Backtesting

Tuesday, April 23rd 2019

NEW! Improvements to the Backtester

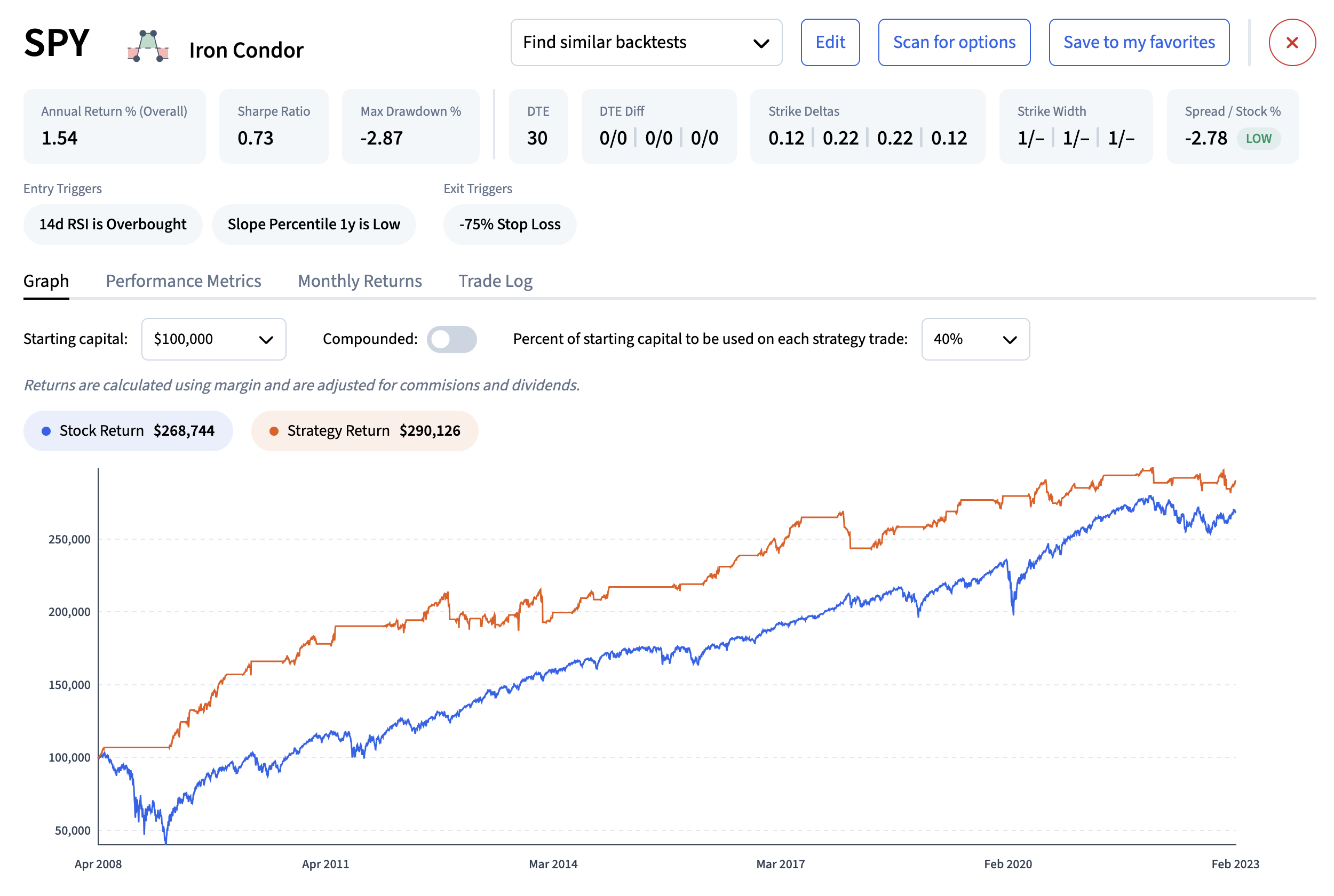

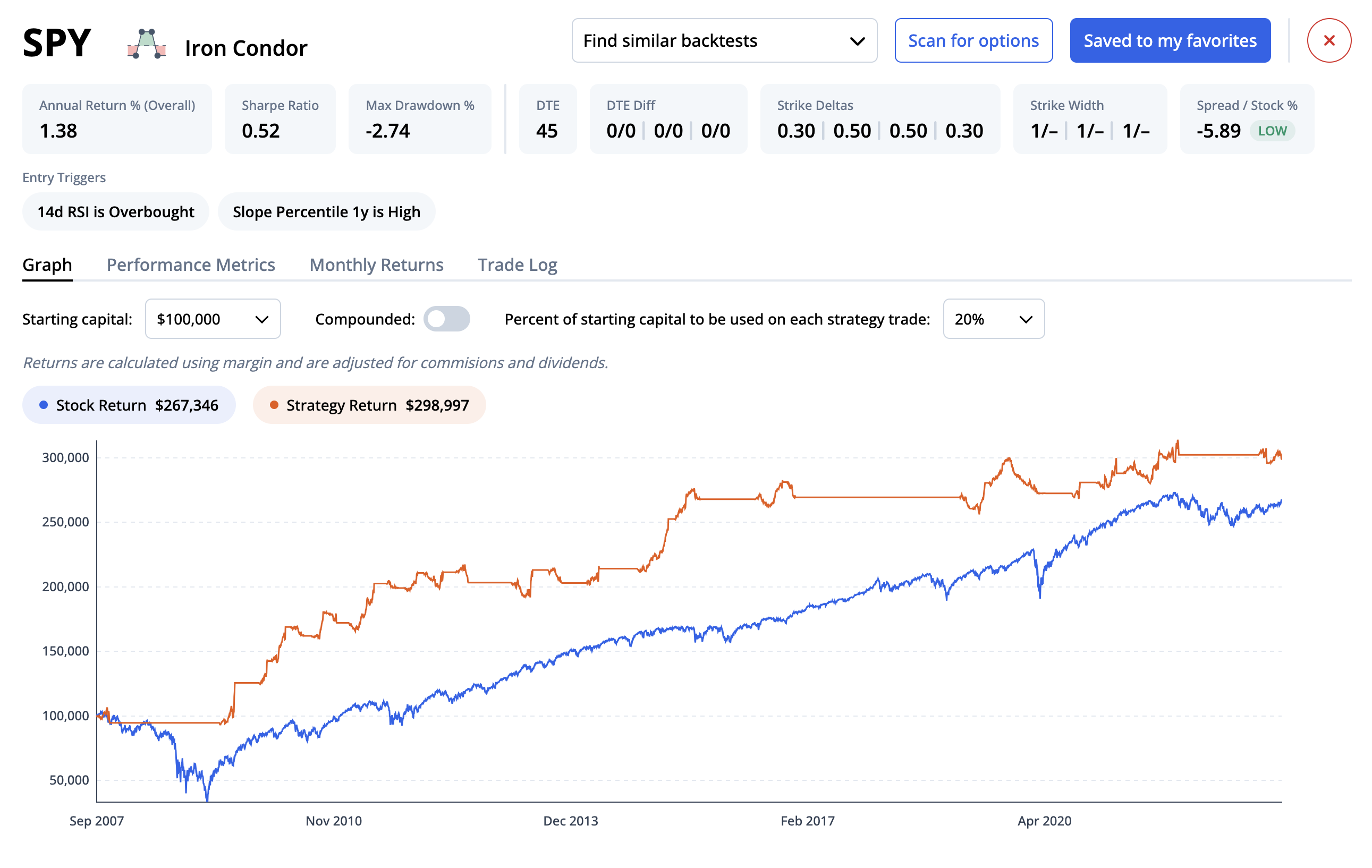

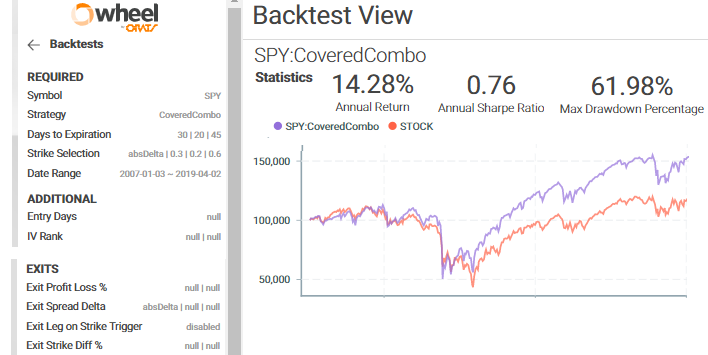

The new ORATS backtester has new amazing features like overlaying long or short stock with any strategy, delta hedging, exiting on spread value vs spread width, multiple symbol combined tests with specific entry and exit dates, and more.

Summary

ORATS has upgraded their backtester with new features such as overlaying long or short stock with any strategy, delta hedging, exiting on spread value vs spread width, multiple symbol combined tests with specific entry and exit dates, and more. They have also launched a Backtest API with advanced features not yet in the online version, including the ability to use signals to enter and exit trades, adjust trades using rules, and combine options backtests with stock only backtests.

We have upgraded the backtester!

Here are the new features:

1. The user input area has been improved and more explanations added. Also, a thumbnail of the inputs is shown while viewing the report.

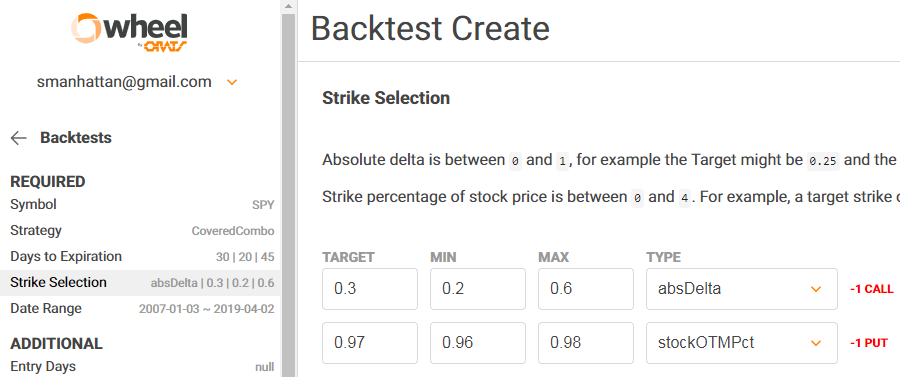

2. Options can now be selected using both delta and stock out-of-the-money percent simultaneously.

3. Options meeting the backtested filters are ranked according to a score weighting the multiple entry parameters. For example, if you used ideal deltas, days to expiration, and yield percent criteria, we choose the simulated trade that most closely matches those inputs using a scoring system. More HERE on scoring.

4. We added an exit rule called Strike Difference Percent Value. For spreads, the trade is exited if the value of the spread divided by the strike difference falls below or rises above min max ratios. More HERE on this exit rule.

5. We've added the ability to use multi-symbol entry and exit date simultaneously to control when options trades are entered and exited.

- NDX 2008-02-07 2009-03-12

- SPX 2009-03-13 2010-04-16

- EEM 2010-04-17 2011-05-21

- EFA 2011-05-22 2012-06-24

- QQQ 2012-06-25 2013-07-29

- IWM 2013-07-30 2014-09-02

- RUT 2014-09-03 2015-10-07

- XLK 2016-11-11 2017-12-15

- NDX 2017-12-16 2019-01-19

- IWM 2019-01-20 2019-04-29

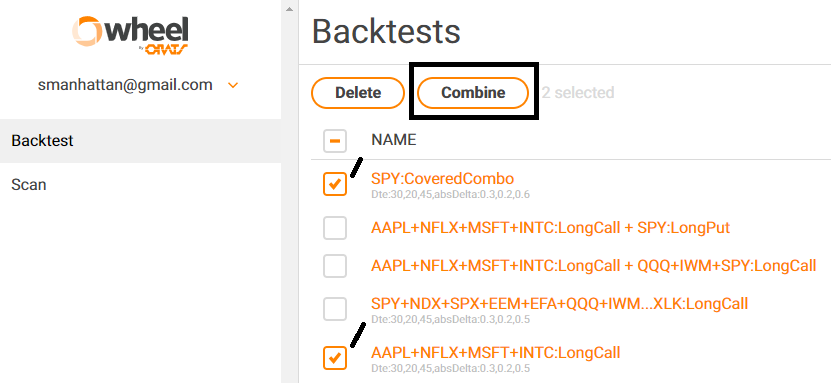

6. We've added the ability to combine multiple symbols backtests (mentioned above) with other multi-symbol or single symbol tests.

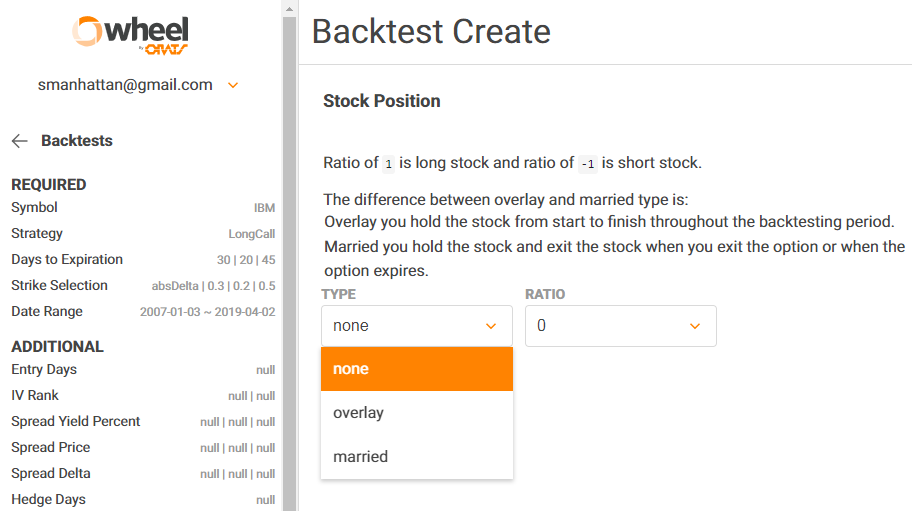

7. The user can now choose to buy or sell stock with option strategy.

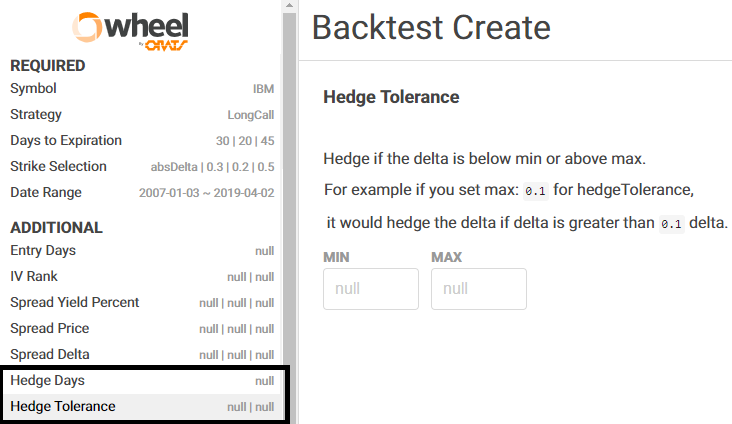

8. We have improved underlying delta hedging, including hedging on an input number of days or delta levels to flatten deltas.

9. In the trades section, there are now stock trades and profit for delta hedging, covered stock, buywrite, stock overlay, married put, and other strategies that have a stock component.

More on our backtesting website here.

New! Backtest API

We are launching the Backtest API with this upgrade. The Backtest API can be accessed programmatically ie with Python.

The Backtest API has advanced features not yet in the online version:

1. Use signals to enter and exit trades using three types of signals: What we call Type 1, that uses our existing Symbol Entry Exit dates method; Type 2 that uses custom single dates like earnings, conferences, or a user custom field; and Type 3 that is a data series like our Core Historical data is mapped to Type 3 signals via the API.

2. The ability to adjust a trade, not by rolling but by using rules to adjust.

3. We have added the ability to combine options backtests with stock only backtests.

4. We have made backend improvements in our AWS cloud infrastructure where we can support 1000's of simultaneous backtests.

We've also made improvements in our backtesting underlying historical quotes data.

We would also like to hear about improvements you would like to see, both in our backtester and in other facets. Contact us and let us know!

To see pricing for various levels of the backtester, go HERE.

If you need to upgrade or cancel your subscription you can do that HERE.

Check out backtesting blogs HERE

More here at our product site: Backtester

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts