400 - Implementation, risk, review

Trade ideas and signals

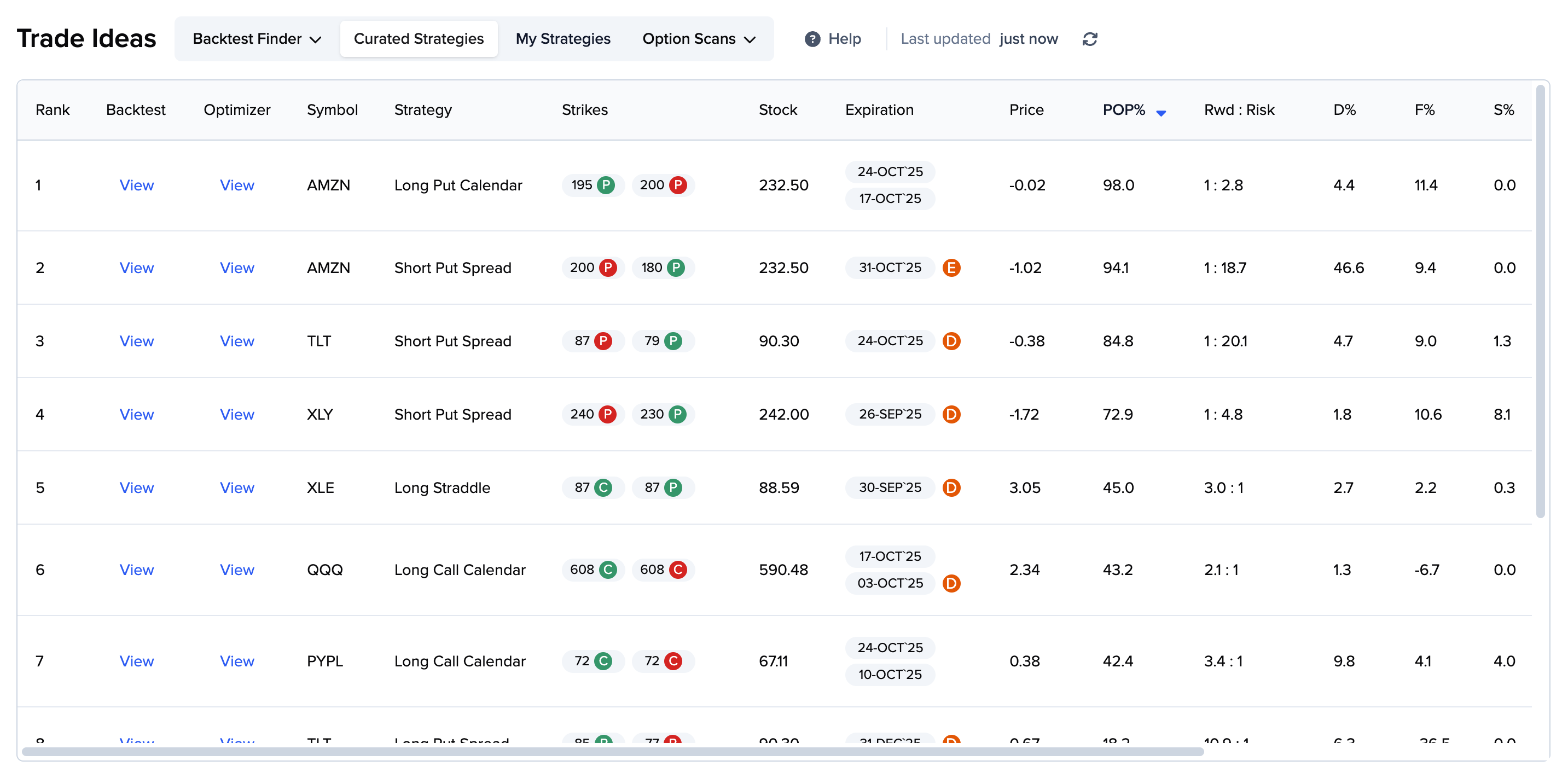

The implementation pillar of successful options trading requires not just scanning capabilities, but a comprehensive system for discovering and evaluating trade opportunities. The ORATS dashboard provides this through two main approaches: the Trade Ideas tab that consolidates opportunities from your research and optimization work, and separate market intelligence tools that help you understand broader market dynamics and institutional positioning.

