Data API

Friday, November 22nd 2024

Implied Dividends: ORATS' Approach to Market Consensus

Gain Market Insights with ORATS' Implied Dividend Analysis—A Powerful Tool for Informed Trading Decisions

Summary

ORATS' approach to calculating implied dividends utilizes put-call parity relationships to derive market-reflective dividend expectations from options prices. By partnering with Wall Street Horizon and employing rigorous quality control, ORATS provides insights into market sentiment, helping traders identify discrepancies between implied and actual dividends. The methodology includes calculating baseline dividend yields, residual yields, and adjusting for market conditions, allowing clients to anticipate potential dividend changes and make informed trading decisions. The implied dividend feed serves as a powerful tool for equities traders, options traders, income investors, and analysts, offering real-time data and insights into future dividend expectations.

Understanding dividend expectations is critical for traders, investors, and analysts alike. ORATS' process of calculating implied dividends offers a unique glimpse into market sentiment, reflecting the expertise of professional options traders. In this article, we explore the key steps in our implied dividend calculation process, why it matters, and who can benefit from it.

Implied Dividends Derived from Options Prices

At ORATS, implied dividends are not derived solely from projected announcements. Instead, we use put-call parity relationships to extract them directly from options prices. This approach provides a more market-reflective view of dividend expectations.

We start by partnering with Wall Street Horizon to access base dividend information. This foundational data includes announced dividends and allows us to analyze the Net Present Value (NPV) of discrete dividends to derive a continuous dividend yield. By comparing announced dividends against the market's implied dividends, we get a reality check on what the market is pricing in. If we see discrepancies, our forecasts are adjusted accordingly, with all values converted to USD for consistency across foreign dividends.

We measure two key implied dividend values: annIdiv, the annual implied dividend, and impliedNextDiv, the next implied dividend payment. This information is critical for traders who want to compare market expectations against actual dividend projections. Discrepancies between the implied and actual dividends often highlight trading opportunities, giving our clients a competitive advantage.

To ensure the highest quality of our data, ORATS employs an in-house dividend consultant for special cases. We make adjustments for stock splits, conform to OCC rules for special dividends, and maintain a robust historical database back to 2007. This meticulous quality control guarantees the reliability of our implied dividend data.

Calculating Dividend Yield: The Foundation

The calculation of implied dividends begins with establishing a baseline dividend yield, which forms the foundation of our insights. This baseline is derived from projected discrete dividends and the risk-free yield rate. We use publicly available company information, such as historical dividend payments and earnings announcements, to establish projected dividends, while the risk-free rate, typically based on government bond yields, serves as a benchmark for comparison.

The combination of these components creates an initial estimate of what the dividend yield should be. However, this is just the starting point. We refine this baseline with market data to provide a more accurate, market-driven representation of dividend expectations.

Solving for Residual Yield and Aligning Call/Put Volatilities

An essential part of the ORATS methodology involves solving for residual yield to ensure that implied volatilities for call and put options align properly. Residual yield helps account for real-world market factors, such as hard-to-borrow costs and other frictions that can influence pricing.

We begin by calculating the residual yield rate at the 50 delta (at-the-money) point, representing the adjustment necessary for accurate alignment. For example, an implied rate of -0.055 translates to a -5.5% adjustment. This adjustment reflects costs associated with borrowing stock and other market realities.

To maintain accuracy, delta weighting is employed: options closer to 50 delta are assigned higher weights, while those with wider bid-ask spreads receive lower weights. This ensures that outlier prices do not unduly influence results. Furthermore, market width adjustments are calculated in implied volatility terms, giving higher confidence to options with tighter bid-ask spreads and assigning lower weights to options with lower liquidity.

To account for variations across different deltas, we also calculate residualRateSlp—the slope of the residual rate linear regression. This allows us to adjust the dividend yield based on call delta, ensuring a consistent representation across different option strikes.

The reliability of these calculations is continuously monitored through quality checks. We use residualR2, an indicator of the quality of the residual rate regression, to confirm the robustness of our calculations. High r-squared values indicate greater reliability, which is essential for traders relying on our data for their decision-making.

Incorporating Dividends Across Expirations

Incorporating dividends across various expiration dates is a complex task, and ORATS takes a comprehensive approach to ensure accuracy. Our system uses data from Wall Street Horizon to track dividend frequency (divFreq) and the growth rate (divGrwth) of forecasted dividends. We maintain a thorough record of historical patterns and seasonality, employing our in-house consultant to handle special situations.

We forecast dividends up to 2.67 years into the future, calculating the expected number of dividend payments before each expiration, the NPV of each expected dividend, and its impact on put-call parity relationships. This helps create a full view of dividend expectations across all expirations.

Our residual dividend analysis compares announced dividends with market-implied values to identify discrepancies. We calculate several key values: annActDiv (actual projected annual dividend), annIdiv (market-implied annual dividend), nextDiv (next expected dividend), and impliedNextDiv (next implied dividend). Any differences between these values often signal opportunities for traders.

A rigorous quality control process helps maintain the reliability of these forecasts. We adjust our projections when market prices suggest different expectations, convert all foreign dividends to USD, and ensure compliance with OCC rules for special dividends. This consistency is maintained across different time horizons, ensuring a uniform view of dividend expectations.

To avoid calendar arbitrage, we adjust for changes in hard-to-borrow rates over time and continuously monitor put-call parity relationships across all expirations. This ensures that implied dividends are consistent throughout the volatility surface.

Weighted Annualized Implied Dividend and Smoothing

Our methodology for calculating the weighted annualized implied dividend focuses on smoothing out market fluctuations to provide a reliable measure of dividend expectations. We assign higher weights to near-term expirations due to their greater influence on current market dynamics. Additionally, options with higher confidence scores are given more weight in our calculations.

We start with put-call parity calculations for each expiration and apply the residual yield rate adjustments to account for hard-to-borrow costs and other factors that fade over time. This process results in a continuous curve that reflects dividend expectations consistently across all expirations.

To calculate the annual implied dividend, we combine weighted inputs from all expirations, compare implied values to announced dividends, and factor in seasonality and market width. By maintaining consistency across expirations, we prevent calendar arbitrage opportunities and ensure that our implied dividend values accurately reflect market sentiment over different time frames.

