400 - Implementation, risk, review

Placing orders

After finding your trade, executing the order is the last step in the implementation process. Trade analysis, exit alerts, execution algos, and broker connections are all critical pieces of this step.

Trade analysis

A thorough assessment of the trade can help you understand how it's behaved in the past (via profit attribution and trade history) and how you can expect it to behave in the future (via a payoff diagram).

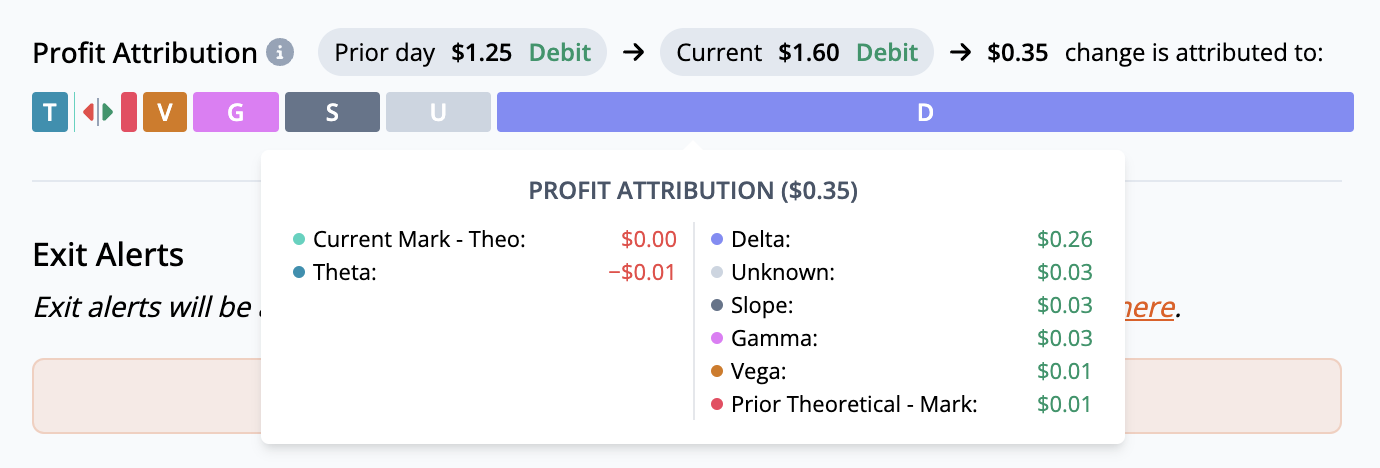

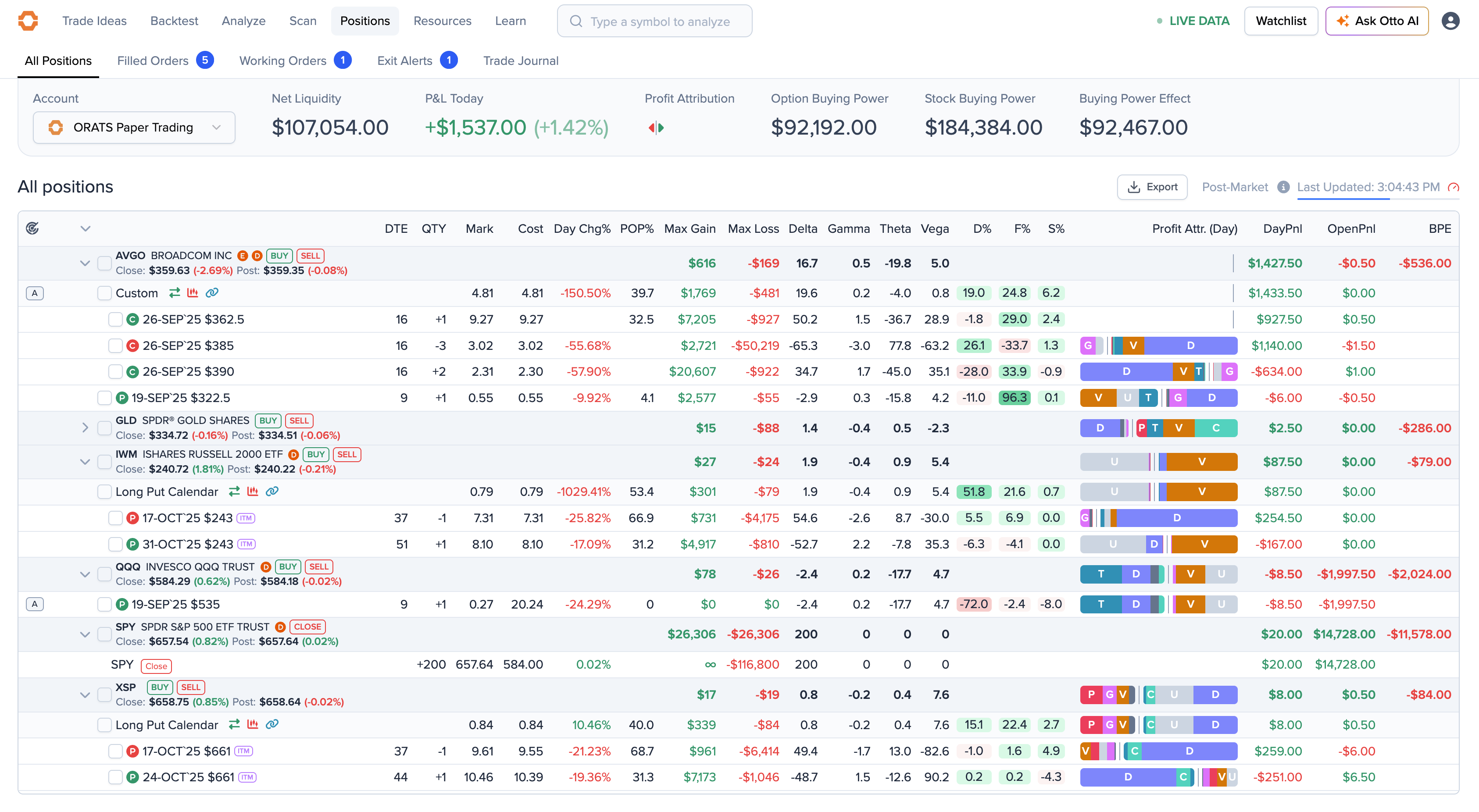

Profit attribution

Developed in-house by the traders at ORATS, the profit attribution calculation breaks down how greeks, skew and theoretical values impact your trades. We calculate this on a per-trade basis, then add it up to get a total portfolio value. For example, if yesterday the debit cost of your trade was $1.25, and today it's $1.60, where is the $0.35 price increase coming from? We break it down into eight factors: Delta, Gamma, Vega, Prior and Current Marks, Theta, Slope, and Unknown.

The delta of a call will add to the profit if the stock is up. The gamma will add to any long option where the stock moved. The vega will add to the profit of a long option if the IV is up. The theta will add to profit for any short options. The current mark minus the theoretical value will add to profit if greater than zero. The prior theoretical value minus the prior mark will add to the profit if greater than zero. The put-call slope will add to the profit for long put options. Unknown is what's left over after adding all these attributions together and comparing to the actual change.

Trade history

Take a deep dive into your trade's intraday history in the Trade History tab. Uncover when, how, and why your trade moved during the past day, week, or month. Explore how the Greeks and IV affected your trade price, and see which bars had the highest volume. Once you've placed your order, you can use this tab to figure out which factors contributed to your gain or loss on the trade.

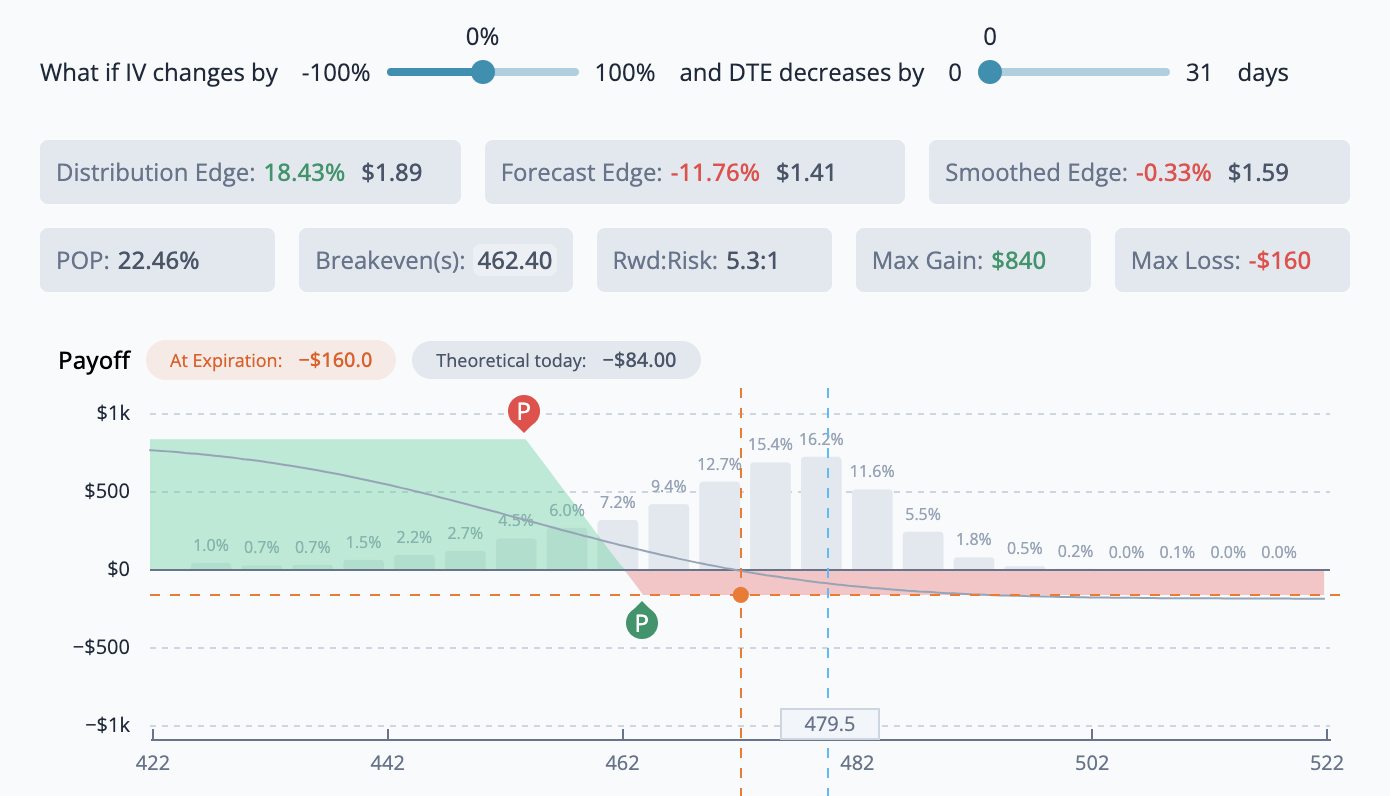

Payoff diagram

To understand how your trade might perform in the future, a payoff diagram can be used to assess your profitability at expiration. Metrics like POP% and Rwd:Risk help you understand the likelihood of you trade expiring in-the-money. Additionally, quickly adjust "What if?" scenarios to see how the theoretical value today will change according to your parameters. We offer two variables:

Implied Volatility Change %: Choose how much to increase or decrease the implied volatility of the position.

Days to Expiration: Choose how much to increase or decrease the time to expiration of the position.

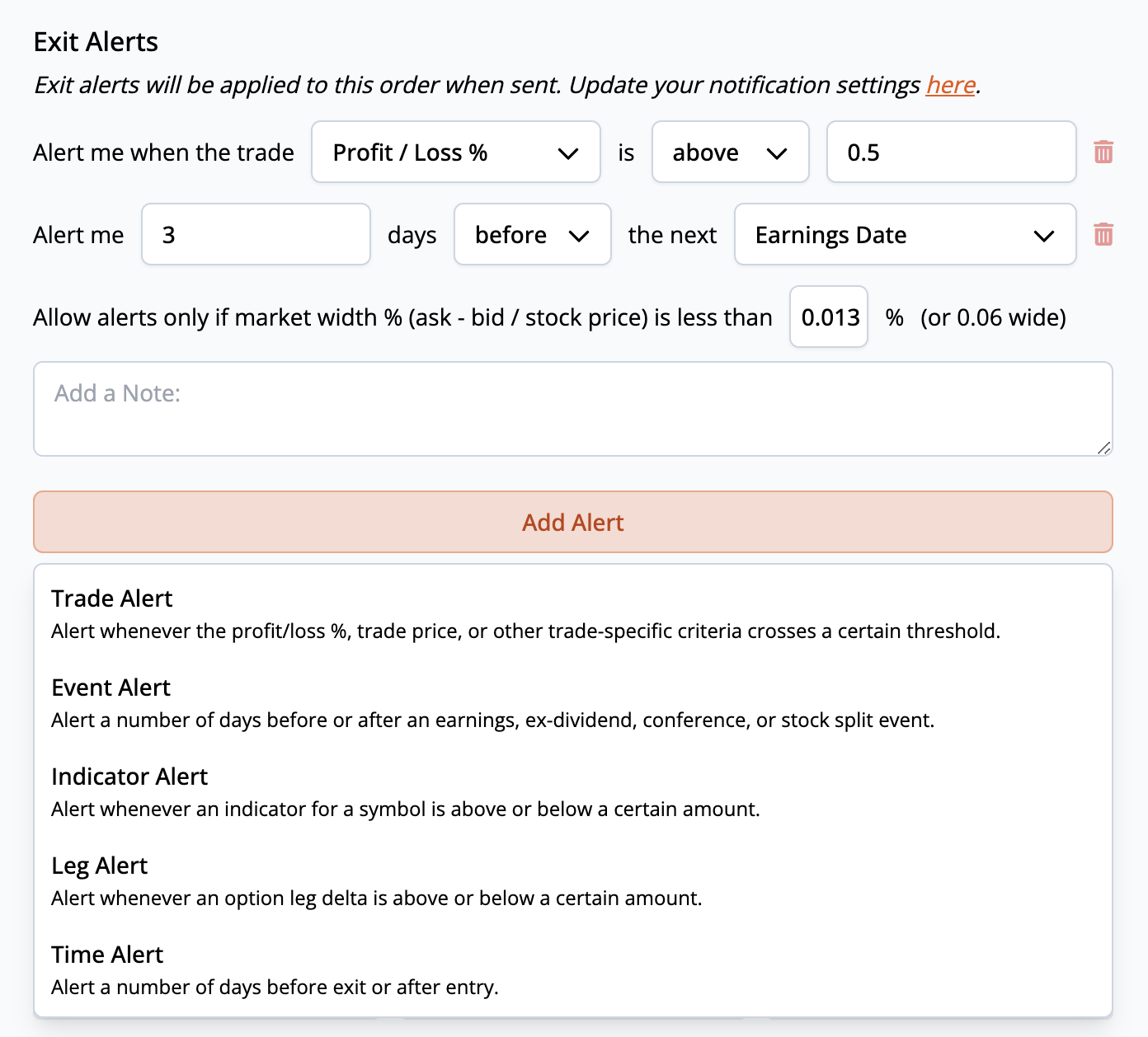

Exit alerts

Once you've analyzed your trade and you're comfortable with the payoff structure, it's time to prepare yourself for anything that might happen during the life of the trade. Exit alerts are an easy way to get notified via email, text, or web of something important happening to your trade. ORATS offers five types of trade alerts to help cover anything that might come up:

Trade alert: Alert whenever the profit/loss %, trade price, or other trade-specific criteria crosses a certain threshold.

Event alert: Alert a number of days before an earnings, ex-dividend, conference, or stock split event.

Indicator alert: Alert whenever an indicator for a symbol is above or below a certain amount.

Leg alert: Alert whenver an option leg delta is above or below a certain amount.

Time alert: Alert a number of days before or after entry.

Execution algos

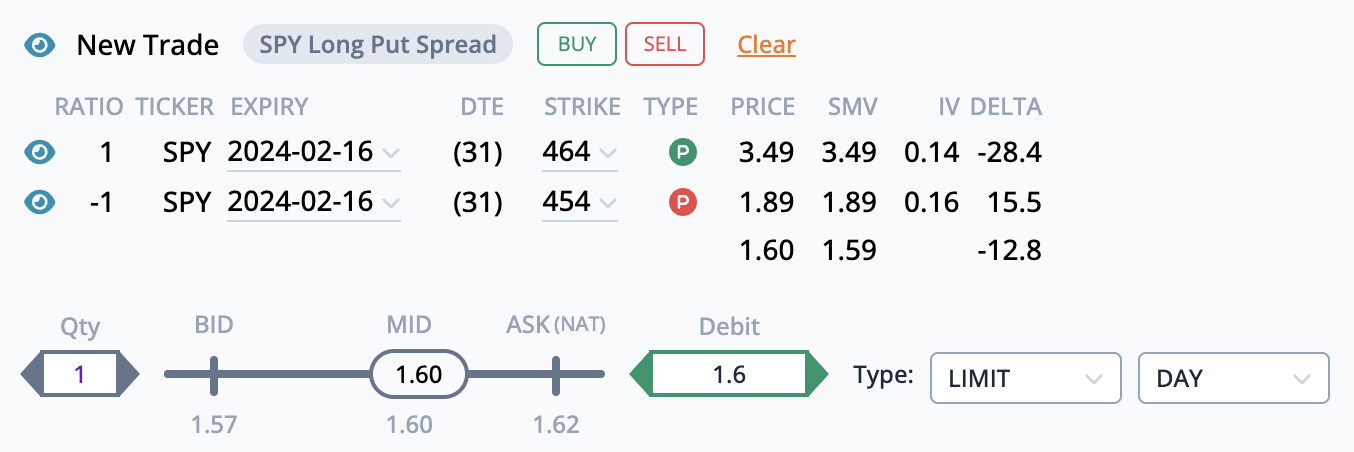

There's one last thing you need to do before sending your order off to a broker - set your price. You've done a lot of analysis and preparation to get to this critical point, so it shouldn't be glossed over. You can take a simple or advanced approach to setting your price.

Simple approach

The simple approach involves sending a limit order using theoretical edges to determine the best price. Our S% edge (explained in more detail here) is useful for determining a fair price for the trade (often somewhere between the bid and ask).

Advanced approach

Many options trading platforms are beginning to offer some variant of "smart execution", which means they change the limit price of your order as it spends more time in the market. Often, this involves traversing the bid-ask spread in some optimal way with the intention of getting you the best fill.

This is really difficult to get right, but is a critical component of any trading strategy. Stay tuned - we're working on some really neat tools related to advanced execution algos.

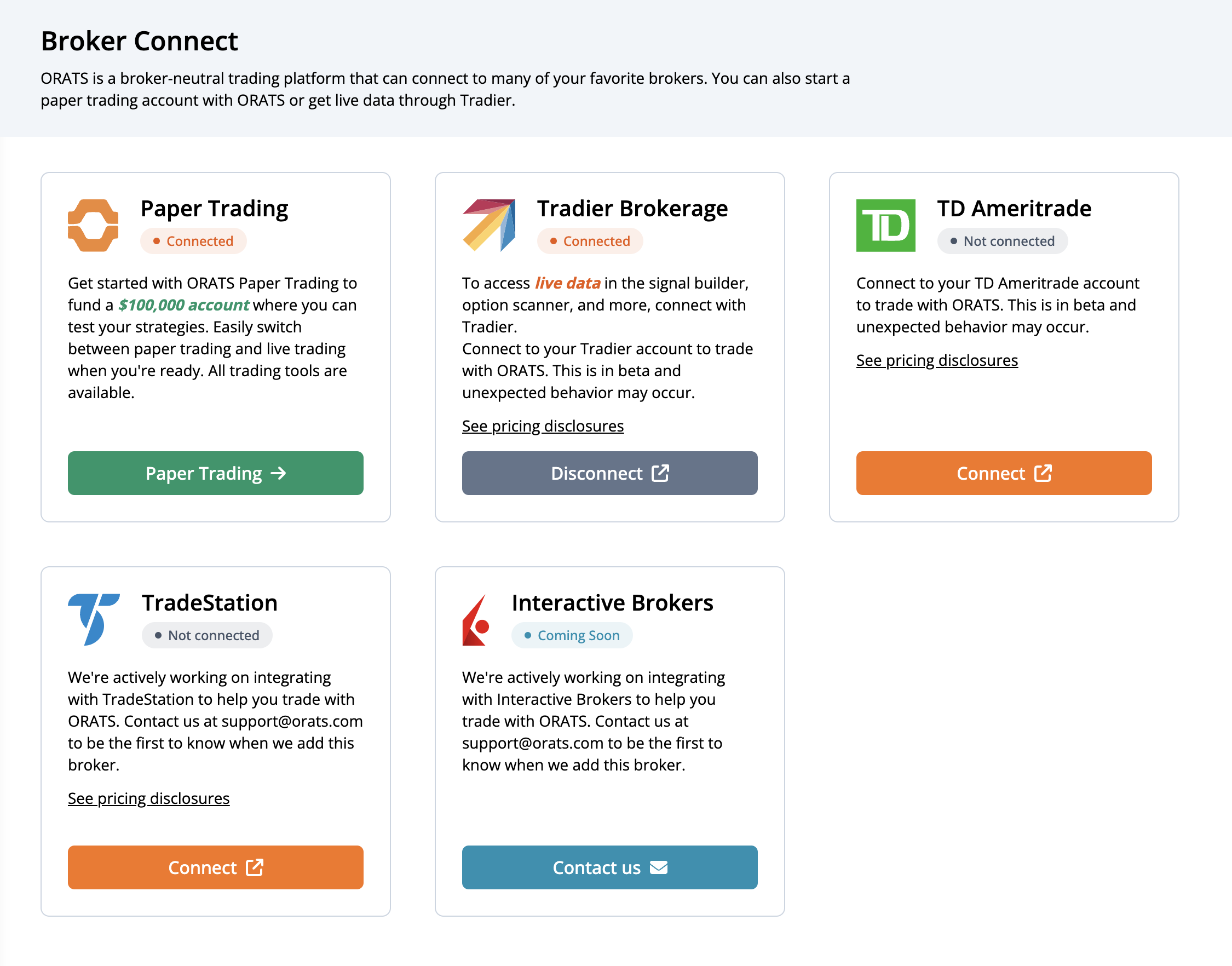

Broker connections

Once you've completed the steps above, you're ready to submit your order to a broker. Because ORATS isn't a broker, we've added several popular brokers to our platform for you to connect to: Tradier, TradeStation, and Interactive Brokers, with others close behind.

We believe that being broker-agnostic helps level the playing field and allows you to choose your brokerage based on your speciic investment needs. If we don't support your broker, please reach out to us at support@orats.com.

Of course, we understand that you might not want to trade live all of the time. ORATS offers a feature-complete paper trading platform so that you can test your strategies without risking real money.

After submitting your trade, it's time for the final and perhaps most important pillar of successful options trading - review. In the next lesson, we'll explore how to use the trade journal to track your performance and learn the best practices that separate successful traders from the rest. Consistent review and reflection on your trades is what ultimately transforms good traders into great ones.