400 - Implementation, risk, review

Review

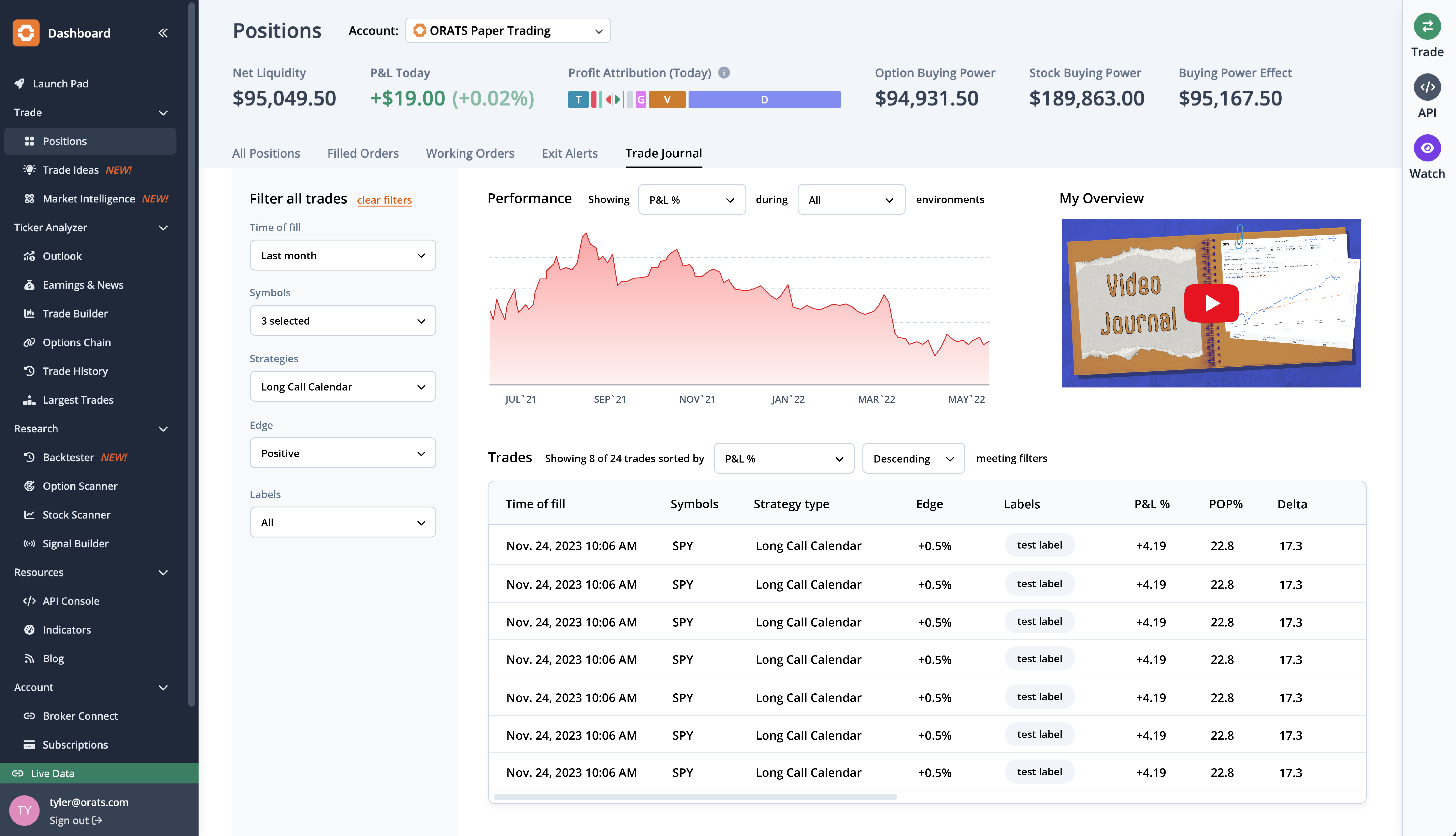

After mastering research, implementation, and risk management, we arrive at the fourth and final pillar of successful options trading - review. The Trade Journal transforms your trading history into actionable insights, helping you identify what works, what doesn't, and most importantly, why.

Position tracking

The Trade Journal works primarily with ORATS paper trading accounts, with additional support for Interactive Brokers through CSV imports.

Automatic synchronization

For paper trading accounts, the journal runs automated processes after market close each weekday, capturing all executed trades with precise entry and exit prices. The system automatically recognizes multi-leg strategies like iron condors and credit spreads, classifying them based on their leg composition. Special events like assignments show as "assigned" in the order type column, while expired positions display their intrinsic value at expiration.

During market hours, positions update every 15 seconds with real-time pricing and P&L calculations. The system accurately prices multi-leg strategies by accounting for each leg's contribution to the overall position.

Interactive Brokers import

For IBKR users, importing trading history is straightforward. Export your trades from TWS or Client Portal in CSV format, then drag and drop the file into the upload modal. The system automatically validates the format, maintains chronological order for accurate P&L calculation, and links related orders for spread identification.

This integration allows you to analyze your entire IBKR trading history within the ORATS ecosystem, leveraging all the analysis tools covered throughout the university.

Performance visualization and filtering

The Trade Journal's interactive graph displays your cumulative profit/loss line alongside the underlying's candlestick chart, revealing the relationship between market movement and your performance. Click any point on the chart to see detailed position snapshots for that specific day, or drag to zoom into particular periods.

Four key metrics update dynamically based on your selected timeframe:

- Starting P&L: Your cumulative P&L at the beginning of the period

- Highest P&L: Peak performance within the timeframe

- Lowest P&L: Maximum drawdown point

- End P&L: Final cumulative result

These metrics help you understand not just your final results, but the volatility of your journey - critical for position sizing and risk management.

The journal's filtering system allows you to analyze performance by underlying, strategy, or time period. The visual P&L distribution chart reveals which symbols generate consistent profits, while strategy filters help you compare the effectiveness of different approaches. The system automatically recognizes and abbreviates common strategies ("IC" for Iron Condor, "LCS" for Long Call Spread, etc.).

Time-based analysis includes presets from 7D to All-time, or you can drag-select custom date ranges directly on the graph to analyze specific market events or trading periods. This granular control helps you identify exactly when and under what conditions your strategies perform best.

Trade details and tool integration

Below the performance graph, the comprehensive trade table provides granular details for every position. Each row displays:

- Strategy classification (automatically identified based on leg composition)

- Strike and expiration details with color-coded option types

- Entry and exit prices for complete trades

- Current mark for open positions

- P&L in both dollars and percentages

- Duration held (formatted as "3d", "2m 5d", or "4h 30m")

The table offers multi-column sorting to identify patterns in your trading. For expired trades, the system clearly marks positions that expired with or without intrinsic value, showing the final settlement amount.

The Trade Journal seamlessly connects with other ORATS tools. Use the "View" button to send open positions directly to the Analyzer for real-time Greeks and scenario analysis. For closed trades, the trade history integration lets you review the exact market conditions when you entered, including the volatility surface and price movements during that period.

This integration creates a continuous feedback loop where each tool strengthens the others, helping you understand which setups consistently work in your favor and transforming random results into repeatable processes.

Validating your edge through review

The Trade Journal bridges the gap between theoretical backtesting and real-world execution, revealing whether your actual trading matches your expected edge.

Comparing backtest to reality

When you enter trades based on backtested strategies, the Trade Journal reveals whether those strategies perform as expected in live markets. If your backtests showed consistent profits but your journal reveals break-even results, you've identified a critical disconnect - perhaps slippage, timing, or behavioral factors are eroding your expected returns.

Filter your journal by strategy type to see if certain approaches consistently outperform or underperform their backtested results. Are iron condors delivering the expected returns? Do your earnings plays capture the anticipated volatility crush? This validation loop helps refine your research parameters and identify which backtested patterns translate to actual profits.

Behavioral patterns and execution quality

The journal reveals patterns invisible in backtesting - like consistently closing winners too early (check those duration metrics) or letting losers run past your planned exit. Maybe you trade certain underlyings better than others, regardless of the theoretical edge. Perhaps your morning trades outperform afternoon entries.

These insights help you optimize not just what you trade, but how and when you trade it. The combination of research (backtesting and optimization), implementation (scanning and order execution), risk management (Greeks and position sizing), and review (journaling) creates a complete feedback system where each pillar strengthens the others.

The four pillars of options trading

You've now completed your journey through all four pillars of the ORATS methodology, each essential for professional options trading.

Research is where edge discovery begins. The Backtester reveals which strategies have worked historically across 15+ years of data. Through optimization, you refine parameters to maximize returns while managing drawdowns. You study historical volatility patterns, predictive indicators, and market inefficiencies. This pillar transforms speculation into statistical edge identification.

Implementation turns research into action. Stock and option scanners identify today's opportunities that match your researched criteria. Trade Ideas aggregates signals from multiple sources. You find specific trades, evaluate theoretical edges, and prepare orders for execution. This pillar bridges the gap between knowing what works historically and finding it in today's market.

Risk keeps you in the game. The Analyzer reveals your Greeks exposure - delta (directional risk), gamma (acceleration risk), theta (time decay), and vega (volatility risk). Payoff diagrams visualize potential outcomes. Position sizing ensures proper capital allocation. You understand exactly what can go wrong and plan accordingly. This pillar transforms blind hope into calculated exposure.

Review is where learning happens. The Trade Journal automatically tracks every position, revealing whether your researched edge materialized in live trading. You discover execution quality issues, behavioral patterns, and which market conditions favor your style. This isn't about individual wins or losses - it's about continuous refinement of your process.

Together, these four pillars create a complete system where each trade makes you a better trader. Get started on your options trading journey today with ORATS.