual volatility of 3.63% vs 10.26%.

Another way to hedge is by flattening out deltas when a certain delta level is reached. There is a feature of the backtester called Hedge Tolerance that will buy or sell the underlying when the Minimum or Maximum tolerance is reached. Below, if the stock were to move down and the delta of the straddle goes below -0.20, 20 shares of stock would be purchased. If the stock were to go back up where the straddle had a positive 0.20 delta, 20 shares would be sold.

This strategy had a slightly better annual return but had a higher volatility since the hedging rule did not trade the underlying as often as the daily hedging.

Finally, a trader might want to blend the hedging strategies above, say a 50%/50% hedging/not hedging. Below, by selecting the check box next to the non-hedged and the hedged backtests and clicking 'Combine', the strategy of hedging each day can be combined in various weightings with a strategy of not hedging, here 50/50.

More reading on combining backtests HERE.

More on delta neutral strategies HERE.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts