Indicators

Friday, January 10th 2020

Symbols with High Options Volume Today vs Normal

Options volume vs normal volume are $PAGP $EWY $MET $KBH $SPCE $LBTYK $RUN $PDD $AGN $C #options #unusualVolume #largeTrades #impliedVolatility

Summary

ORATS computed today's total options volume in all tickers with US equity options and compared the total options volume for each symbol to its average volume for the past 20 days. The tickers with the highest ratio of options volume today to the 20 day average are PAGP, EWY, MET, KBH, SPCE, LBTYK, RUN, PDD, AGN, and C. The document includes details on each ticker's options volume, call-put ratio, delta, and implied volatility.

ORATS computes today's total options volume in all tickers with US equity options. The total options volume for each symbol is compared to its average volume for the past 20 days. The tickers with the highest ratio of options volume today to the 20 day average are presented below.

PAGP EWY MET KBH SPCE LBTYK RUN PDD AGN and C have unusual options volume today.

14600 options traded vs normal volume 4800. Calls to puts is 13891 to 754 for a call-put ratio of 18.4

PAGP is trading $19.2 down -0.41% today. The week change is -0.98% and month is 8.72%.

6799 #1 volume $20 strike call delta 0.3 Feb-21 DTE 43 OI 2361 bid-ask $0.3 - 0.35 IV 28.6% (prior $0.3 - 0.4 IV 27.9%).

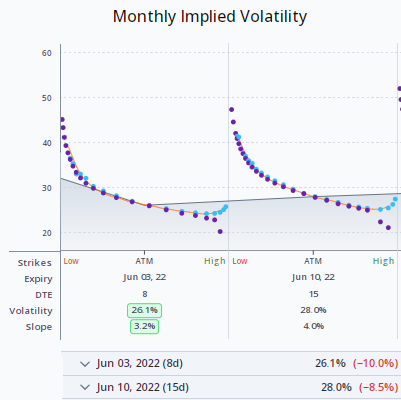

6788 #2 volume $19 strike call delta 0.6 Jan-17 DTE 8 OI 8738 bid-ask $0.35 - 0.45 IV 29% (priorIV 26.1%). 8171 OI+ on 12/17/2019

IV 30-day 29.3% +1.8%. Put-call strike slope 1.5% -0.6%.

iShares MSCI South Korea ETF (EWY) is second highest volume today/20 day at 2.6x

15700 options traded vs normal volume 6000. Calls to puts is 15333 to 337 for a call-put ratio of 45.5

EWY is trading $62.68 up 1.16% today. The week change is 2.91% and month is 8.67%.

9066 #1 volume $63 strike call delta 0.48 Feb-21 DTE 43 OI 199 bid-ask $1.31 - 1.35 IV 17.4% (prior $1.04 - 1.08 IV 17.7%).

6009 #2 volume $61 strike call delta 0.85 Jan-17 DTE 8 OI 11557 bid-ask $1.72 - 1.77 IV 18.7% (priorIV 18.6%). 8600 OI+ on 12/12/2019

IV 30-day 16.8% -1.1%. Put-call strike slope 2.8% +0.2%.

MetLife, Inc. (MET) third highest volume ratio at 2.6x

29000 options traded vs normal volume 11100. Calls to puts is 28757 to 221 for a call-put ratio of 130.1

MET is trading $52.47 up 0.19% today. The week change is 2.7% and month is 6.89%.

28168 #1 volume $55 strike call delta 0.24 Mar-20 DTE 71 OI 2243 bid-ask $0.55 - 0.56 IV 17.1% (prior $0.58 - 0.6 IV 17.8%).

1979 #2 volume $52.5 strike call delta 0.37 Jan-10 DTE 1 OI 1498 bid-ask $0.07 - 0.09 IV 52.7% (prior $0.1 - 0.12 IV 17.7%).

IV 30-day 20.7% +0.4%. Put-call strike slope 3.6% +0.3%.

KB Home (KBH) is in fourth place for today vs 20-day volume at 2.2x earnings is 2020-01-09 After

6100 options traded vs normal volume 2800. Calls to puts is 4167 to 1901 for a call-put ratio of 2

1142 #1 volume $37 strike call delta 0.21 Jan-17 DTE 8 OI 2958 bid-ask $0.15 - 0.17 IV 27.3% (priorIV 53.6%). 1667 OI+ on 1/9/2020

700 #2 volume $35 strike call delta 0.74 Jan-17 DTE 8 OI 1686 bid-ask $1.09 - 1.13 IV 29.2% (priorIV 53%). 402 OI+ on 1/9/2020

IV 30-day 28.4% -10.8%. Put-call strike slope 1.6% 0%.

(SPCE) is #5 at 2.1x

28100 options traded vs normal volume 13300. Calls to puts is 26334 to 1808 for a call-put ratio of 14.6

SPCE is trading $12.47 up 3.57% today. The week change is 5.59% and month is 33.51%.

2489 #1 volume $12.5 strike call delta 0.53 Jan-17 DTE 8 OI 11816 bid-ask $0.5 - 0.55 IV 72.9% (prior $0.25 - 0.35 IV 70.2%).

1429 #2 volume $11 strike call delta 0.92 Jan-17 DTE 8 OI 7439 bid-ask $1.55 - 1.65 IV 59.6% (prior $1.1 - 1.2 IV 71.8%).

IV 30-day 67.9% +0.3%. Put-call strike slope 0.2% +0.6%.

Liberty Global plc CL C (LBTYK) is #6 at 2.1x earnings is 2019-11-06 After

15600 options traded vs normal volume 7500. Calls to puts is 15530 to 34 for a call-put ratio of 455.4

LBTYK is trading $19.78 down -0.95% today. The week change is -6.92% and month is -3.51%.

12621 #1 volume $20 strike call delta 0.54 Feb-28 DTE 50 OI 0 bid-ask $1.05 - 1.2 IV 37.5% (prior $0.95 - 1.2 IV 36%).

50 #2 volume $21.5 strike put delta -0.71 Feb-14 DTE 36 OI 121 bid-ask $1.75 - 1.95 IV 36.9% (prior $1.8 - 1.95 IV 37.6%).

IV 30-day 34% +2.2%. Put-call strike slope 0.9% +0.3%.

Sunrun Inc. (RUN) is #7 at 2x earnings is 2019-11-12 After

5000 options traded vs normal volume 2500. Calls to puts is 108 to 4916 for a call-put ratio of 0

RUN is trading $14.98 down -0.13% today. The week change is 4.24% and month is 13.57%.

1635 #1 volume $14 strike put delta -0.3 Feb-21 DTE 43 OI 942 bid-ask $0.4 - 0.5 IV 43.1% (prior $0.4 - 0.5 IV 43.2%).

1624 #2 volume $13 strike put delta -0.16 Feb-21 DTE 43 OI 1345 bid-ask $0.15 - 0.2 IV 42.4% (prior $0.15 - 0.25 IV 44.3%).

IV 30-day 42.3% -0.1%. Put-call strike slope 1.9% +0.2%.

Pinduoduo Inc. (PDD) is #8 at 1.9x earnings was 2019-11-20 Before

25700 options traded vs normal volume 13800. Calls to puts is 20319 to 5389 for a call-put ratio of 3.8

PDD is trading $38.42 down -3.13% today. The week change is -6.04% and month is 2.98%.

10013 #1 volume $40 strike call delta 0.51 Apr-17 DTE 99 OI 10657 bid-ask $3.4 - 3.5 IV 48.7% (priorIV 48.8%). 8495 OI+ on 1/9/2020

8129 #2 volume $41 strike call delta 0.18 Jan-17 DTE 8 OI 16870 bid-ask $0.2 - 0.25 IV 43.4% (prior $0.4 - 0.45 IV 39.4%).

IV 30-day 41.5% +1.3%. Put-call strike slope 1.3% +0.3%.

Allergan plc (AGN) is #9 at 1.6x earnings was 2019-11-05 Before

3100 options traded vs normal volume 2000. Calls to puts is 528 to 2547 for a call-put ratio of 0.2

AGN is trading $192.62 down -0.02% today. The week change is 0.81% and month is 3.2%.

1406 #1 volume $160 strike put delta 0 Feb-21 DTE 43 OI 10950 bid-ask $0.9 - 1.01 IV 40.1% (prior $1 - 1.02 IV 39.6%).

66 #2 volume $190 strike call delta 0.74 Jan-17 DTE 8 OI 1459 bid-ask $2.64 - 3.9 IV 10.7% (prior $2.15 - 3.55 IV 20.2%).

IV 30-day 15.5% +1.1%. Put-call strike slope 6.4% -1.5%.

Citigroup Inc (C) is #10 at 1.5x earnings is 2020-01-14 Before

89000 options traded vs normal volume 59000. Calls to puts is 69617 to 19429 for a call-put ratio of 3.6

C is trading $79.99 up 0.79% today. The week change is -2.3% and month is 4.72%.

1929 #1 volume $80 strike call delta 0.45 Jan-17 DTE 8 OI 49999 bid-ask $1.01 - 1.03 IV 27.7% (prior $1.3 - 1.33 IV 27.5%).

1123 #2 volume $79.5 strike call delta 0.54 Jan-10 DTE 1 OI 2929 bid-ask $0.21 - 0.22 IV 51.2% (prior $0.68 - 0.71 IV 23.7%).

IV 30-day 22.4% 0%. Put-call strike slope 3.4% 0%.

Disclaimer:

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Related Posts