The Trade Ideas tab

The Trade Ideas tab is your central command center where all your research converges into actionable trade opportunities. This powerful hub aggregates results from four distinct sources, each bringing its own analytical approach to finding profitable trades.

Backtest finder

The backtest finder browses over 300 million pre-compiled backtests across 100+ symbols and 15 strategies to identify those whose entry criteria match the current market environment. You can filter by market direction (Neutral, Bullish, or Bearish) to focus on strategies that align with your market outlook. The system matches strategies based on current conditions including:

- VIX levels

- IV percentile

- Technical indicators (SMA, RSI)

- Slope percentile

For these high-performing, environment-matched backtests, the system then scans for current options trades, ranking them by probability of profit and risk/reward. Each result includes detailed historical performance metrics and a full trade log, giving you confidence that the strategy has worked well in similar market conditions.

Curated strategies

The curated strategies section showcases professionally-built strategies developed by the ORATS team. These strategies are created by:

- Starting with top-performing backtests from our database of over 300 million backtests spanning 100+ symbols and 15 strategies

- Running them through the optimizer to incorporate ORATS proprietary indicators

- Balancing for optimal average profit per day while maintaining low p-values for statistical significance

The system continuously runs option scans based on each curated strategy's parameters and entry/exit indicators. When a strategy's conditions are met, it displays the best trade opportunity based on probability of profit and risk/reward. These results update throughout the day as market conditions change.

My strategies

The my strategies section works identically to curated strategies, but displays results from your own saved strategies created in the optimizer. When you save an optimized strategy, it automatically appears here with:

- Continuous option scans based on your strategy parameters

- The best trade opportunity for each strategy that currently meets its entry criteria

- Real-time metrics including theoretical edge, POP%, and Greeks

- Updates throughout the day as market conditions evolve

This personalized section gives you the same powerful scanning and ranking capabilities that our team uses for curated strategies, but applied to your own custom-built approaches.

Option scans

The option scans section allows you to create and run custom scans across thousands of contracts in real-time. Features include:

- Pre-built templates for common strategies (high IV rank, unusual volume, technical setups)

- Custom scan building with filters for Greeks, profitability metrics, and market conditions

- Real-time scanning with customizable ranking algorithms

- Ability to save and reuse successful scan configurations

All four sections work together to provide a comprehensive view of current opportunities, each updated in real-time as market conditions change.

Additional discovery tools

Beyond the Trade Ideas tab, the ORATS dashboard provides several additional tools in separate locations for understanding market dynamics and discovering opportunities through different analytical lenses.

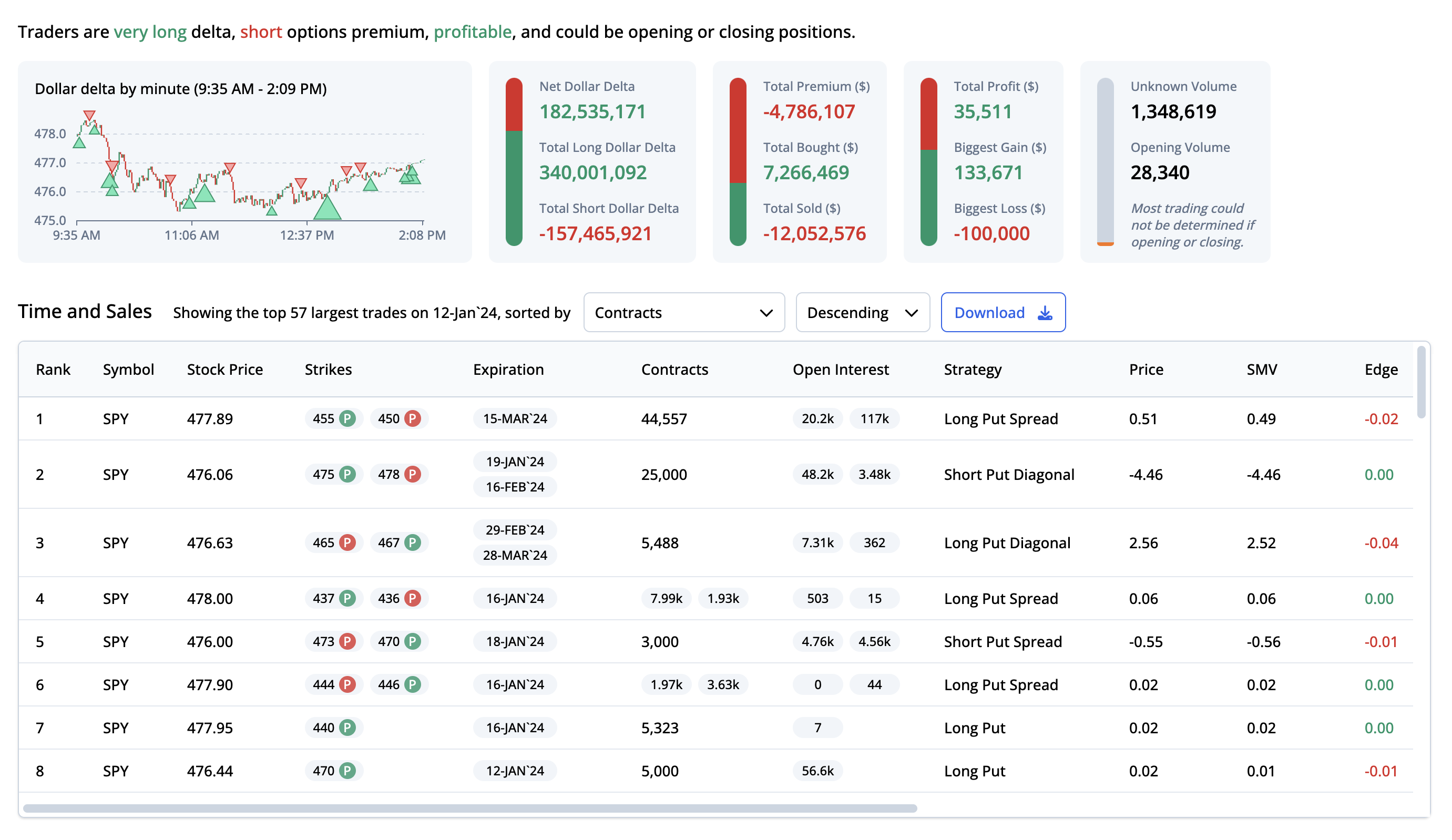

Time and Sales

The Time and Sales tool (found in the Analyzer section) examines raw order flow for individual stocks to detect the largest trades coming through the market. This granular view provides:

- Strategy identification and contract size for each trade

- Trade amount in dollars

- Theoretical edge compared to ORATS pricing

- Relative position size (contracts / avg. option volume 20d)

Additionally, the tool presents an intraday chart of dollar delta plus a summary of total premium, total profit, and opening vs. unknown volume. These metrics help you understand whether institutional traders are accumulating or distributing positions.

Discover tab

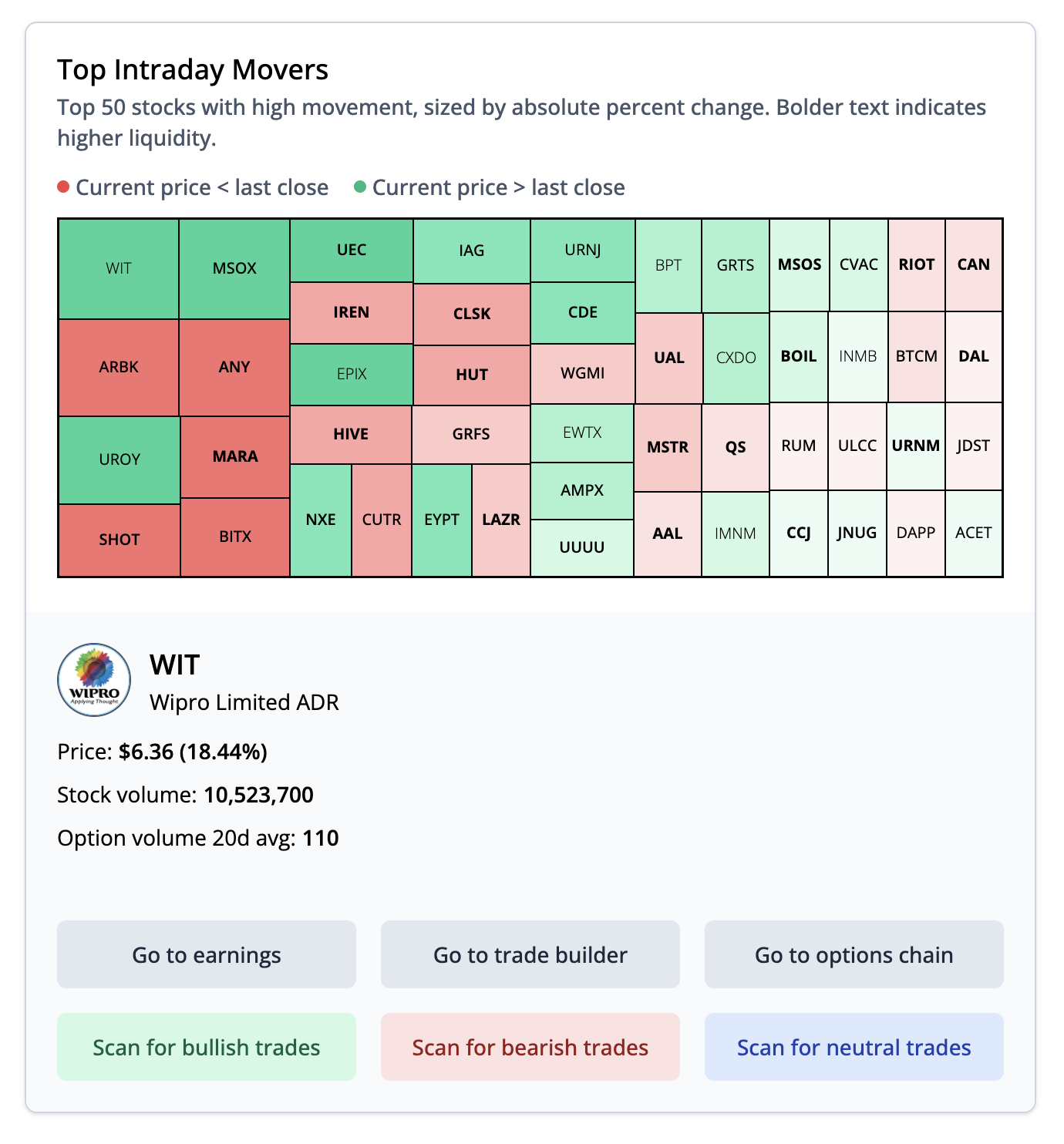

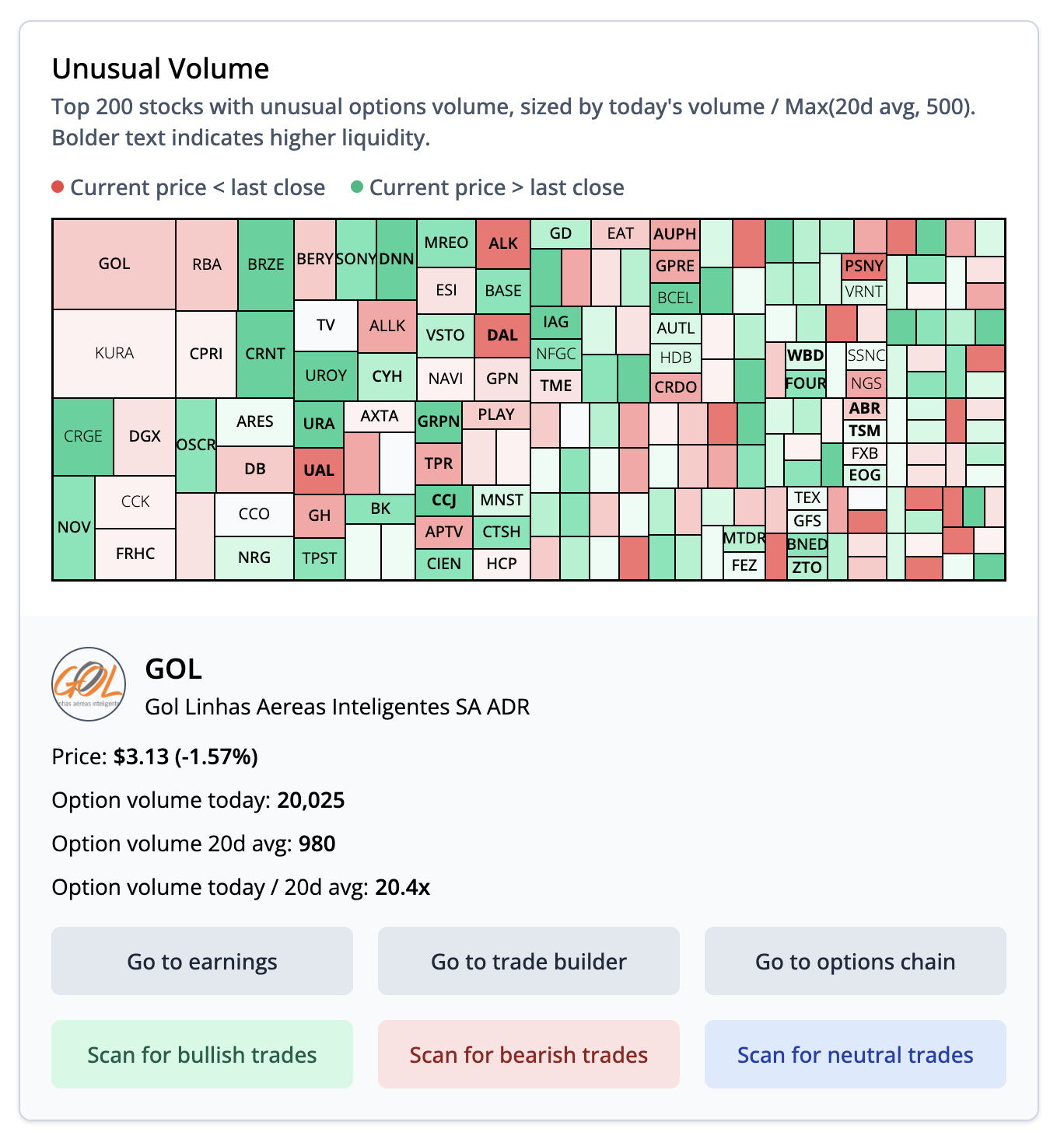

The Discover tab provides comprehensive market intelligence through visual reports that help identify trends and unusual activity across the entire market.

Top movers: Displays the top 50 stocks with significant price movement, sized by absolute percent change and colored by daily performance. Available during pre-market, intraday, and post-market sessions.

Unusual volume: Highlights the top 200 stocks with exceptional options activity, sized by today's volume relative to 20-day average. Color coding shows daily performance, helping you spot where smart money might be positioning.

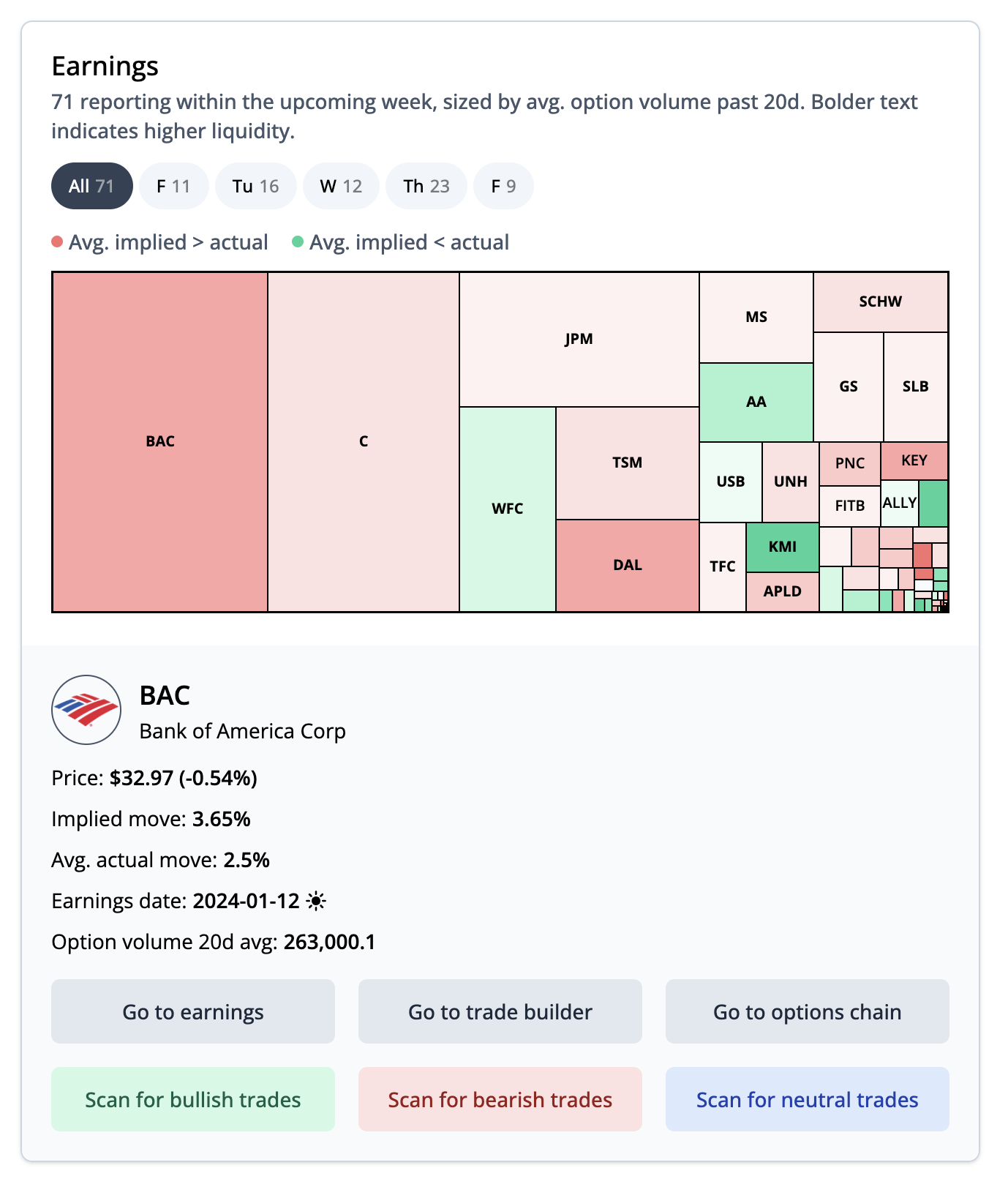

Earnings: Shows all stocks reporting earnings this week, sized by average option volume. Stocks are colored based on whether implied move exceeds or falls below average actual move, highlighting potential volatility opportunities.

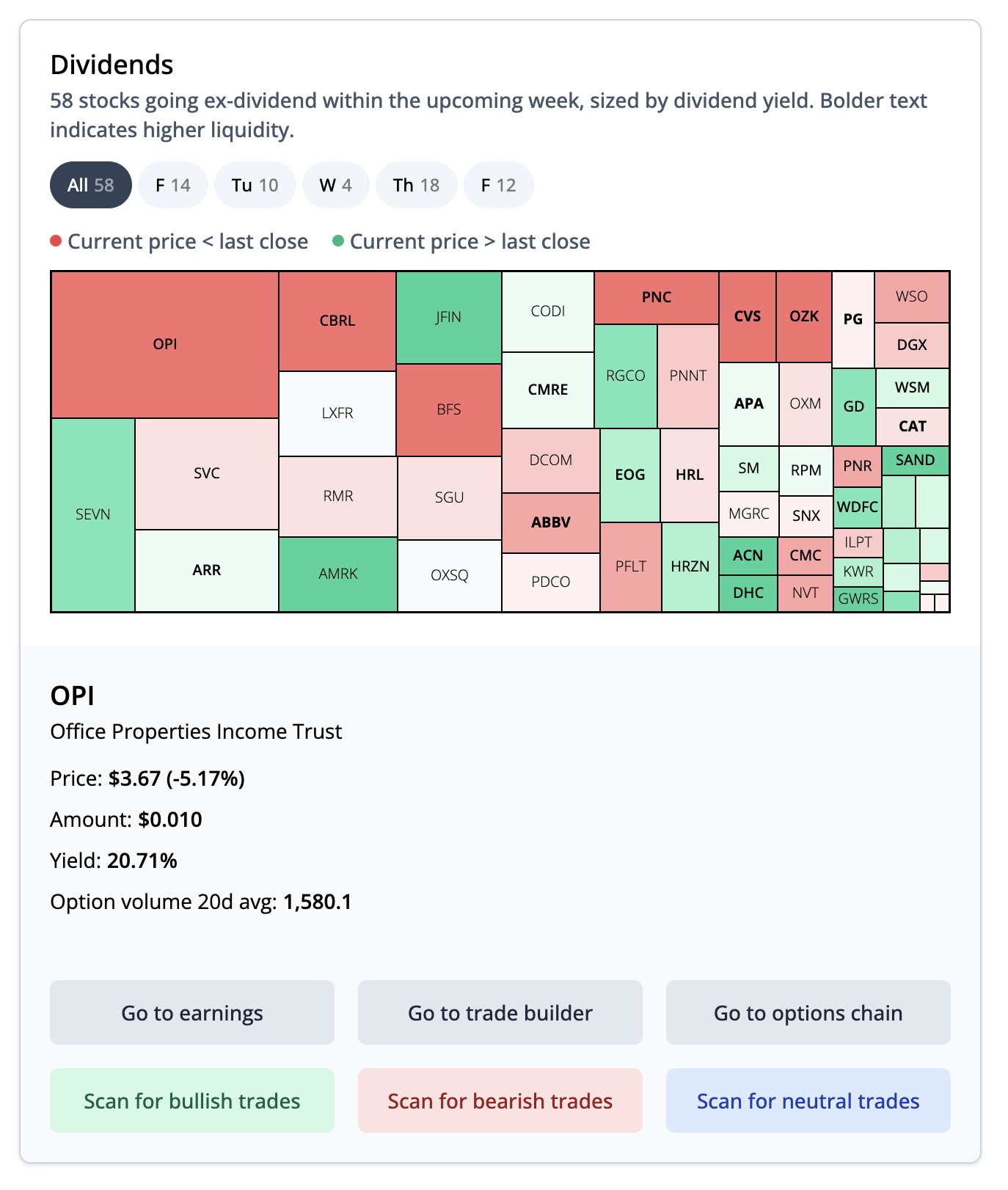

Dividends: Displays stocks going ex-dividend this week, sized by dividend yield and colored by daily performance, useful for income strategies and dividend capture opportunities.

Largest Trades tab

The Largest Trades tab scans the entire market to uncover the most significant trades by size and unusual activity. This market-wide perspective helps you understand institutional positioning and identify stocks with exceptional activity that might warrant further investigation.

Macro Calendar

The Macro Calendar tab provides a comprehensive view of upcoming economic events, Federal Reserve announcements, and macroeconomic data releases. This helps you prepare for potential market-moving events and adjust your trading strategies accordingly.

Bringing it all together

The ORATS dashboard provides a complete ecosystem for discovering profitable trading opportunities through two complementary approaches:

The Trade Ideas tab consolidates your research work - aggregating results from backtests, curated strategies, personal strategies, and custom scans into a single actionable view

Market intelligence tools in other dashboard sections provide broader context - helping you understand market sentiment, track institutional activity, and identify unusual opportunities

Together, these tools ensure you never miss a trading opportunity. Start with broad market intelligence from the Discover tab to understand the day's themes, then drill down into specific opportunities in Trade Ideas. Validate interesting setups using time and sales data, and always check the macro calendar for upcoming events that could impact your trades.

Now that you have mastered finding and validating trade opportunities, the next critical step is execution. In the following lesson, we'll explore how to analyze payoff structures, set appropriate exit alerts, and choose the right execution strategy to ensure you get filled at the optimal price.