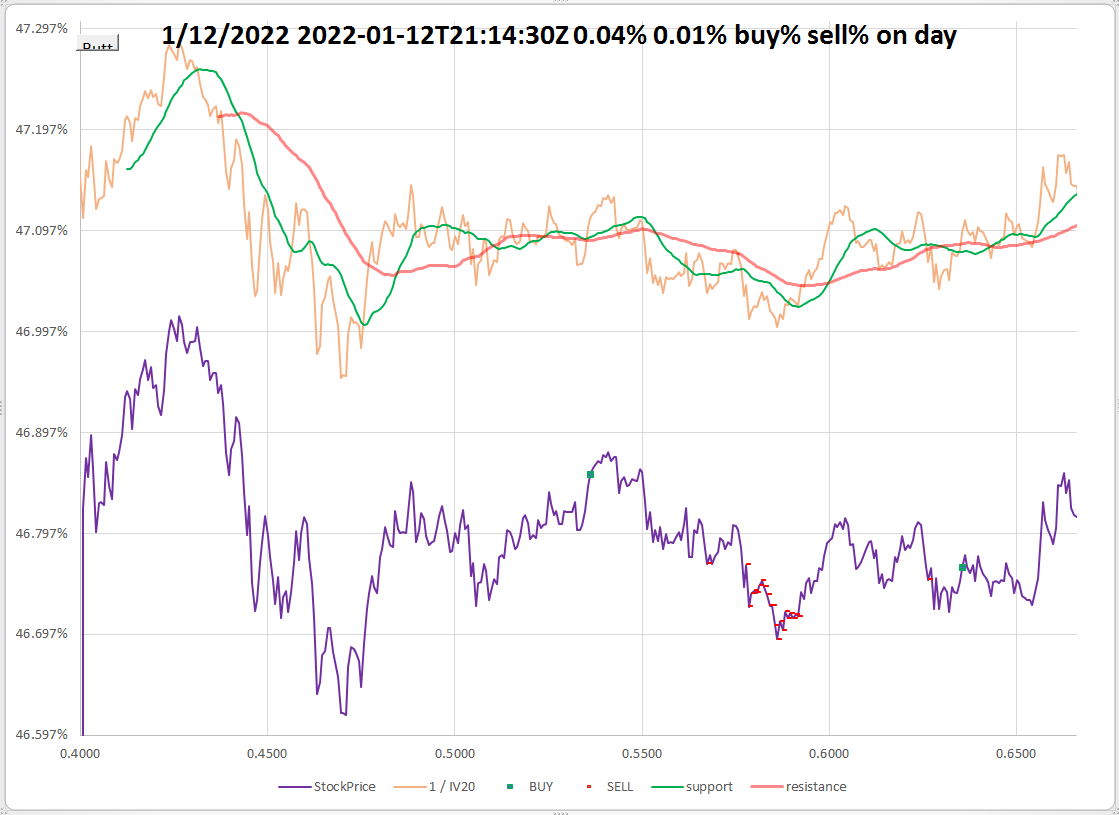

Tracking changes in implied dividends over time allows us to compare short-term versus long-term market expectations, monitor divergences from announced dividends, and adjust for evolving market conditions. This comprehensive approach provides our clients with a holistic understanding of dividend trends.

Market Expectations and Comparison

ORATS uses implied dividends to gauge market expectations and identify potential opportunities. By comparing annIdiv (market-implied annual dividend) to annActDiv (projected annual dividend), we can discern how the market's sentiment differs from the broader consensus. Confidence scores are derived from various market quality factors, such as tight bid-ask spreads, higher option volume, greater market depth, and more activity around at-the-money strikes.

The quality of our calculations heavily depends on market conditions. We prioritize at-the-money options, as they tend to have tighter spreads and provide more reliable signals. Conversely, wide markets receive lower confidence ratings. This approach ensures that our clients receive the most accurate dividend data possible.

One of the key insights that ORATS provides is the ability to detect potential dividend changes before they are announced. By examining divergences between impliedNextDiv, nextDiv, and historical dividend patterns, we can often identify shifts in market sentiment that may signal future dividend changes. These insights are invaluable for traders and investors looking to stay ahead of market movements.

Our process includes tracking key market indicators, such as borrow30 and borrow2y rates, as well as residualRateSlp, which helps identify systematic pricing differences. By monitoring changes in implied dividends and comparing them to sector averages and seasonal trends, we provide clients with a comprehensive understanding of where dividend expectations are headed.

Key Insights and Advantages of ORATS’ Approach

The implied dividend feed from ORATS captures the collective intelligence of professional options traders. By inverting the pricing model, we derive consensus dividend levels across expirations, providing a distilled and actionable view of market sentiment. This complex process is simplified into an easy-to-use resource, saving our clients time and effort.

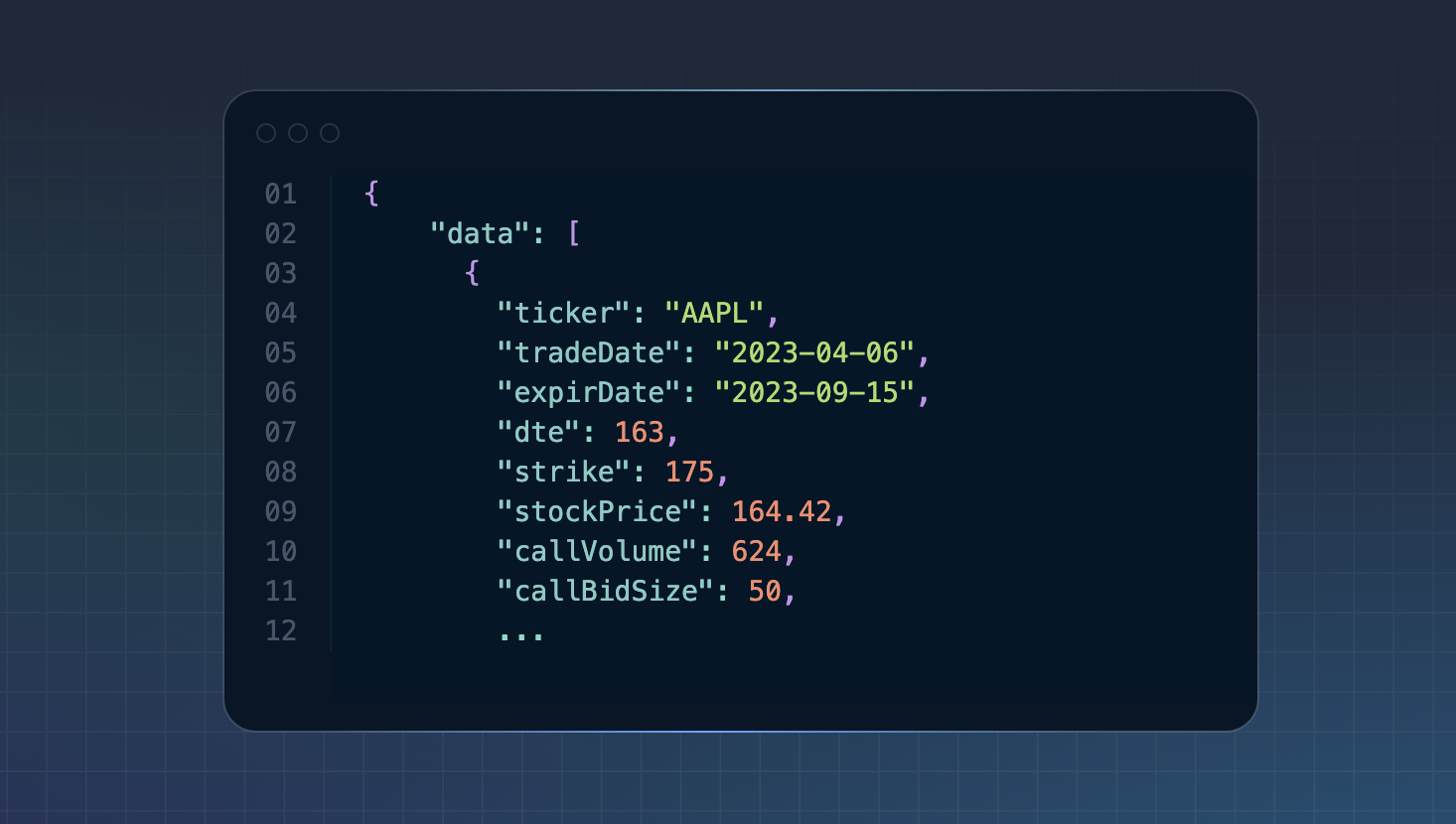

Ease of Access is a core advantage of the ORATS approach. Delivered through a straightforward API, our implied dividend feed provides real-time data that can be seamlessly integrated into trading models and analysis tools. Broad applicability means that this feed is useful for equity traders, options traders, analysts, and income investors alike.

Moreover, implied dividends act as a leading indicator, offering early warnings for potential dividend changes before official announcements. This gives our clients an edge in anticipating market movements and making more informed trading decisions.

The feed is updated throughout the day, ensuring real-time accuracy and allowing users to react quickly to market signals. This level of responsiveness is crucial in today's fast-moving financial environment, where conditions can change in an instant.

Why Implied Dividends Matter

Implied dividends provide critical insights into future dividend expectations, helping traders and analysts forecast corporate behavior and assess dividend sustainability. For options pricing, implied dividends are essential to accurately value options that are sensitive to dividends, such as calls and puts on dividend-paying stocks.

Additionally, implied dividends serve as indicators of market sentiment. Subtle shifts in these values can reflect changes in investor confidence or expectations regarding corporate policies. By monitoring these shifts, ORATS clients gain a deeper understanding of underlying market dynamics.

Who Benefits from ORATS’ Implied Dividend Feed?

The ORATS implied dividend feed is a powerful tool for a wide range of market participants:

- Equities Traders: By comparing implied dividends to analyst projections, equities traders can identify discrepancies that may point to undervalued or overvalued stocks.

- Options Traders: Implied dividends are crucial for enhancing pricing models, particularly for dividend-sensitive options, and for fine-tuning hedging strategies.

- Income Investors: For income-focused investors, implied dividends provide insights into potential dividend bargains or risks, offering a market-driven perspective on dividend sustainability.

- Analysts: Analysts benefit from unique insights into corporate payout expectations that may not be immediately apparent from standard dividend projections, helping to enhance their analysis.

Conclusion

The implied dividend feed from ORATS distills professional market research into an accessible, real-time resource. Whether you are forecasting dividends, searching for income investing opportunities, or identifying undervalued stocks, ORATS has done the heavy lifting, allowing you to focus on making informed decisions.

By capturing the market's consensus on dividends, ORATS provides an early warning system for potential changes, giving you a valuable edge in today’s data-driven trading environment. The accuracy, reliability, and ease of access provided by ORATS' implied dividend feed make it an indispensable tool for anyone looking to stay ahead in the financial markets. From equities traders and options traders to analysts and income investors, ORATS offers a powerful way to harness market sentiment and transform it into actionable insights.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts