Dividends

Saturday, March 2nd 2019

Dividend Forecasting: Using Implied Dividends

Dividend forecasting methods using implied dividends and seasonality

Summary

ORATS provides a dividend feed for options traders that utilizes historical dividends and implied future dividends from the options markets. The feed is an amalgamation of fundamental analysis, proprietary analysis of historical dividend payouts, seasonal effects, and implied dividends. Implied dividends are a distillation of all research performed by every professional options trader in the industry, and ORATS makes this data available as an easy-to-consume API web call. Implied dividends are a leading indicator for anticipated dividend change and can be used by professional equities traders, analysts, personal investors, or options traders.

ORATS has a hard-to-come-by yet invaluable approach to dividend forecasting.

ORATS provides an unparalleled dividend feed for options traders. We utilize our deep database of historical dividends along with our ability to imply future dividends from the options markets. We partner with top corporate actions provider Wall Street Horizon whose algorithms are continuously scanning the news wires and providing ORATS with updated data. We constantly monitor, verify, and evolve our dividend forecast methods to ensure quality.

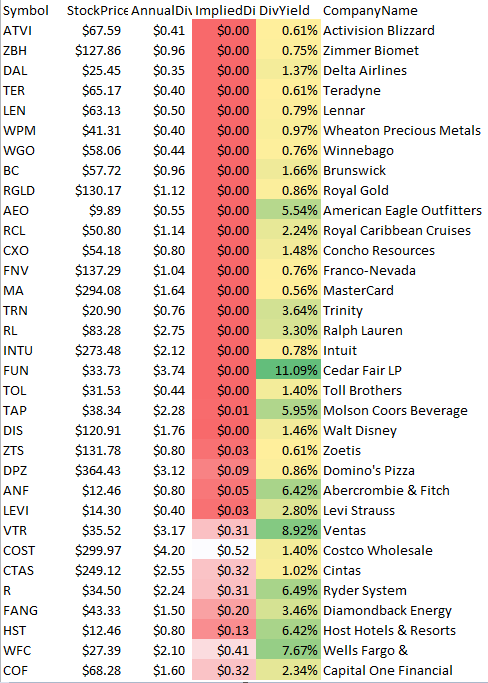

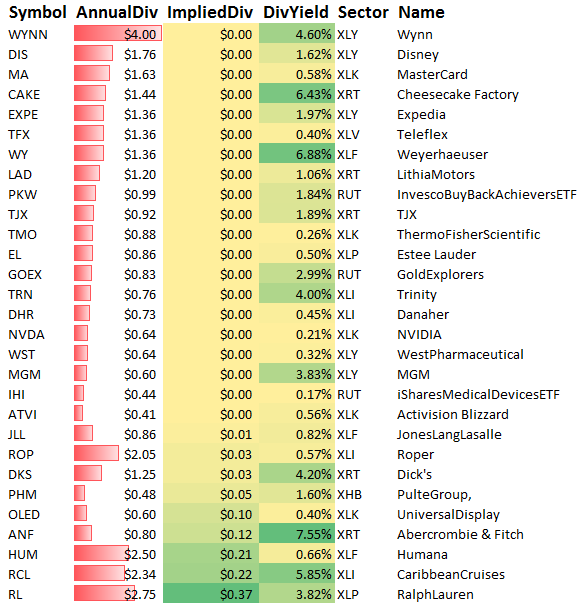

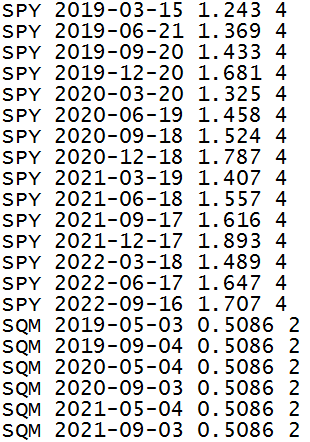

Here's SPY and SQM from our dividend forecast file:

SYMBOL EX-DATE AMOUNT FREQUENCY

Our implied dividend is a distillation of dividend assumptions from the options market. The implied dividend calculation is complex and hard to master, so much so that few professionals in the industry attempt it. However, ORATS does all the hard work and makes this data available as an easy to consume API web call.

Consolidated Analysis and Forecasting

ORATS forecasts are an amalgamation of four major models:

- The fundamental analysis performed by our partner Wall Street Horizon.

- ORATS proprietary analysis of historical dividend payouts.

- ORATS model of dividend seasonal effects.

- ORATS implied dividend feed

We then contrast and combine these perspectives to produce the best consolidated forecast we can muster. We continually backtest our predictions to monitor, verify, and evolve our methods and ensure our quality. And lastly, our dividend analysts spot-check the results daily to make sure the feed contains nothing but clean data. The result is, in our opinion and as well as those of our happy customers, one of the best dividend forecast feeds available in the industry.

Implied Dividends

At the heart of our approach is the use of "implied dividends" - the dividend levels implied by prices within the options markets. In the case of equities that both have dividends and have exchange-traded options on their stock, the dividend price is a major component in the calculation that traders use to compute a fair price for those options. ORATS runs that calculation backwards to compute "implied dividends", a measure that reveals the broad consensus of all players in the options market about how much a company will pay as a dividend along the entire option expiration calendar. Simply put, the implied dividend is a distillation of all of the research performed by every professional options trader in the industry -- you can't ask for a reading much better than that! The implied dividend calculation is complex and hard to master, so much so that few professionals in the industry attempt it. But ORATS does all the hard work and makes this data available as an easy to consume data feed.

The beauty of this is that you don't have to even understand options to make use of our implied dividend feed. Everyone who needs accurate and robust dividend forecasts for any purpose at all - professional equities traders, analysts, personal investors, or options traders to name a few - will find the ORATS feed incredibly useful. Implied dividends are an unparalleled resource for both an alternative price perspective as well as a highly sensitive leading indicator for anticipated dividend change. We update implied dividends throughout the day so that you will be reliably notified when the options markets predict a change in dividends. So whether you are looking for bargains while investing for income or want to be the first to find stocks that are undervalued or overvalued with respect to their dividend, implied dividends can play a key role.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts