Indicators

Friday, September 13th 2019

Smoothing Options Implied Volatilities Using ORATS SMV System

Options quotes are cleaned, normalized and smoothed. The resulting option Greeks and theoretical values give our clients an edge in the market.

Summary

ORATS SMV System smooths market volatilities derived from options quotes, producing theoretical values and accurate option Greeks. The system cleans and normalizes quotes, solves for a residual yield rate, and fits a non-arbitrageable smooth curve through strike implied volatilities. The resulting data is critical for risk management and trading, and is available from 2007 to present.

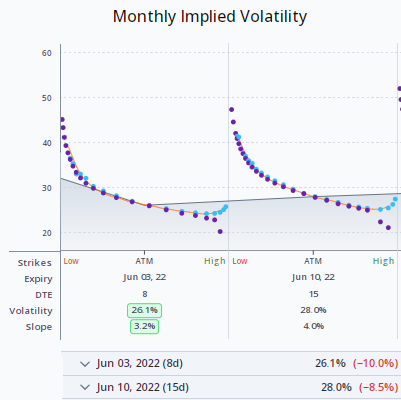

Smooth market volatilities (SMV) derived from the options market helps traders make sense of a plethora of exchange quotes. Options quotes are cleaned, normalized and smoothed in the SMV system. By smoothing the IVs, call and put theoretical values can be compared to market bid-ask quotes to see if the options are under or overpriced. The smoothed IVs produce more consistent greeks by which to manage risk too. By parameterizing the smoothed curve, the shape can be evaluated comparing to other tickers or to history of the skew parameter.

The first step in the SMV System is cleaning the quotes and applying good inputs to our modified binomial pricing engine. Using ORATS popular dividend feed and option pricing methodologies, a residual yield is solved for based on the put-call parity formula. Applying the residual yield rate process helps with summarizing hard-to-borrow stocks or stocks with differing dividend assumptions. The effect is to line up the call and put implied volatilities.

Next, using the call and put mid-price IVs, a non-arbitrageable smooth curve is fit through the strike implied volatilities. This smoothing system produces powerful theoretical values and accurate option Greeks. The Strikes Report shows each option's bid-asks, greeks and theoretical values. Delta, Vega, Theta, Rho, Phi and theoretical values are critical for risk management and trading.

ORATS SMV also differentiates itself is by producing meaningful analytics on thinly traded securities. The SMV incorporates historical information when the current confidence in the market summarization is low.

Moreover, the SMV treatment of the wings, the small delta out of the money calls and puts, produces more realistic implied volatilities than unadjusted IVs based on bid-ask prices with little premium.

Let's look at an example of American Air Lines (AAL).

Here, we plot the call and put ask implied volatilities in green and blue against the SMV line in red. See how the call IVs go way up to 90%, and the puts IV in the 80% range when the at the money IVs are under 40%.

The process ORATS uses is to continue the rational slope of the volatility skew when there is little premium left and the IVs start to lose their meaning.

Theses SMV market datasets are available from 2007 to present.

The SMV system descriptions for data in the Strikes reports are below. Notice there is an External Volatility section in the SMV and those values are fed by the ORATS forecasts of volatility.

Strikes Report Headers:

- Parameter Description

- ticker Underlying symbol.

- stkPx Stock Price at the time of the options prices observation. For indexes such as SPX, the stock price is the solved price using put-call parity at each expiration.

- expirDate Expiration Date.

- yte Years to expiration.

- strike Option strike.

- cVolu Call volume today.

- cOi Call open interest from the day before calculation.

- pVolu Put volume.

- pOi Put open interest from the day before calculation.

- cBidPx Call Bid Price.

- cValue Call theoretical value based on smooth volatility.

- cAskPx Call Ask Price.

- pBidPx Put Bid Price.

- pValue Put theoretical value based on smooth volatility.

- pAskPx Put Ask Price.

- cBidIv Call Bid Implied Volatility.

- cMidIv Call Mid Market Implied Volatility.

- cAskIv Call Ask Implied Volatility.

- smoothSmvVol ORATS smoothed implied volatility applied to the strike.

- pBidIv Put Bid Implied Volatility.

- pMidIv Put Mid Implied Volatility.

- pAskIv Put Ask Implied Volatility.

- iRate Continuous interest (risk-free) rate.

- divRate The continuous dividend yield of discrete dividend’s NPV.

- residualRateData Implied Interest Rate Data.

- smoothedResidualRate Smoothed Implied Rate Used in Calculations.

- delta Delta

- gamma Gamma

- theta Theta

- vega Vega

- rho Rho

- phi Phi

- Ext Vol ORATS forecast of volatility for the strike

- Ext Call Theo The theoretical value of the call based on the Ext Vol.

- Ext Put Theo The theoretical value of the put based on the Ext Vol.

Try the Data API and get access to this report HERE.

More reading:

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts