Indicators

Friday, June 28th 2019

Strike Skew Killer Metrics

The implied volatility skew between each strike is an important measurement not only for options trading skew based strategies like vertical spreads.

Summary

The implied volatility skew between each strike is an important measurement not only for options trading skew based strategies like vertical spreads, but for movement in the underlying stock. ORATS presents various ways to get a sense of the richness or cheapness of the skew, including the slope of the curve, which is communicated as the percent the 10 delta lower strike is higher than the higher delta strike. These measurements can give traders an edge, especially when trading options strategies with sensitivities to slope like verticals.

The implied volatility skew between each strike is an important measurement not only for options trading skew based strategies like vertical spreads, but for movement in the underlying stock. ORATS presents various ways to get a sense of the richness or cheapness of the skew.

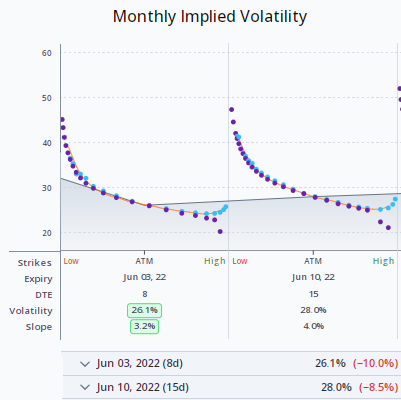

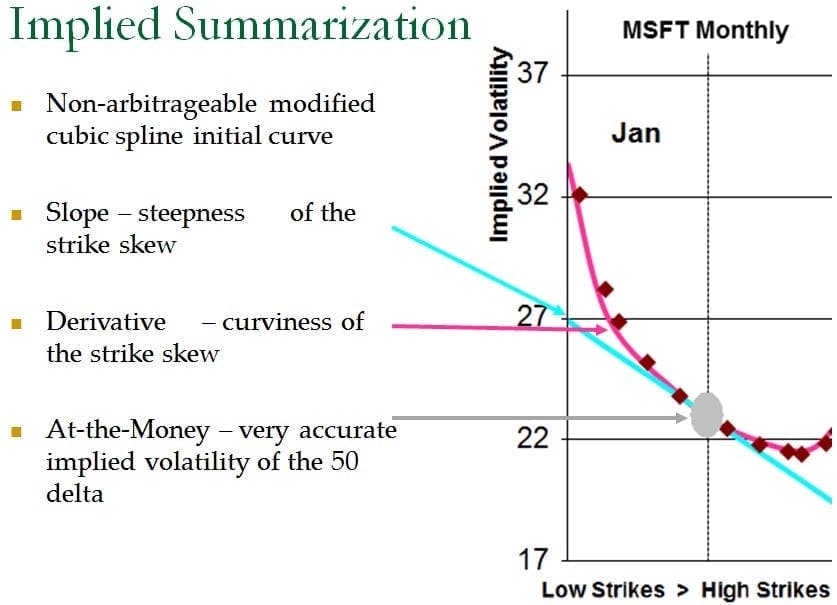

Here's a picture of a typical strike skew for a month.

We have talked about modeling the skew in other posts, but today we want to get a sense of how to understand the valuation levels. We will focus on the most important measurement, the slope of the curve, the aqua colored line above.

The slope of the line with implied volatility on the y-axis and call delta on the x-axis is communicated as the percent the 10 delta lower strike is higher than the higher delta strike. Since the low strikes tend to have higher volatility than the high strikes, this makes the communication of the skew slope easier.

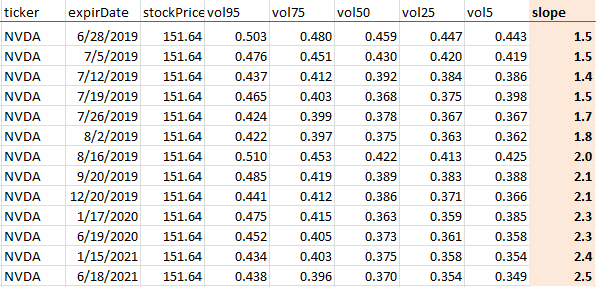

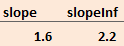

For example, for the ticker NVDA, the slope of the expirations around 30 days is 1.6% and the slope. The average of the long term slopes is about 2.2%. So, how do we know if this is low or high?

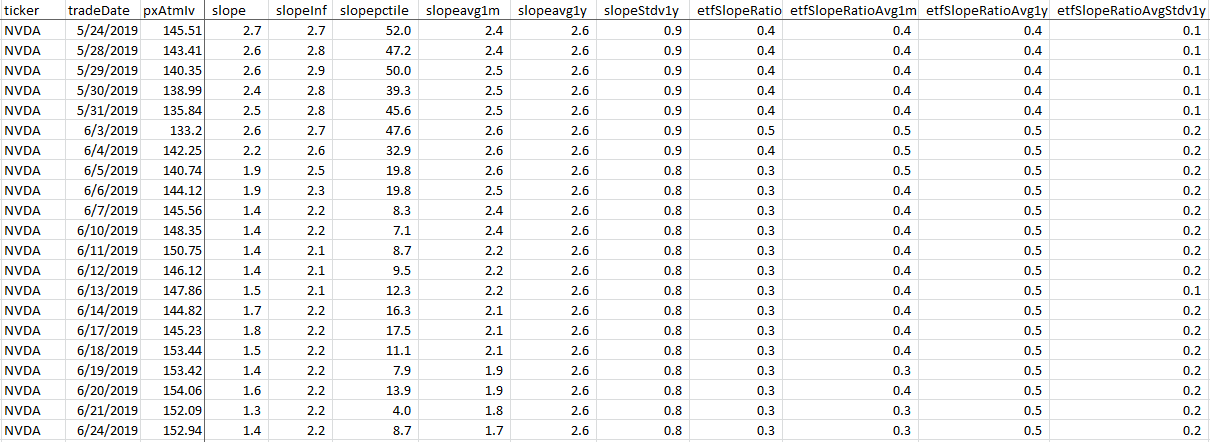

One way to assess the slope is to compare it to historical levels. Another way is to compare it to a related ETF. From the table below, we can see the important slope measurements from the ORATS General Core data. NVDA's slope is in the 8.7 percentile meaning that 91.3% of the time this year the slope was higher. The average slope for the year was 2.6% and the standard deviation of the slope was 0.8% so we can say that the current slope of 1.6% is 1.25 stdevs less than the mean.

We can also look at the slope of NVDA in comparison to its best related ETF, the XLK. The slope of NVDA/XLK = 30%, and that has been its ratio for the month, but the year ratio was 50% with a stdev of 20%. So we see that NVDA is 1 stdev below the mean relationship to the ETF.

These are some pretty killer measurements when looking at the skew slope. These are meticulous and intensive calculations that can give you an edge especially when trading options strategies with sensitivities to slope like verticals.

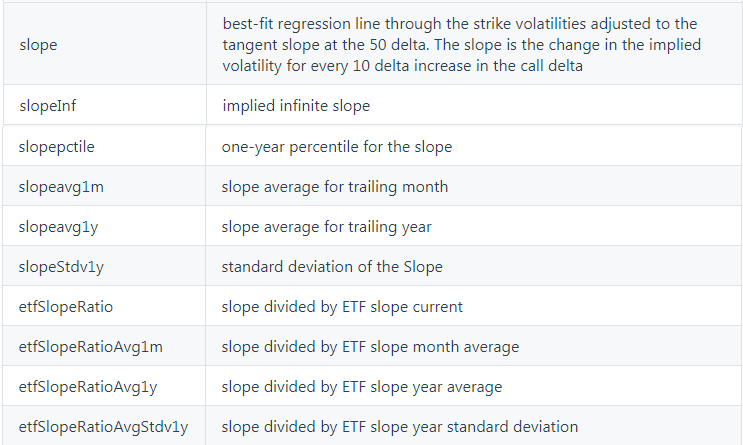

Here are the definitions for the above from our Data API documentation.

Here are some more skew articles:

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts