Indicators

Monday, March 14th 2022

How To Find The Best Options Trade Using Theoretical Values

Use theoretical values to identify the best options trades with smoothing the implied volatility skew, creating a distribution of underlying returns, and forecasting historical volatility.

Summary

This article discusses the use of theoretical values to identify the best options trades, including smoothing the implied volatility skew, creating a distribution of underlying returns, and forecasting historical volatility. By incorporating theoretical values into scanning and trade analysis tools, traders can choose the best options trades and add confidence they are getting their money's worth for a trade. The article also explains the different types of theoretical values and how they can be used to identify the best trades.

Typically, traders will use the middle price between an options bid and ask to think about a fair value. Problems occur using this mid price method:

- when markets are wide,

- when a bid and ask are temporarily off from their normal levels based on recent demand, or

- when the entire expiration month or implied volatility is temporarily off based on underlying factors.

Theoretical values can be used to help with these shortcomings. Three types of theos used by ORATS are based on the following:

- smoothing the implied volatilities of all strikes in an expiration,

- a distribution of returns from the underlying asset, and

- a forecast of volatility based on historical movement.

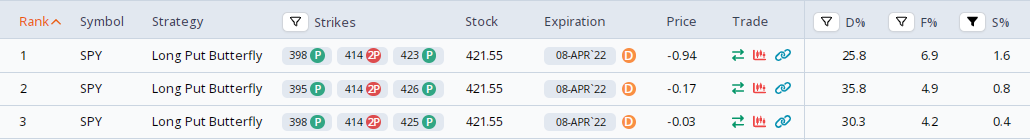

By incorporating theoretical values into scanning tools and trade analysis tools, options traders can choose the best options trades and add confidence they are getting their money's worth for a trade. For example, below is the ORATS Options Scanner with S% representing smooth edge, D% as distribution edge and F% being forecast edge.

Option number 1 has the lowest D% at 25.8% but the highest forecast edge 6.9% and smooth edge 1.6%.

Smooth Edge - S%

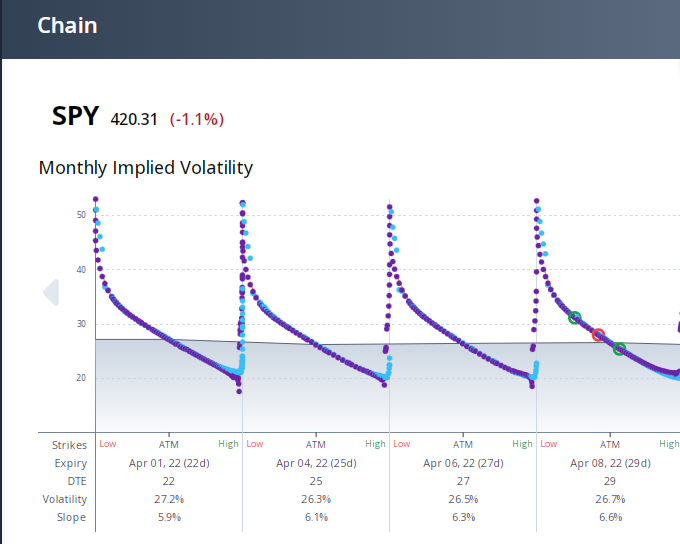

To calculate a smoothed theoretical value, the implied volatility skew of an expiration is used to draw a smooth curve. To start, IVs are calculated using appropriate interest rate and dividend yields. Call and put IVs should be lined up using a residual yield using put call parity. Having more put and call data points creates more confidence in the smooth curve. More information on ORATS smooth market values (SMV) can be found in these other blogs. ORATS header of S% indicates the theoretical edge of the smoothed theoretical value divided by the options mid point.

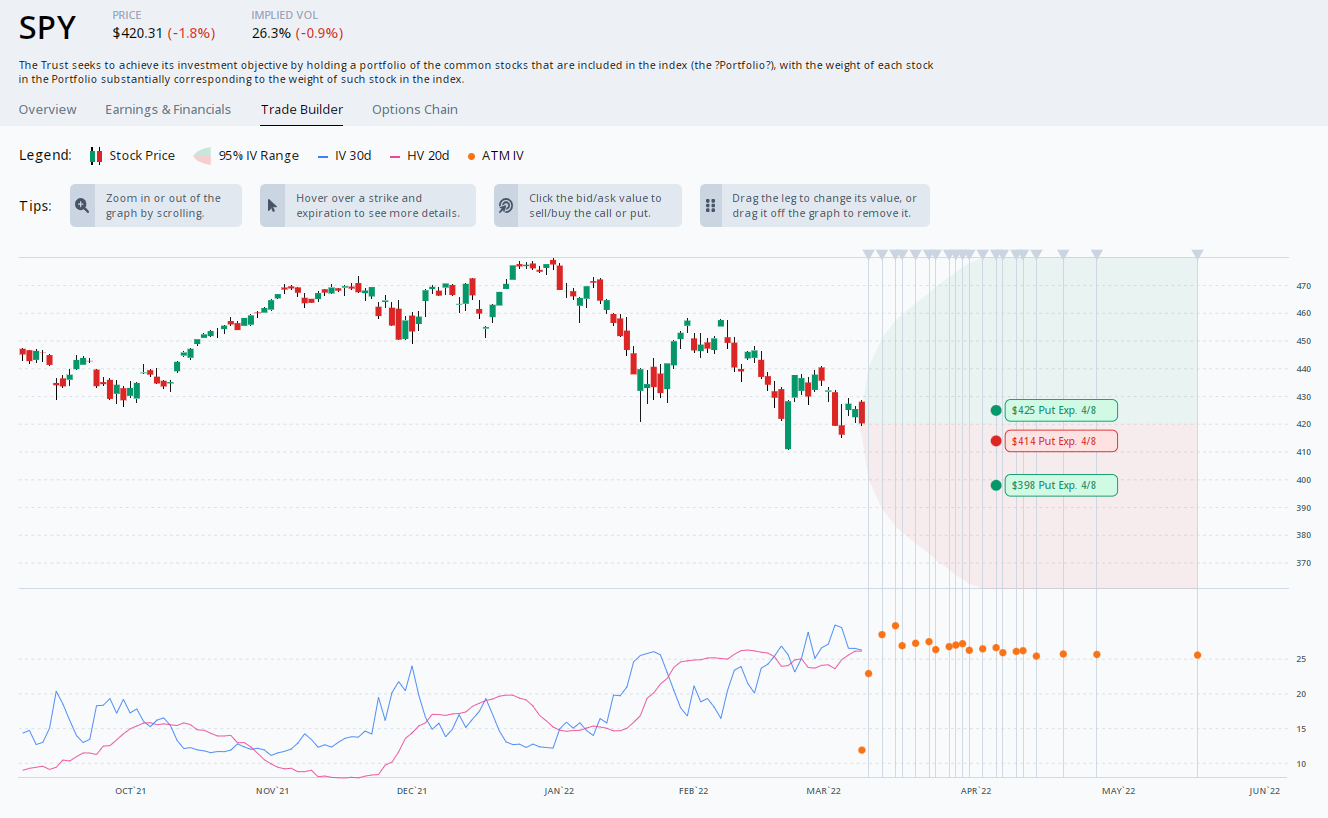

Below is from the ORATS Chain showing the smoothing and where the three options fall on the curve indicated by green circles for the buys and red for the sell

Note that for all edge calculations, smooth, distribution and forecasts, the minimum divisor is the greater of the options trade price and the minimum margin for a trade. The minimum margin is $0.375 times the number of options in a trade. For example, a single leg option has a minimum margin of $0.375. A vertical has two options for a minimum of $0.75. A three option trade like a call 1x2 (1call x -2calls) or put spread collar (1put x -1put x -1call) has $1.125 minimum divisor. A four option trade like an iron condor or butterfly (1 x -2 x 1) has a minimum margin of $1.50.

For example, option number 3 above with a trade price of $-0.03 instead would use as a denominator of $1.50 and a numerator of the Smooth value of $-0.02 giving an edge of $0.01 / $1.50 = 0.7%

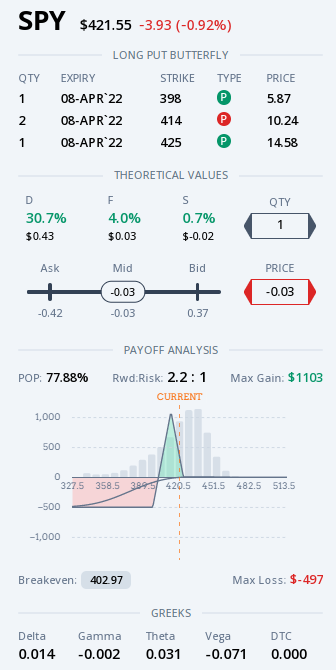

Distribution Edge - D%

Observing changes in the underlying price over the same number of days as the trade and placing those observations into 21 buckets creates a distribution of returns. To normalize the distribution for periods of high volatility, returns are adjusted using implied volatility at the time of the observation. Multiplying the terminal values of an options trade at each bucket's mid price times the probability of ending up at that bucket gives an expected value for the options trade. For example above, the distribution bars represent the probability and the terminal value is denoted by a solid line and red for losses and green for gains. Multiplying the bars time the terminal values gives a distribution theoretical value of $0.43 for an edge of 30.7% (0.43/1.50 slightly off due to rounding).

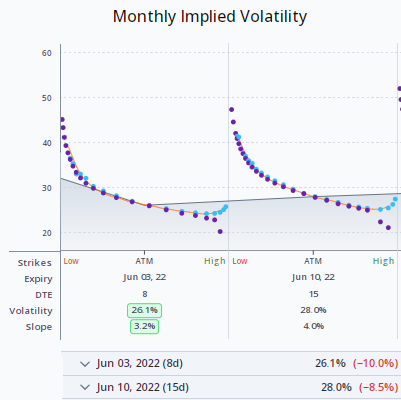

Forecast Edge - F%

Using historical volatility and skew readings to forecast future volatility is another way to create a theoretical value. The forecast value from the trade above is $0.03, very close to the mid price of the trade of $-0.03. Observing the historical volatility - cyan colored line - graphed on the implied volatility in blue below in the ORATS TradeBuilder, the lines are touching at the end. This makes for a forecast close to the implied volatility of the trade. Other factors that go into the ORATS forecast are explained here.

Summary

- Using theoretical values in addition to mid point prices between the bid and ask give the trader more confidence, understanding, and a way to compare alternative trades.

- Smoothing values are the most comparable and should be closest to the mid price. These two prices diverge when there are wide markets or there is an anomaly in the options prices.

- Distribution values will likely be farther away from the mid price than the smoothed price, but this does not devalue the method. Distribution values often point out differences in the look of the payoff diagram of the terminal values and hidden value can be found. For example, in a non-normal distribution as observed in SPY above, the shape of the various butterfly payoffs matter on how they are overlay with the distributions to calculate the D% values.

- Forecast values will also diverge from the mid price more than the smoothed values do. Forecasts use skew information in addition to historical volatility to produce a forecasted surface.

- Adding these additional theoretical values can help identify the best option trade based on what is important to the trader.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts